The Office of Personnel Management's inspector general says the agency needs a contingency plan to address risks in the long-term care insurance market.

The Office of Personnel Management has no contingency plan for its Federal Long-Term Care Insurance Program (FLTCIP) if the market continues to spin out of control.

The long-term care market has and is changing rapidly, and OPM needs to better prepare for those changes, the agency’s inspector general said in a recent report.

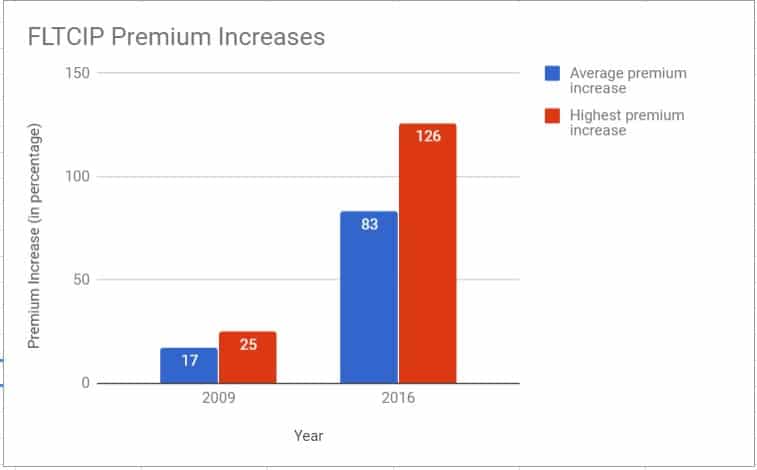

Long-term care insurance premiums rose as much as 126 percent the last time OPM re-competed its contract for the program back in 2016. The premium hikes affected roughly 264,000 active and retired federal employees, who are paying an average of $111 more per month for the same coverage they had in previous years.

With the current pace of change in the long-term care insurance market, FLTCIP participants could see even higher premiums in the future, the IG said. Premiums rose the previous time OPM re-competed its long-term care contract in 2009, but the increases weren’t as dramatic.

OPM, however, said it doesn’t need a contingency plan. The agency said it’s in regular contact with its insurance provider, John Hancock Life & Health Insurance Company, which provides OPM with monthly updates on the program’s operations, premium rates and funds.

The agency’s current contact ensures the program will continue, OPM said.

“OPM recognizes the evolving state of the long-term care industry and has been proactive in monitoring the program’s performance, while engaging in meaningful dialogue and analysis to best position the program for the future,” the agency wrote in response to its IG. “OPM will continue to assess plan benefit and design options to ensure that FLTCIP enrollees are receiving an array of options to meet their long term care needs.”

OPM does have a provision in its most recent contract, which would let the agency extend the contract past its expiration date and require John Hancock to continue providing long-term care services to previous enrollees — even if the insurance vendor does not bid on future proposals.

The agency said it’s considering new product and plan options for the current FLTCIP, but Congress would have to authorize significant changes to the program in the future, OPM said.

Though it’s encouraging that OPM is discussing possible changes with John Hancock, the agency needs to go a few steps further, the inspector general said.

“We would like to see more formal plans in place as to the implementation of future product changes,” the IG said. “Although these are ‘what if’ scenarios, any potential changes to the product or discontinuance of the current product in the future would require significant planning and work with Congress to potentially change legislation.”

The IG’s assessment and OPM’s response is in line with what the agency told Congress back in 2016, when lawmakers berated OPM officials over the sudden premium rate hikes.

Though it may seem like long-term care insurance prices skyrocketed seemingly overnight, the market has undergone a series of stark changes since OPM started the FLTCIP 15 years ago.

Since 2000, the market has lost more than 100 long-term care insurers. In 2000, there were 125 insurers in the market, the IG said. By 2014, just 12 insurers offered 2,500 individual policies and five companies offered group insurance plans.

With insurance companies leaving the long-term care market, OPM has fewer options and less competition for the FLTCIP contract, the IG said.

“This is likely because the ‘true group’ plan (like FLTCIP) is almost non-existent in today’s marketplace,” the inspector general wrote. “However, John Hancock has stated they intend to continue to bid on and service the current FLTCIP contract.”

OPM last awarded a contact for the long-term care program in 2016. The fixed-price contract award went to John Hancock, the only bidder.

The agency’s latest contract with John Hancock generally followed the proper procurement policies, the IG said. But it’s more concerned about the “fast-paced change” in the market.

John Hancock itself stopped selling group long-term care insurance plans back in 2010 and individual policies in 2016. It only administers the FLTCIP, and its current contract with OPM will expire in 2023.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED