Timing your last day at work (Part 2)

The decision to pull the plug depends on the job, your family situation, health, financial goals and, maybe, whether you’re a glass-half-full versus...

On any given day, the obituary section of almost any big city newspaper may contain the death notice of someone who was retired longer than he or she worked — nice! And on the same page there may also be a write up on an individual who spent 40, 50 or even 60 years on the job — also good!

Sometimes, like in the Washington, D.C. area, both the early retiree and the job-for-life person were federal workers. So who won, who got it right?

The decision to pull the plug can be easy or difficult. It depends on the job, your family situation, health, financial goals and, maybe, whether you’re a glass-half-full versus glass-half-empty type. Your personality, how much you worry and about what, may be a major factor in deciding when or if to go.

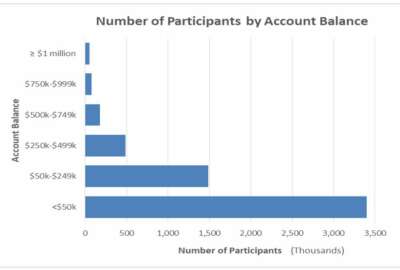

Tuesday’s column was about a well-educated, successful Interior Department employee with 30-plus years of service. He’s 67 and his Thrift Savings Plan account is around $1.2 million. He’s good to go but he’s staying. Earlier we asked feds both active and retired what motivated them to stay on once they could retire. Or, what made them retire ASAP? More on their responses later, which are interesting and may be helpful in your planning. But today we turn to retirement expert Tammy Flanagan. She knows all the rules and regulations but she says there are times when, after you’ve done all your pre-retirement homework, you need to look inward to see what’s driving you to retirement, or to work until you drop.

Worried about the next recession? All the pros say we are long-overdue for a major stock market correction of 20% or more, maybe even a much bigger hit like in 2008 — either way, one that could do damage to your TSP account.

Worried that years of record low inflation are coming to an end, that the diet COLA feature of your Federal Employees Retirement System plan will gradually eat into your retirement income? What if Congress, again, talks about making changes in the Civil Service Retirement System or FERS plans? What if it, again, considers basic retirement on your highest five-year average salary. While none of that is likely to happen in an election year, the threat of change — usually for the worst — is always out there. Then there’s Coronavirus — always something! So lets look at retirement.

Tammy will be my guest on today’s Your Turn radio show at 10 a.m. EST on www.federalnewsnetwork.com or 1500 AM in the Washington metro area. All our shows are archived on our website so if you miss it, or want to listen again, or tell a friend, you can. Today’s she’s going to talk about things you should put on the list when you are weighing the pros and cons of retiring, and when or if; ways to boost your Social Security dramatically, and whether to get life insurance, long term care insurance or self-insure via your TSP. And also, how to consider whether your own personality type — glass half full or glass half empty — is something to consider while making your retire-or-not choice.

Nearly Useless Factoid

By Amelia Brust

The long, beak-like masks commonly worn by plague doctors in 17th-century Europe were designed to hold flowers, spices or herbs inside. This is because many believed in the miasma theory, that bad air or smells could transmit disease.

Source: Wikipedia

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED