Federal employee health programs are ‘essential services’ during future shutdowns, OPM says

New draft regulations from the Office of Personnel Management will ensure employees and annuitants experience no major interruptions to their federal health,...

Whenever the government shuts down next, employees and annuitants should have some greater peace of mind about their federal health and life insurance benefits.

New draft regulations from the Office of Personnel Management, which are scheduled for publication on Monday, make several important changes to ensure employees experience no major interruptions in their federal health, dental, vision, life and long-term care insurance during any future government shutdown.

The regulations implement certain provisions of the 2020 National Defense Authorization Act, which instructed OPM to make certain federal health and life insurance services “essential” under the Antideficiency Act.

Specifically, OPM’s new regulations designate services under the Federal Employees Health Benefits Program (FEBH) and the Federal Employees’ Group Life Insurance (FEGLI) Program as essential during any future lapse in appropriation.

“These services include, but are not limited to, any activities related to enrollment, changing enrollment, temporary extension of coverage and conversion, eligibility, certification of coverage and matters relating to reemployed annuitants and survivor annuitants,” OPM said.

The federal employees who process new dependents or FEHB enrollment changes are also considered “excepted” workers, and agencies should continue to employ them during future government shutdowns, OPM said.

Under current regulations, employees who are furloughed or working without pay are placed in “non-pay” status and usually can’t enroll or make enrollment changes to the FEHB. But moving forward, federal employees will be able to make those changes during future shutdowns.

Federal employees make most FEHB changes during open season, which typically runs from mid-November to mid-December.

But some had difficulty enrolling new dependents during the last 35-day government shutdown, because the employees who would otherwise enroll new dependents were, in some cases, furloughed.

For employees who are furloughed or are “excepted” and working without pay during future government shutdowns, their coverage under the Federal Employees Dental and Vision Insurance Program (FEDVIP) and Federal Long Term Care Insurance Program (FLTCIP) will also continue.

According to OPM regulations, employees won’t lose their coverage if they’re placed in “non-pay” status and, as a result, they’re not paying their premiums.

Currently, most federal insurance programs will continue during government shutdowns, but if the lapse goes on for two consecutive pay periods, these programs could go on to directly bill their enrollees for missing premiums.

The length of the last government shutdown prompted OPM to extend that number to three consecutive pay periods. If the shutdown had extended a few days longer, FEDVIP enrollees would have received a bill for missing premiums.

But that scenario is no longer a possibility under these new regulations. Coverage under FEDVIP and FLTCIP for furloughed and excepted employees will simply continue.

Once the government shutdown ends, FEDVIP and FLTCIP premiums will be paid from the participants’ back pay — or some other source if enrollees make direct FLTCIP payments, OPM said.

Under a bill passed into law in 2019, Congress appeared to guarantee back pay for all excepted and non-excepted employees during future government shutdowns.

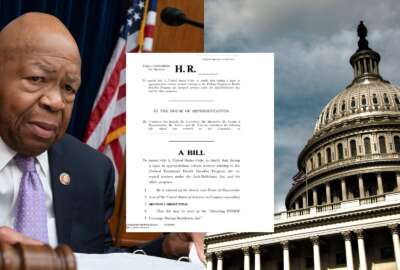

The 2020 provisions originated as standalone legislation, which a bipartisan, bicameral group of lawmakers had introduced in reaction to 2018-2019 government shutdown. The group included the late House Oversight and Reform Committee Chairman Elijah Cummings (D-Md.), former congressman and now White House Chief of Staff Mark Meadows (R-N.C.) and several other members of Congress from the Maryland and Virginia delegations.

Lawmakers were clearly reacting to the most recent government shutdown, which, because of its length, created several problems for federal employees trying to enroll new dependents or make other important changes to their insurance.

Members of the public will have 30 days to comment on OPM’s proposed regulations.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED

Related Stories