TSP returns continue to fall in October

For the third month in a row most Thrift Savings Plan funds posted negative returns, with the exception of the government securities investment G fund, which posted...

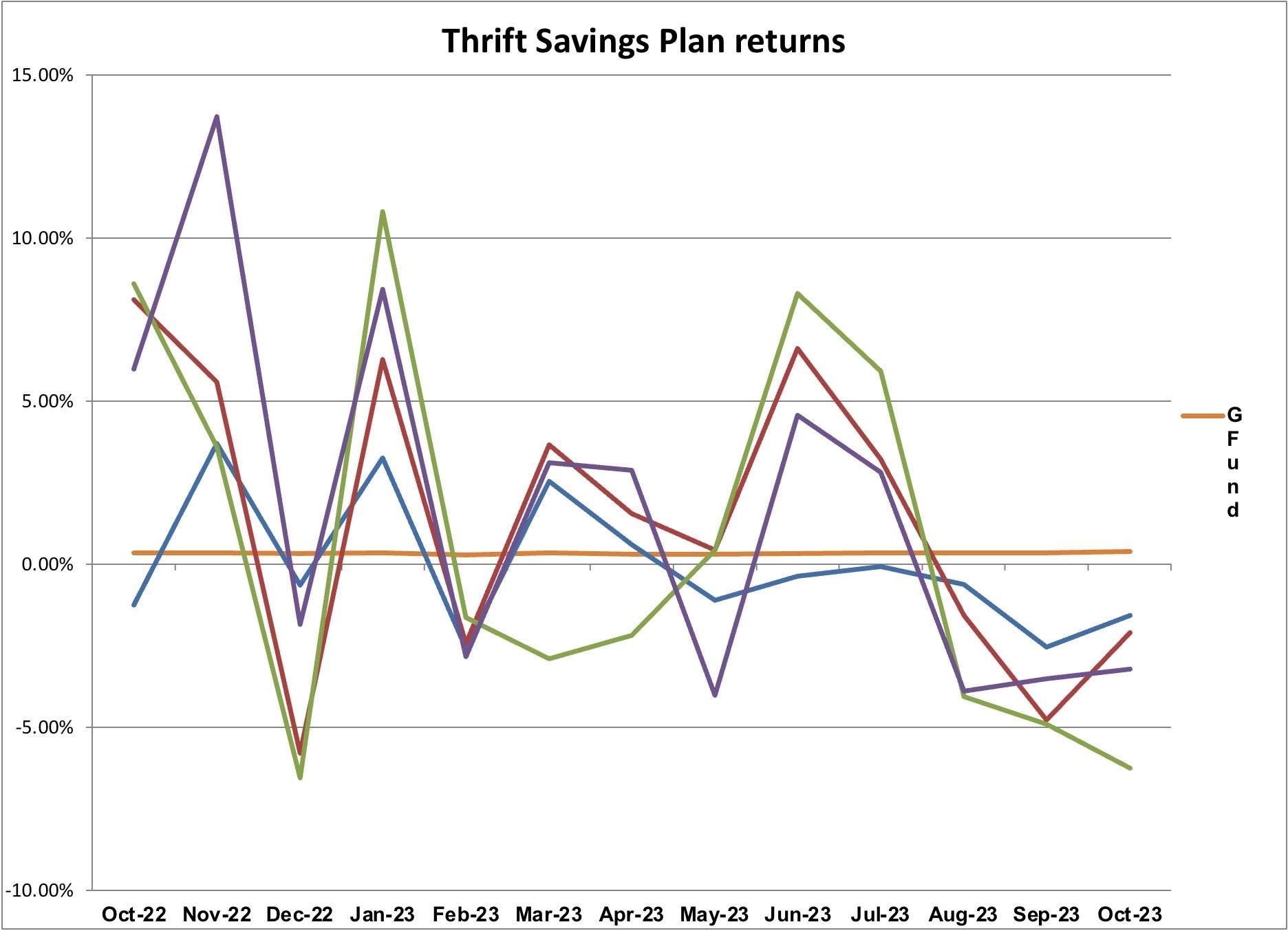

For the third month in a row most Thrift Savings Plan funds posted negative returns, with the exception of the government securities investment G fund, which posted returns of 0.40%. That’s up from its 0.35% in September.

With returns still negative in October, most funds remain in the black for the year-to-date, with the exception of the fixed-income investment index F fund which is -2.61% this year. The common stock index C fund continues to post the highest year-to-date returns at 10.67%. This is still down from September’s 13.05% returns. The international stock index I fund continues to post the highest returns over the last 12 months at 15.51%

The small cap stock index S fund once again reported the worst return of the month with -6.26%.

For the second month in a row, the fixed income F fund is showing positive returns over the last 12 months. However, the fund’s year-to-date performance is still negative with -2.61% returns in October.

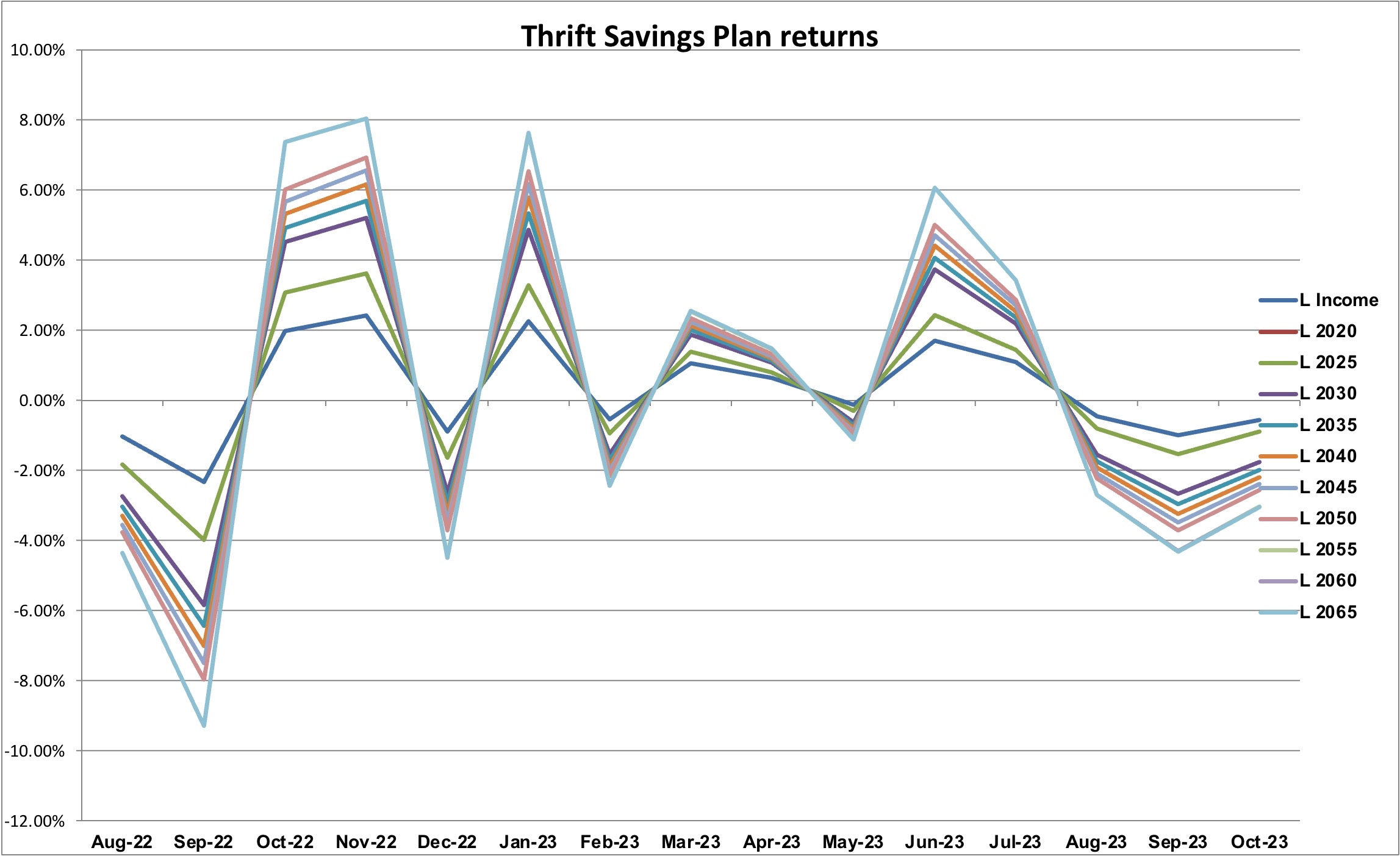

All Lifecycle funds are in the red for the third month, but remain in the black for the year and the last 12 months.

| Thrift Savings Plan — October 2023 Returns | |||

|---|---|---|---|

| Fund | October | Year-to-Date | Last 12 Months |

| G fund | 0.40% | 3.40% | 4.10% |

| F fund | -1.58% | -2.61% | .34% |

| C fund | -2.10% | 10.67% | 10.10% |

| S fund | -6.26% | 2.03% | -1.23% |

| I fund | -3.22% | 3.49% | 15.51% |

| L Income | -0.56% | 4.07% | 5.62% |

| L 2025 | -0.90% | 4.80% | 6.81% |

| L 2030 | -1.77% | 5.42% | 7.99% |

| L 2035 | -1.99% | 5.56% | 8.30% |

| L 2040 | -2.20% | 5.73% | 8.62% |

| L 2045 | -2.39% | 5.85% | 8.87% |

| L 2050 | -2.57% | 6.01% | 9.15% |

| L 2055 | -3.04% | 6.98% | 10.38% |

| L 2060 | -3.05% | 6.97% | 10.38% |

| L 2065 | -3.05% | 6.97% | 10.38% |

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Michele Sandiford is a digital editor at Federal News Network.