The path forward for OPM’s proposed retirement changes

Federal News Radio explains each of OPM's proposed changes to the federal retirement system and details their outlook in Congress.

For many federal employees, the four proposals the Office of Personnel Management recently sent to House Speaker Paul Ryan (R-Wis.) to change the retirement system are so familiar, they’ve been hearing about them since the earliest days of their public service.

Still, the announcement elicited many questions and some anxiety from Federal News Radio readers. Many are contemplating retirement in the coming months and years and are considering changes to their existing retirement plans to avoid the sheer possibility of lower annuity payments or no annual cost-of-living adjustment.

Though the proposed changes are certainly disconcerting for some federal employees, several federal retirement experts say it’s unlikely these proposals will go far in Congress.

In response to readers’ questions and concerns, Federal News Radio will explain each of OPM’s retirement proposals in more detail, describe the outlook for these potential changes in Congress and give some advice from federal experts who are watching the proposed legislation closely.

The proposals

Generally, employees in the Federal Employees Retirement System (FERS) are covered by a three-part retirement system: an annuity, Social Security benefits and the Thrift Savings Plan. OPM’s proposals target two out of three of those components for FERS employees.

Though Congress and the White House have previously recommended changes to the rate of return on the TSP’s G fund, that suggestion is not detailed in OPM’s most recent legislative proposal.

Click through to learn about each of OPM’s legislative proposals, who they might impact and how.

Any and all changes to federal retirement, by law, must come through Congress. The same is true for Federal Employee Health Benefits Program (FEHBP) or changes to the rate of return on Thrift Savings Plan funds.

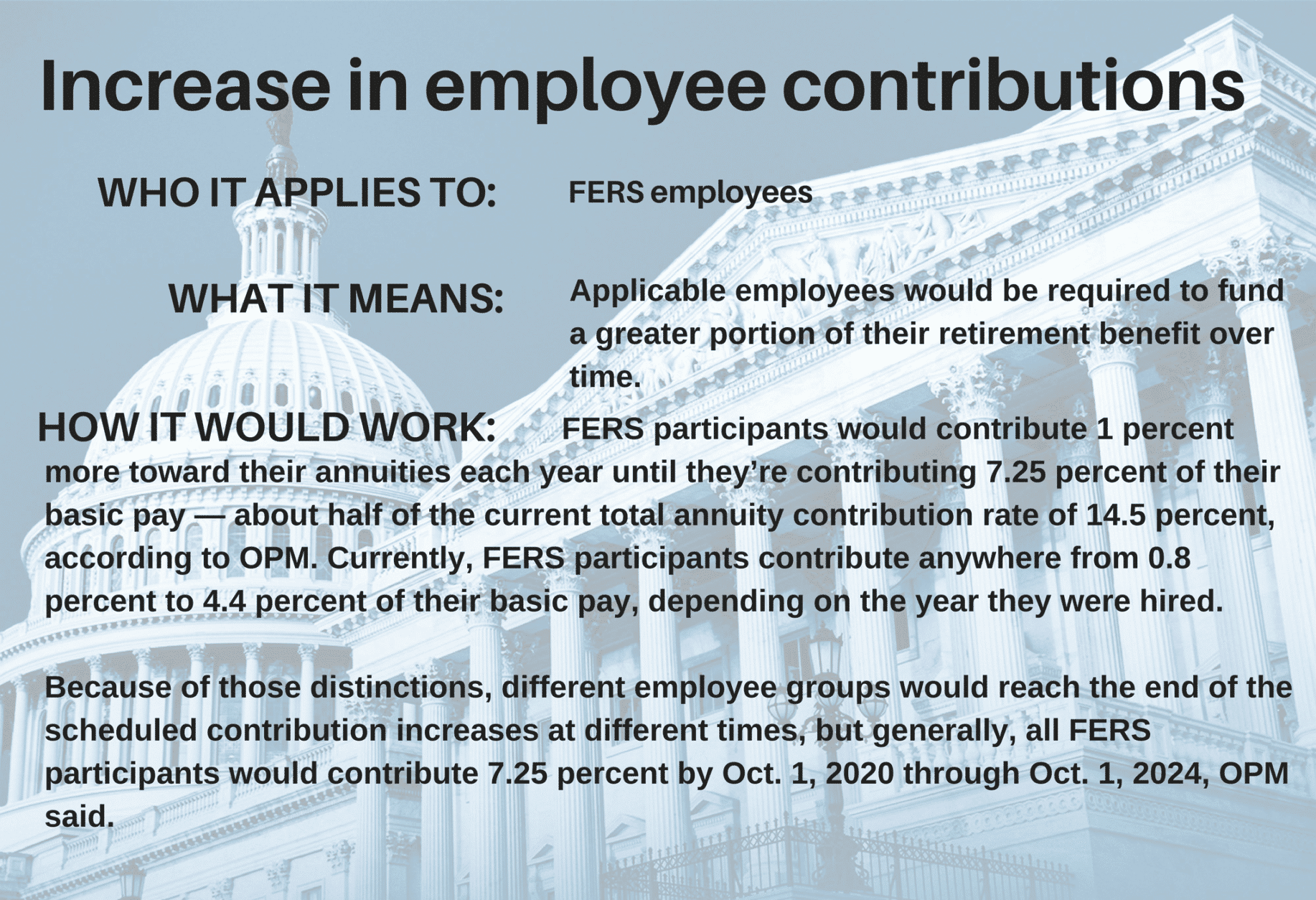

Though OPM recently sent four legislative proposals to House Speaker Paul Ryan (R-Wis.) for his consideration, they are simply — at this stage — recommendations. Though lawmakers can and may negotiate with OPM and other administration officials over the details of potential retirement legislation, Congress must explicitly state when such proposals would go into effect, what population of federal employees and retirees would be impacted and other deadlines.

To be clear, neither Congress, nor OPM, has publicly detailed that information yet, making it difficult if not impossible for federal employees to plan for retirement around these proposals and avoid their negative impacts.

What could happen?

If lawmakers do want to move forward with these retirement proposals, there are two main paths they could take.

(Graphic by David Thornton)

Congress attempted to use the budget resolution and reconciliation process in 2017 to prompt significant changes to the current retirement system, but the motion never went through.

But several members of the federal community have said Congress is less likely to go through the budget resolution process this year for several reasons. Lawmakers don’t have to enact a new budget resolution every year.

First, lawmakers typically use the budget resolution process as a vehicle to put legislative priorities in motion that congressional leaders want to enact with a simple majority of votes in the Senate. That’s exactly what happened last year, when Congress used the budget resolution to send reconciliation instructions to various committees, which then wrote and passed new tax legislation.

But in 2018, it’s unclear what major legislative priority congressional leaders want to tackle with a budget resolution and reconciliation.

Second, lawmakers have already set spending caps under a two-year deal they passed in February. The deal set the spending limit for defense agencies at $629 billion in fiscal 2018 and $647 billion in fiscal 2019, while domestic agencies would be authorized to spend no more than $579 billion and $597 billion this year and the next. Those totals are significantly higher — about $300 billion — than spending limits during the previous two fiscal years.

And in enacting that two-year budget deal, lawmakers included about $100 billion in offsets. But cuts to the federal retirement system weren’t part of those offsets.

Yes, Congress often turns to the federal workforce as a “pay-for” when it wants to offset the costs of a legislative priority or the impacts of sequestration. Consult your federal history books for more examples, but Congress has tried and succeeded before to change the current retirement system for newly hired employees.

And yes, lawmakers could still pass stand-alone bill or attach OPM’s proposals to the defense authorization act, which is considered must-pass legislation.

But the House Armed Services Committee finished its markup, and OPM’s retirement proposals are nowhere to be found. They could reappear when lawmakers debate the NDAA on the House floor. The Senate Armed Services Committee is expected to begin its markup next week.

Some members of Congress and a few think tanks floated these ideas during the Obama administration. President Donald Trump has included these proposals practically verbatim in his own budget requests for 2018 and 2019, but they haven’t gone far in the legislative process.

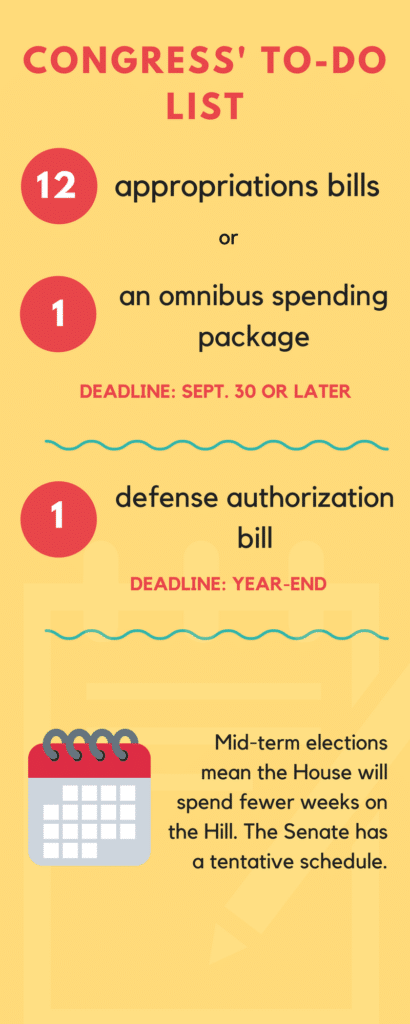

Timing is also tight. Congress has a busy schedule, and the House has four scheduled weeks off in October and November leading up to the mid-term elections. The Senate’s schedule is more tentative, but federal retirement legislation has and will continue to be significantly more difficult to move in that chamber.

Plus, members of Congress are federal employees too. These proposals would impact lawmakers and many affect some of their staff members.

Finally, the Civil Service Retirement and Disability Fund, the OPM-managed fund that pays out annuities and other benefits to its recipients, is solvent and has the ability to pay its obligations to federal retirees and survivor annuitants for several decades to come, said Tammy Flanagan, principal retirement specialist with the consulting organization Federal Retire.

What should I do?

Without more details or a clear sense that Congress will, in fact, act on these ideas from OPM and the president, several retirement experts and federal advocacy groups have a simple recommendation: stay the course.

Calculate what day is best to retire — if you haven’t already — and work toward that goal.

Though Flanagan said there may be a time when the traditional government pension plan becomes a thing of the past, she suggests federal employees stay focused on their current retirement goals.

“If changes occur, then it is time to re-focus your goals,” she said.

Greg Klingler, director of wealth management at GEBA, has similar advice: Control what you can control. Think about the three components of your FERS retirement benefits. Even with OPM’s proposals, what parts are still under your control?

“We can’t necessarily control what happens with FERS,” Klingler said in an interview last October. “Obviously, we can talk to our legislators and we can call our congresspeople. … The one thing that we can control, the one piece of the puzzle or the one leg of the three-legged stool that we can control is the TSP.”

After all, Congress is unpredictable.

“NARFE suggests that under these circumstances, you do not make your retirement decisions based on something Congress might do,” said Jessica Klement, staff vice president for advocacy at the National Active and Retired Federal Employees (NARFE) Association. “I would stick with your retirement plans, because you can always change them, but you cannot un-retire.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED