TSP tracking coronavirus impact on its funds, operations and employees

Participants in the Thrift Savings Plan are reacting to the coronavirus and recent stock market volatility with more withdrawals and more transfers from the C, S, I...

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

The coronavirus pandemic is having an outsized impact on nearly every aspect of life, and as most participants can attest, the Thrift Savings Plan is no different.

The Federal Retirement Thrift Investment Board, the agency that administers the TSP, is tracking the pandemic and its impact on three fronts.

“We are monitoring the impact on the TSP funds and our participant accounts,” Ravi Deo, the FRTIB’s executive director, told TSP board members Monday. “We are monitoring the impact on our ability to service the participants and ensure the running of the TSP. And of course, we are monitoring the impact on the health and well-being of our employees and contractors. We have created teams that are looking at all three aspects above. The teams meet regularly and make recommendations to Suzanne [Tosini], our chief operating officer, and me.”

There are already some signs that recent stock market volatility is having an impact on TSP funds and participants.

Participants, for example, are making more withdrawals so far in the month of March compared to this time last year and recent months.

TSP participants made 96,000 withdrawals in February and 95,000 in January. As of March 19, participants have made 218,000 withdrawals, Sophie Dmuchowski, deputy for TSP policy operations, said Monday.

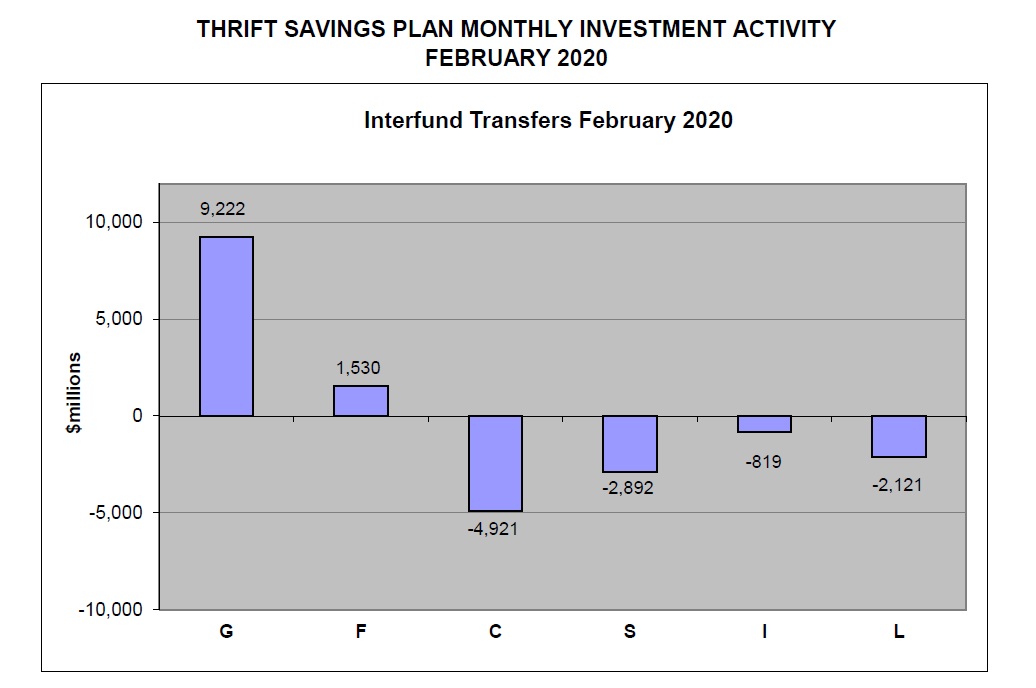

Inter-fund transfers (IFTs) are up as well.

Between Feb. 24 and March 17, participants transferred $21 billion into the G fund.

“This movement into the G fund corresponded to net flows out of the C, S, I and L funds,” Sean McCaffrey, the TSP’s chief investment officer, said. “This represents the highest volume of IFT activity both on an absolute basis and as a percentage of assets for any three-week period since the TSP implemented a limit on IFTs in May 2008.”

But a relatively small number of participants are responsible for the historic IFT levels. Just 5% of participants submitted an inter-fund transfer between late February and mid-March, McCaffrey said.

“In other words, 95% of participants were not spurred to action during the measurement period during the same volatility,” he said.

BlackRock, which manages several TSP funds, has its own contingency plans in place for the coronavirus pandemic, McCaffrey said.

TSP service centers remain open, for now

All three TSP contact centers, which are staffed with contractors, remain open.

“The contact centers are dealing with a higher than normal volume of calls,” Deo said. “Those calls tend to spike at certain points during the day. We are still answering the vast majority of calls in less than 20 seconds, but the situation may get worse and we have to reduce staffing and allow service levels to slip in order to ensure safety for all employees at the contact centers.”

The FRTIB is working to set up telework capabilities for contact center staffers, though the agency acknowledged employees may initially have some difficulty making and taking calls from TSP participants.

The agency is also exploring telework options for its service bureau, special processing unit and operations center.

“We’re working through the issues with telework,” Deo said. “The goal is to have all the contractors have the ability to telework in the not-too-distant future.”

TSP contact centers should still be able to process all participant and agency contributions and systematic withdrawals, as well as participant withdrawals, most changes in contribution allocations and inter-fund transfers submitted online.

Some transactions, especially those that still require mailed in forms, may be more difficult, especially if the TSP is forced to reduce staffing levels due to illness.

Deo said the FRTIB is accelerating a previously-planned project, which would allow participants to upload and submit some TSP forms electronically.

All FRTIB employees teleworking

Meanwhile, employees at the FRTIB headquarters in Washington, D.C., began mandatory telework Monday. The workforce is required to telework until at least April 3, though Deo acknowledged the date could change.

The agency conducted an agency-wide telework “test” last week. All 750 employees and contractors successfully connected into the TSP’s virtual private network, Deo said.

The FRTIB had its Washington office cleaned earlier in March as a precaution, he added.

Deo and other TSP leadership have been sending daily email updates to the FRTIB workforce since mid-March. The agency created a designated team to prepare employees for telework, track sick leave and create guidance and other health resources for the workforce, Deo said.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED