A ‘diet COLA’ for FERS retirees has compounding effects on retirement savings

A reduced cost-of-living adjustment, or “diet COLA,” for FERS retirees can create a much larger difference in retirement savings over time.

Federal retirees were feverishly hitting the refresh button on their internet browsers the morning of Oct. 12 as they awaited the Social Security Administration’s announcement of next year’s cost-of-living adjustment (COLA).

The anticipation to see the percentage for that 2024 COLA was no surprise. The annual adjustment, intended to keep retirees on pace with inflation, means gradually growing numbers for federal retirement annuities and Social Security checks.

But some federal retirees will not see that full percentage adjustment added to their annuities in January.

When the federal government switched from the Civil Service Retirement System (CSRS) to the Federal Employee Retirement System (FERS) back in the 1980s, Congress opted to change the COLA calculation for FERS annuitants.

Now retirees on the newer system get what long-time Federal News Network host and columnist Mike Causey would creatively refer to as a “diet COLA.”

After SSA received the final puzzle piece needed to calculate next year’s adjustment, the 2024 COLA wound up at 3.2%. That means FERS retirees will be taking a “diet COLA” of 2.2% for their annuities.

Looking at the 2024 COLA, it doesn’t appear to make all that much of a difference in just one year. But federal unions and organizations say the “diet COLA” creates a much larger separation in the long run, when compared with what FERS retirees would receive with the full COLA.

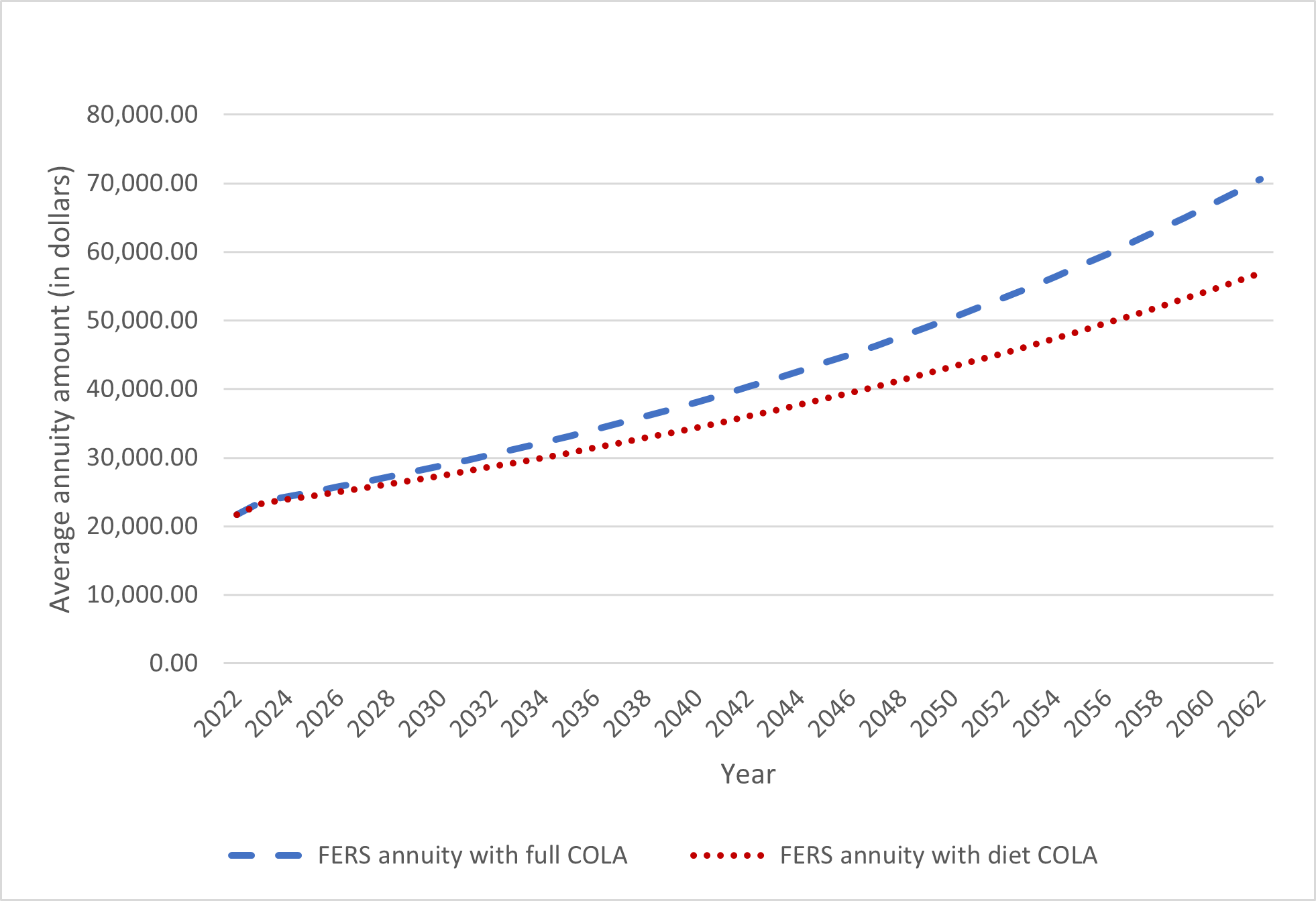

Projected FERS annuities: Full COLA versus diet COLA

“It compounds to be a lot when you project it out over 30 or 40 years. Maybe it’s a $100 difference in one particular year, but each year that extra $100 gets added onto what you don’t get the next year as well,” John Hatton, staff vice president of policy and programs at the National Active and Retired Federal Employees Association (NARFE), said in an interview with Federal News Network.

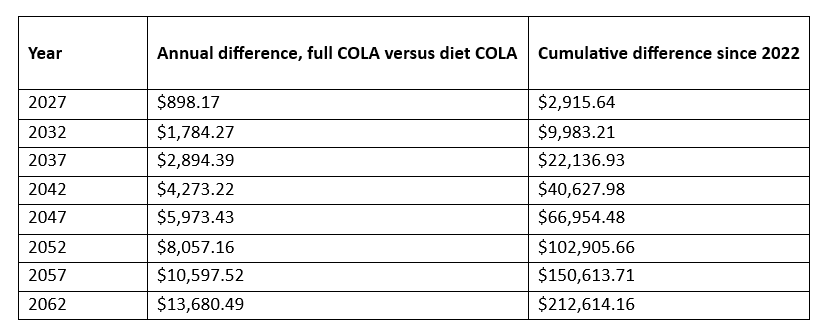

If the FERS COLA continues on its current trajectory, within five years, FERS retirees will see their annuities fall about $900 behind what they would have received with a full COLA.

After even more time, that difference grows to thousands — and then tens of thousands — of dollars.

Projected difference in average FERS annuities over time

Why did Congress give FERS retirees a “diet COLA”?

When the government transitioned to the new retirement system about 40 years ago, the idea at the time was to try to keep things fair between CSRS annuitants and FERS annuitants.

The FERS annuity, along with Social Security and the Thrift Savings Plan (TSP), create the three components of retirement for FERS retirees. The idea was to use a reduced FERS annuity to align with the overall value of the larger CSRS annuity.

FERS retirees also get a 5% matching government contribution on their Thrift Savings Plan (TSP) accounts — under the assumption that individuals contribute at least 5% of their own earnings to receive the matching rate. CSRS retirees do not receive the matching government contribution.

As a result of these differences, Congress determined that by law, if the CSRS COLA increases more than 3%, FERS retirees will receive 1% less than the full COLA. A CSRS COLA between 2% and 3% means a 2% COLA for FERS retirees. And for any CSRS COLA under 2%, FERS retirees receive the full adjustment.

With the negative impacts on retirement savings, many unions, organizations and retirees themselves have spoken out against the “diet COLA.”

“It’s not clear that FERS is providing the same value. And particularly for people who are living longer, that inflation protection becomes very valuable,” Hatton said. “A COLA is supposed to provide protection against inflation and your annuity losing value. Something that takes a cut of 1% every time inflation is high is not going to be adequate.”

Is anything being done to try to change this?

The 2024 COLA of 3.2% is not nearly as large as the COLAs from the last couple of years — CSRS retirees saw an 8.7% COLA for 2023, and a 5.9% COLA for 2022.

The last few years of big COLAs means FERS retirees have continued receiving a 1% COLA deduction, the largest disparity possible. That came out to a 7.7% COLA in 2023 and a 4.9% COLA in 2022 for FERS retirees.

To address the disparity, some lawmakers have been pushing for a full COLA for FERS retirees for years.

The Equal COLA Act, which Rep. Gerry Connolly (D-Va.) and Sen. Alex Padilla (D-Calif.) reintroduced earlier this year, would give FERS retirees a full COLA if enacted.

The bill has been around for years, but the last three rounds of hefty COLAs are bringing greater attention to the issue. NARFE and other advocates are holding out hope for the eventual passage of the bill, while seeing support slowly build over time.

“It is still an uphill battle right now. But there’s more co-sponsors to the House bill today than there were at the end of last Congress, and we’re not even through the full two years of this Congress,” Hatton said. “I think it takes time for legislation, particularly when it has costs, to get attention. If we’re able to build support year after year, we increase the chance that we’re able to get this included in some type of package.”

Nearly Useless Factoid

Lemons float, but limes sink.

Source: bestfoodfacts

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED