Social Security: Insurance or investment?

Should you treat Social Security like insurance or like an investment? Your answer may affect how much money you collect.

A major financial decision facing almost everyone at some point in their life is when to take Social Security. Not if, but when.

It can be a big bucks decision. And the correct answer is, it depends.

For some people, Social Security is more like an investment. They want to get the maximum number of dollars before they die, so they start collecting at the earliest possible age. Especially if you are a male.

For some, it is insurance. They want to make sure that no matter how long they live, they won’t run out of money.

Last week’s column listed the pros of waiting as long as possible to collect Social Security. Retirement expert Tammy Flanagan says people can boost their final payment by 6-to-8% each year they defer benefits. By waiting to start it at age 70, they can boost their starting benefit by 68%.

A no brainer, right?

Not according to some readers. They believe waiting to apply for Social Security can actually short-change them if they die early. For example, Geoff — a fed from Philadelphia — sees it like this:

Mike, there is some false logic in delaying the start of Social Security.

Check out these examples of someone with a starting Social Security benefit, at age 62, of $1,500. If that person waited until age 66 to collect, the monthly benefit would jump to $2,000. If that same individual waited eight years to collect, at age 70 they would start out with a monthly benefit of $2,640 per month — a whooping 76% difference.

From age 62 to 70, this person is foregoing eight years (96 months) of $1500 payments. That’s a total of $144,000.

By waiting until 70, they get an extra $1,140 more per month, but it takes 126 months to catch up to that $144,000 they missed (without considering any returns if they invested).

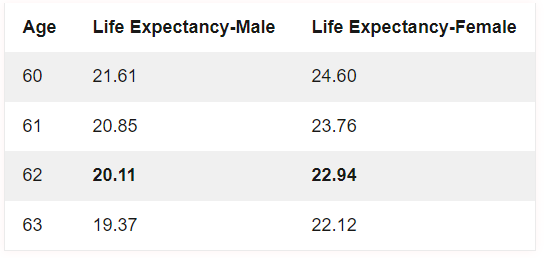

That person will be 82 and a half before they catch up, and current life expectancies are:

So males fall short of break-even, and females only get a couple months.

To which Flanagan replied:

I never understood why someone would care if they ‘break even’ on their Social Security… it’s INSURANCE!!!

Geoff is missing my point! I am not worried about dying early — I’m worried about running out of money if I live a long time! If I die and don’t break even, who cares? But If I live to 90 or even 100, I will appreciate that larger monthly benefit that will last as long as I do!

Look at the stats from this report:

A baby born today can be expected to live, on average, 78.6 years, according to numbers from the Centers for Disease Control and Prevention. A 65 year old has a life expectancy of 19.5 years.

These CDC statistics are averages. That means many people don’t live that long, and many people live much longer. It’s not crazy to expect your time in retirement to last longer than your time in the workforce.

And the older you get, the longer you can expect to live, as you’ve escaped many of the risks.

According to CDC data, out of 100,000 people born alive:

- At age 65: More than 85 percent were still alive.

- At age 80: Nearly 58 percent were still alive.

- At age 85: More than 42 percent were alive.

- At age 90: Nearly 25 percent had survived.

- At age 95: More than 9 percent remained.

So, while it’s true the U.S. life expectancy has actually DECLINED by 18 months in 2020 (because of COVID), that’s more likely a horrible blip on the life expectancy scale.

Different strokes!

Nearly Useless Factoid

By Jonathan Tercasio:

After the breakup of the Soviet Union, Lithuania could not afford to send its basketball team to the 1992 Olympics. The psychedelic music band Grateful Dead offered to sponsor the team, and sent them a box of tie-dyed shirts that resembled Lithuania’s national colors. The Lithuanians donned the shirts, which featured an image of a skeleton dunking, as they accepted their bronze medals.

Source: The Olympic Games

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED