Limiting period of performance is killing highly successful 8(a) GWAC

SBA and GSA are defending their decision to limit the period of performance under the 8(a) STARS II governmentwide acquisition contract as part of raising the...

For many of the 700 or so companies on the 8(a) STARS II contract, the Small Business Administration pulled the rug out from under them.

Many believe SBA’s decision to let the General Services Administration increase the ceiling of the popular governmentwide acquisition contract by $7 billion only if the contract’s period of performance ended in June 2022 — nearly two years sooner than the original contract had laid out when awarded in 2009 — is shortsighted and misinformed, and reverses decades of small business policy and precedence.

And similar to the decision that the Department of Health and Human Services made with its Program Support Center, SBA is putting its customer agencies and the companies they are supposed to support at risk for a flawed set of reasons and rationales.

“What is unfair is the way SBA surprised everyone with their decision to limit the period of performance,” said John Shoraka, a former associate administrator of government contracting and business development at SBA and now co-founder and managing director of GovContractPros. “If the decision was made several years ago, then maybe I could see it as being fair. But if I’m an 8(a) firm or a government buyer, I’ve planned on this contract being available to use until 2024 and the decision to limit the period of performance is throwing everything into upheaval.”

The upheaval is even more pronounced because GSA and SBA made the decision as agencies entered the fourth quarter buying season.

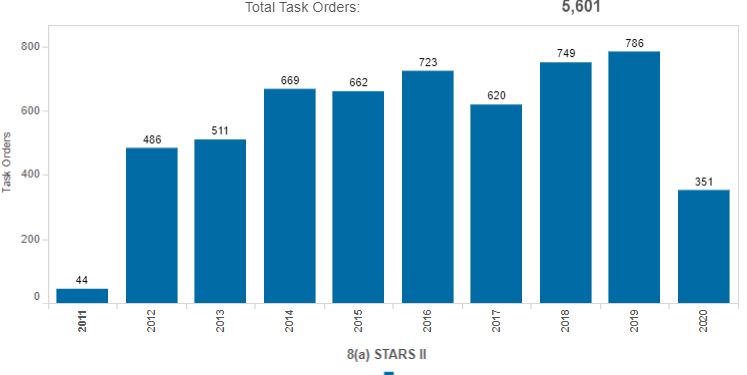

Clyde Goldbach, principal with Solutions By Design II, LLC, an 8(a) STARS II contract holder, said in August and September 2019, agencies flocked to the GWAC, placing 47% of all orders during that time period. Of that 47%, 31% happened in September alone.

He said through July 30, the number request for quotes on STARS II are down 20% as compared to 2019.

The ceiling increase and shortened period of performance went into effect on July 1.

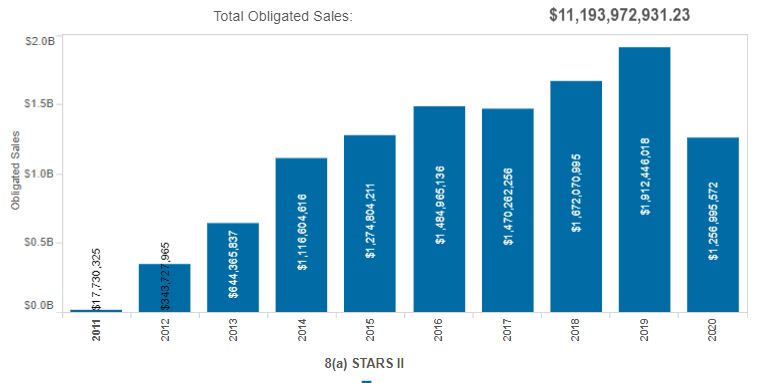

One official at a company impacted by SBA’s decision, who requested anonymity for fear of retribution by the agency, said as of Aug. 21, there were fewer than five task orders on GSA’s e-Buy platform for 8(a) STARS II. A much different environment than in previous years when agencies, on average, obligated more than $1.4 billion a year through the contract.

“What SBA is telling Congress and the media is how this $7 billion ceiling increase is a big deal and a great accomplishment for small businesses. But there also is a little bit of sensationalism in that number. It’s not a funded amount. It’s just a ceiling increase and agencies will get nowhere near that amount procured,” the official said. “There is no justification. There is no rationale as to why the period of performance was required to be shortened when they increased the ceiling. I think a lot of people would want to know. If the increase in STARS II is so great, then why isn’t it being used? The reason is period of performance.”

GSA, USCIS changing solicitations

The data is starting to support that claim too.

Goldbach and others say agencies are pulling back planned and in-process solicitations planned for 8(a) STARS II before SBA shortened the period of performance.

On May 21, the U.S. Citizenship and Immigration Service cancelled a solicitation for a planned contact under STARS II. On July 21, GSA’s Federal Acquisition Service cancelled a procurement too. Both cited the limited period of performance as it why they cancelled the contracts.

Goldbach said the Justice Department pulled a RFQ planned for STARS II and instead awarded to an Alaskan Native corporation, meaning the opportunity is gone from the 8(a) program forever.

Goldbach, who is helping to lead an effort called the 8(a) STARS II Coalition of vendors impacted by SBA’s decision, provided comments from other firms who are feeling the impact of the limited period of performance.

“We have already seen the ill effects of GSA’s decision. USCIS just lopped off an option year of a solicitation that they have in process. Now all price submissions must be revised and resubmitted,” said one company.

Another wrote, “I just got finished convincing <agency> to seriously consider STARS II for an upcoming recompete of our work and now that plan has crashed and burned. A few possible end of year directed actions I was hoping to put through STARS II are now also overcome by events with the new period of performance.”

Taking the legs out from under them

SBA, however, said in email comments to Federal News Network that while GSA would be the better agency to comment on how customer agencies are using STARS II currently, contracts in the 8(a) program can’t be moved out of it without SBA’s approval.

“It is always within the discretion of the procuring agency to use one 8(a) vehicle instead of another, i.e., to seek a competitive 8(a) award which is open to all eligible participants; to seek the award of an order under an 8(a) multiple award contract that is available only to specified 8(a) participants who are contract holders; or to seek to make a sole source 8(a) award above the general competitive threshold amounts to a current entity-owned 8(a) participant,” the SBA stated. “Where an agency seeks to make a competitive 8(a) award, which is open to all eligible participants or seeks to make a sole source 8(a) award above the general competitive threshold amounts to a current entity-owned 8(a) participant, the award will be made to a current participant in the 8(a) program and will further the goal of assisting in the business development of program participants.”

Shoraka, the former 8(a) executive, said agencies and companies have been planning to put work on the GWAC for 12-to-18-24 months so the last minute change is causing unnecessary challenges.

“SBA is surprising a large group of firms in the last minute during the fourth quarter and it’s unfair to them and to the agencies, because it puts them in a difficult position too,” he said. “It could’ve been planned better especially given we are in an environment where the government is looking for ways to support small and minority businesses. This is, in my mind, directly contrary to that and we don’t want to take the legs out from under them.”

SBA and GSA have been aggressively pushing back against these concerns and complaints.

GSA’s Laura Stanton, the assistant commissioner for the Office of the IT Category, wrote a blog post explaining the rationale around limiting the period of performance. Stanton basically posted the letter GSA and SBA sent to 8(a) STARS II holders explaining the three reasons why the period of performance (PoP) had to be limited.

Stanton said in the post that in coordination with SBA raising the ceiling and decreasing the PoP to two years was the best business decision for several reasons:

- GSA and SBA anticipated the two-year PoP would permit agencies to respond to the immediate agency needs for the COVID-19 pandemic.

- All of the 8(a) STARS II vendors will now have the opportunity to pursue $7 billion in new business. Approximately 538 vendors have graduated from the 8(a) Program and, thanks to the ceiling increase, are still benefiting from the opportunities on 8(a) STARS II. In addition, the 204 current 8(a) firms and 45 Joint Venture firms also now are able to compete for up to $7 billion in new opportunities.

- A two-year PoP will allow 8(a) program graduates the opportunity to transition out of the STARS II program. Both GSA and SBA provide a wide variety of training courses and other resources to assist small businesses that have graduated from the 8(a) Program with positioning themselves to win federal contracts. Examples include training and guidance on finding federal procurement opportunities, pursuing small business set asides and becoming a mentor-protégé.

In responses to email questions, SBA offered more insights behind its thinking of limiting the period of performance.

“[O]nce the ceiling was reached no new orders could be issued. At that point all firms who were contract holders on STARS II could no longer expect any additional awards under STARS II. At the same time, GSA had already issued its intent to start the procurement process for STARS III – and currently expects awards under STARS III in August 2021,” the agency said. “STARS II has been a 10-year contract. Many of the 8(a) firms who are contract holders under STARS II graduated from the 8(a) program many years ago. These firms received nine years in the 8(a) program, may have been awarded STARS II contracts right before leaving the program and have benefited from the 8(a) program eight, nine or 10 years beyond their graduation dates (or a total of 17, 18 or 19 years of 8(a) benefits). Unfortunately, these firms do not see that SBA and GSA have given them the opportunity to receive additional 8(a) orders and perform for an additional two years when there was no such opportunity on the ceiling was hit.”

GSA released the STARS III request for proposals in July with a $50 billion ceiling.

A bunch of whiners?

On the surface, the argument that many of these firms have benefited a great deal from being on 8(a) STARS II provides a strong reason to limit the period of performance any further. As GSA highlighted, 538 of the 787 firms on STARS II have graduated from the 8(a) program meaning they are receiving additional benefits beyond the traditional nine years.

“As a sampling, of 32 firms who have objected to SBA and Congress about the perceived shortened performance period, 28 have already graduated from the 8(a) program (with four still current participants); 15 of those firms graduated from the program in 2014 or earlier (with firms graduating in 2009, 2010, 2011, 2012, 2013, and 2014) – meaning about half of the firms who have objected have received 8(a) awards through STARS II for at least six years beyond the end of their program terms so far and will be able to perform orders under STARS II for another two years,” SBA stated.

Based on those numbers, it would seem that these firms are “whining” about having to “leave” the 8(a) program 4 or 5 or, in some cases, 10 years since actually graduating.

But Shoraka and others say, SBA is changing the rules at the end of the game.

“The fact that companies how graduated from the program are still receiving contracts shouldn’t be a surprise to them. That’s why, in my mind, they are almost changing policy midway when they got an opportunity to do so. They shouldn’t use this situation to change previous policy. If SBA wants to change policy do it in more deliberate way,” he said. “The way firms have used this tool is as a post 8(a) graduate program. That was how it was presented to them when they were awarded a spot on the contract in the first place. If we hadn’t reached the ceiling, they would’ve benefited to 2024, but for reaching ceiling SBA is changing the rules.”

Goldbach said the issue of graduated 8(a) firms continuing to receive contracts under the 8(a) program is common across many contracts. He said, for instance, 40% of all 8(a) firms who have a Schedule 70 contract from GSA have graduated but still benefit from the program.

And the argument that STARS III is coming as a reason to limit the period of performance rings hallow too to some.

The company official said these GWACs take much longer than expected to get to award, as evidenced by GSA releasing the 8(a) STARS II on-ramp in 2015 but not awarding it until 2017.

Tension between companies, oversight

A former SBA official, who requested anonymity because they didn’t get permission from their current company to talk to the press, said the need to raise the ceiling put the agency in a tough spot— either impact companies or continue to get beat up by Congress and auditors.

SBA seemed almost to confirm that in comments to Federal News Network.

“Knowing that the STARS III procurement process was already underway and that orders for additional performance could be issued under STARS III as soon as STARS III awards were finalized in one year, it made sense to limit additional performance under STARS II to an additional two years, particularly when SBA has been criticized by its OIG and Congress for allowing ‘awards’ to firms that have graduated from the program,” the agency stated.

SBA is working on a changes that would require small businesses who win spots on a GWAC or multiple award contract to recertify if their status changes or if they are bought by a large company. That new rule for 8(a) recertifications, called for in the 2010 Small Business Jobs Act, however, remains in the rulemaking process.

Read more: Reporter’s Notebook

The former official said the problem with taking a hardline now is the rules when GSA awarded STARS II should remain in effect throughout the life of the contract.

“People assumed the contract would operate as it always had, and if not for the ceiling issue, this would’ve never come up so can I see why it’s concerning to these companies,” the former official said. “At same time, how are we helping current 8(a) participants if you can only reach former 8(a)s? That is a tension that has been around for a long time?”

A tension now exacerbated by SBA’s decision to change the rules at the end of the game.

Lawmakers take interest in changes

The 8(a) STARS II Coalition has received support from House and Senate lawmakers who are pressuring SBA and GSA for answers.

Rep. Eleanor Holmes Norton (D-D.C.), wrote to GSA on July 27 asking for a written explanation of the decision to limit the period of performance.

Then four House members and three Senators wrote to SBA and GSA on July 28 seeking answers to 10 questions by Aug. 14 about the decision and impact to limit the period of performance on STARS II.

While it’s unclear if SBA or GSA responded to the lawmakers’ letters, the small businesses are left in the cold because of a decision that could’ve been made with more pragmatism and forethought.

Few would argue that the recertification process is broken, and the fact that SBA knows a fix is coming for 8(a) STARS III and other future contracts, it would’ve have been smart and practical not to rewrite long-standing policy, especially in the fourth quarter buying season and for a highly successful 8(a) contract, but keep the popular program available based on the terms and conditions SBA and GSA promised from the beginning.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED

Related Stories

GSA adds $7B to 8(a) governmentwide contract’s ceiling

Cancellation of Alliant 2 Small Business caps a rough few months for small firms