OPM facing schedule delays, budget overruns for its trust fund modernization initiative

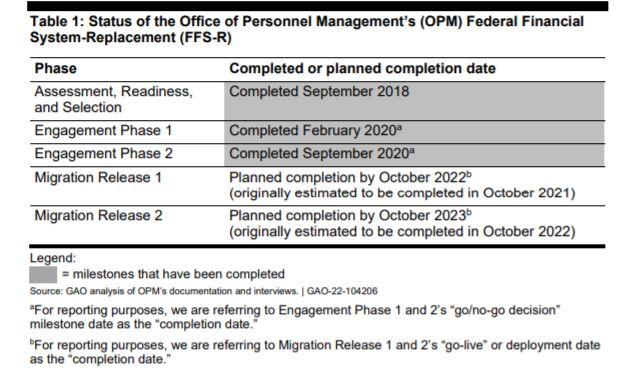

The Government Accountability Office said in a new report that the new Trust Funds Federal Financial System (FFS) will not go live in October 2023.

The technology modernization effort for the system that manages $1 trillion in combined assets across the government’s retirement, health benefits and life insurance programs is a year behind schedule and could be over budget by more than $13 million when it’s completed.

And on top of that, the Office of Personnel Management’s decision to move its Trust Funds Federal Financial System (FFS) to the Treasury Department’s Administrative Resource Center (ARC) for financial management shared services may be further complicating matters and adding to the delays.

OPM told the Government Accountability Office that FFS, which supports more than 8 million active federal employees and retirees, will not cross the IT modernization finish line until October 2023, nearly six years after the initiative began.

“Despite the progress made on the modernization, OPM began experiencing schedule impacts and increased costs. Specifically, according to OPM’s risk register, these negative impacts were due to realizing several risks, including those related to gaps in knowledge and documentation of the legacy processes, system, and associated interface needs; and OCIO resource constraints,” GAO found in a new report released Feb. 23. “In particular, staff from [the] Office of the chief information officer did not have the requisite system knowledge or documentation to support a thorough understanding of the FFS legacy system or associated interface needs. In addition, according to representatives from OPM’s OCIO, staff most knowledgeable about the FFS legacy system were no longer with the TFM Program Management Office. Further, an ARC official stated that OPM lacked adequate documentation on the legacy systems.”

GAO said the steps OPM took to resolve these issues is a major reason for the delayed schedule and cost increases.

“For example, OPM tasked ARC to reverse engineer the system’s interface requirements, build an integration layer and develop test plans and scenarios to replicate OPM business cases, increasing the cost of the modernization by $4 million,” auditors said.

Vendors, software contributed to delays

GAO delays also came from the initial contractor, which GAO didn’t name, due to software issues, including gaps in skills and knowledge.

“Specifically, the program and the vendor used different versions of the same scheduling software, which corrupted the schedule files. As a result, the program had to recreate its schedule at least twice,” GAO said. “The official also stated that OPM’s new vendor addressed the software challenge by leveraging an older version of the scheduling software that was compatible with the agency’s version and now both vendor and agency are using the same software version. According to that official, the new vendor is also working to resolve the shortcomings indicated in our initial schedule assessment.”

The new vendor seems to be Deloitte. OPM awarded the consultant company a three-year, $7 million contract in late 2019 or early 2020 for Trust Funds Modernization products and services.

A third reason for the delay is attributed to OPM and ARC’s relationship. OPM entered into an agreement in 2019 to move FFS to ARC’s technology platform, standardize business processes and take advantage of software services for the operations and maintenance of the system, while OPM performs the transactional processing.

GAO found OPM didn’t have enough funding to meet the goals of its initial roadmap. In the report, ARC’s program manager told auditors that this delay was due to ARC needing to work around OPM’s resource constraints

OPM requested $8.8 million for the FFS program in 2022. If Congress approves full funding, GAO estimates OPM will have spent $71.9 million since 2017 on this project.

Shared service transition challenges

But it’s more than a funding issue. GAO said OPM and ARC’s systems potentially have trouble sharing data.

“In order to process health benefit credit accounts, OPM’s systems need to interface with Treasury’s Automated Standard Application for Payments. According to OPM, if the agency is unable to transition this functionality to Treasury’s system, it will delay the decommissioning of the legacy system and potentially increase the costs and extend the planned schedule of the program,” the report stated. “Although OPM initially identified this risk in July 2018, it increased the rating to high risk in May 2021. To mitigate this risk, OPM planned to conduct a high-level assessment of the gaps and incorporate the additional requirements for the solution into the next migration release schedule.”

Additionally, GAO said there are gaps between OPM’s business needs and ARC’s shared services.

“According to OPM’s risk register, if gaps exist between the agency’s business needs and ARC’s solution, the program may require additional time and resources to complete the modernization, while continuing to depend on legacy systems. OPM initially identified this risk in July 2018. To mitigate this risk, OPM completed a high-level gap analysis in January 2020 (during Engagement Phase 1) and planned to conduct conference room pilots during the migration phase,” the report stated. “According to ARC officials, the conference room pilots are intended to demonstrate custom development and standard system functionality, during the migration phase. In addition, OPM baselined all release 1 requirements during the engagement phases; but did not baseline release 2 requirements. However, it planned to complete the remaining requirements definition documents during the migration phase. Further, OPM noted possible custom configurations may be needed, which could result in increased costs.”

This isn’t the first time auditors called out the FFS for its struggles.

In 2018, the OPM inspector general found OPM transferred $500,000 earmarked for the FFS modernization to the Consolidated Business System modernization effort. Congress appropriated $21 million for OPM to pay for governance, environment modernization, and business modernization, which FFS falls under.

The IG says OPM senior leadership decided to strengthen “OPM’s legacy IT environment, not the improvement of business processes through new IT solutions.”

Modernization has never been easy

For much of the past two decades, OPM has struggled to modernize mission systems like FFS. Even after the 2015 cyber breach and with millions of additional dollars from Congress, the IG found in 2017 OPM fell short on its planning for how best to use the funding and before that in 2016 saying the agency’s capital planning process was lacking.

OPM’s new CIO Guy Cavallo is trying to address many of these long-standing IT modernization challenges by moving the agency’s network infrastructure to the cloud as much as possible.

Cavallo also led the effort for OPM to win $9.9 million from the Technology Modernization Fund to accelerate its move to a zero trust architecture.

GAO made five recommendations, including developing new cost estimates, conducting a risk assessment of its migration plans and review its interagency agreement with ARC to ensure it meets both parties’ needs.

OPM said it concurred with two and partially concurred with two others, but disagreed with the recommendation that it still needs to add more cybersecurity expertise to the project. OPM said it has done that already.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED