Still got a shutdown hangover?

Some of the 800,000 feds that felt the impact of the record long government shutdown in their pockets may still be playing financial catch-up.

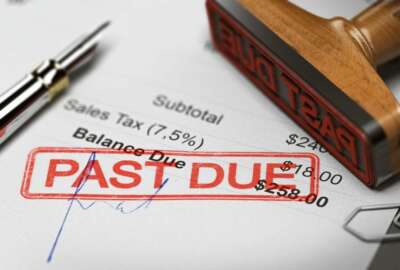

Are you current with your monthly bills? Or are you still avoiding the landlord? Are you not answering phone calls because it may be an angry creditor on the other end? Or the power company threatening to cut off your juice?

Although the record long 35-day government shutdown is history, some of the 800,000 feds hit by it may still be playing financial catch up. Not getting paid for four weeks, over the Christmas holidays no less, was a financial gut punch for many. The Federal Employees Education and Assistance Fund made a record number of emergency/hardship loans during the shutdown. Prior to the shutdown, the feds-helping-feds Combined Federal Campaign charity had made $8 million in hardship loans to 11,000 feds since 1986. It also sponsored a scholarship program that provided full-ride-college scholarships to all of the children of workers killed in the Oklahoma City terrorist bombing. That program lasted more than 20 years because one of the recipients hadn’t been born when his father was killed in the attack on the federal building.

A FEEA official said that while the number of requests for hardship loans has dropped dramatically since the shutdown, it is still a “bit higher” than in the past.

Staffers at a large federal credit union based in Alexandria said both phone and foot traffic for this time of year are, “much higher than usual.” Employees said there were a high level of walk-ins, mostly people taking money out of their savings accounts, over the last two weekends. About 90% of the credit unions members are civilian employees of the federal government.

The shutdown, which lasted much longer than experts anticipated, was a political duel between millionaires in the White House and millionaires in Congress. Unlike their fellow feds who were either forced to work without pay, or forced to stay home without pay, they continued to draw their salaries.

It is only in recent days that the majority of workers finally got back pay from the shutdown. Some still haven’t received all of it. Some are still waiting for the retroactive portion of their pay that that took effect in January.

So how are things with you and folks where you live and work? D.C. isn’t the only federal city. Lots of communities, in both the Carolinas, Ohio, Georgia, Texas, Utah, Oklahoma and California depend on the federal-military pay roll to support local businesses. During the shutdown, we heard from a number of feds who talked about what it was doing to their families and how the were holding up.

So what about now? What is life post-shutdown like? Are you still playing catch up? Are you concerned about and/or prepping for the possibility of a repeat performance this October? Any updates or thoughts you have on the subject would be greatly appreciated. We’ll keep your names and agency confidential if you wish. Thanks: mcausey@federalnewsnetwork.com

Nearly Useless Factoid

By Alazar Moges

Dentists once used human teeth to create dentures. Back in the 19th century, when dentistry was still in its early stages, dental hygiene was not a highly held priority by most. This led to a high volume of tooth decay, and in turn, a high demand for dentures. Following the Battle of Waterloo in 1815, teeth were pulled from the bodies of dead soldiers and sold to dentists. The teeth were then reshaped for use in dentures and the dentures were distributed to those who could afford them. But historians say there is plenty of evidence well before Waterloo that the practice of using teeth from the dead for dentures was all too common.

Source: BBC

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED