Wanna be a millionaire? Stick with Uncle Sam or go private?

There were 5.6 million accounts in the TSP at the end of September. A few were just born in the right family but the majority are self-made.

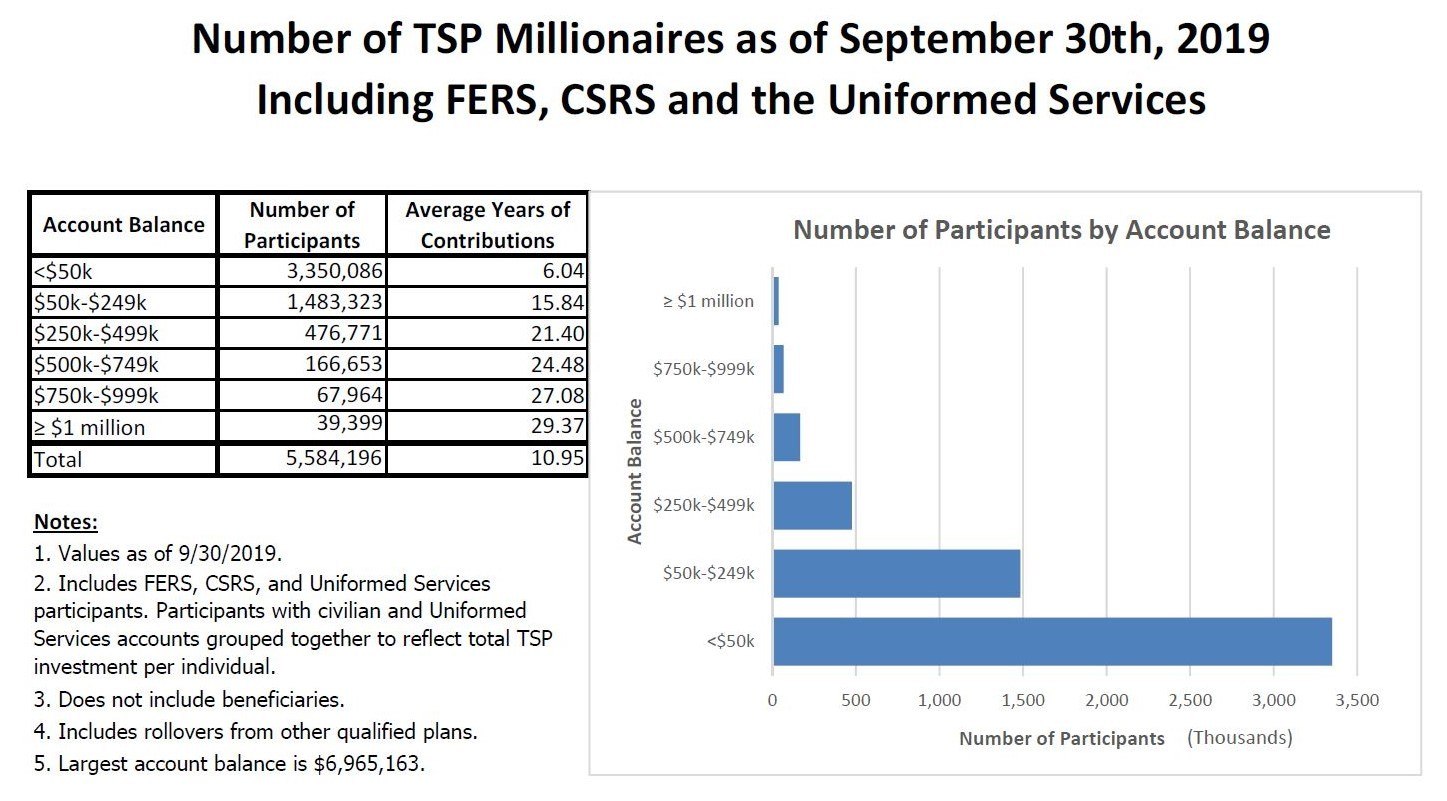

A lot of people, both in and out of government, are fascinated to learn that there are 39,399 (at the end of September) current or retired federal-postal workers who have $1 million or more in their Thrift Savings Plan accounts.

There were 5.6 million accounts in the TSP, the government’s version of a 401(k) plan. Most investors are eligible for a 5% match from Uncle Sam. Some are political appointees, members of the House or Senate, or federal judges. A few were just born in the right family.

But the majority are self-made. They qualified for the millionaires club by investing in the Thrift Savings Plan, sticking with the stock funds through good and bad times and maxing out their investments and getting the 5% government match. For a deeper look at TSP accounts, check out Monday’s column.

For some the question is whether the federal government is top-heavy with millionaires? And if so, is that the result of federal pay, or are feds simply prudent and good investors?

Unfortunately, I don’t do math, even less statistical analysis. But there are people who do, like Dave, a reader with an inquiring mind and some statistical background. He said that the ratio of 401(k) plan millionaires is higher in the private sector than in government. He said this may be because private sector retirement plans are not equal to the federal Civil Service Retirement System and Federal Employees Retirement System, forcing workers to build a bigger share of their retirement nestegg.

He explained:

“To put your ‘TSP millionaire’ articles in perspective, you should run an article comparing the percentage of TSP millionaires to the percentage of millionaires in other major retirement savings institutions, i.e. Vanguard, Fidelity, etc. Based on 2019 data (see below) it looks like a comparison is what a rational investor would predict:

2019 Retirement Account Millionaires compared to total accounts

- Fidelity = 1.16% (196,000 millionaire accounts)

- Vanguard = 1.12% (55,900 millionaire accounts)

- TSP = 0.71% (33,900 millionaire accounts)

“The above shows there are essentially 56% more millionaire accounts in both Fidelity and Vanguard than TSP per million participant accounts. Thus seems to make since given TSP participants have access to both a pension and Social Security while Vanguard and Fidelity 401(k) participants likely have only Social Security.

“A higher percentage of millionaires in Vanguard and Fidelity reflects rational thinking by investors that are likely targeting on average a 70%-80 % income replacement rate — some lower or a higher percentage — in retirement.

“Both TSP, Vanguard and Fidelity appear to have an average age for millionaires of about 60 although not sure how average salary of Fidelity and Vanguard millionaires compared to TSP.”

Nearly Useless Factoid

By Amelia Brust

Despite having one of the strongest economies in Europe, Germany has the lowest rate of homeownership on the continent — about 46%. This can be traced to a boom in public housing after the destruction of World War II, a lack of nationwide programs to promote homeownership since the mid-2000s, rising property prices in cities, and a long tradition of a well-developed rental market with comprehensive rent control laws.

Source: Springer Nature

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED