Federal employees to see some relief in FEHBP premium increases in 2019

After several years of premium rate increases that reached as high 6.4 percent, participants in the Federal Employees Health Benefits Program will see more modest...

Participants in the Federal Employees Health Benefit Program (FEHBP) can expect to pay, on average, 1.5 percent more for their health care premiums in 2019.

The Office of Personnel Management announced the premium rates for 2019 ahead of the upcoming open season, which runs from Nov. 12 through Dec. 10 this year.

Overall, FEHBP premiums will go up an average of 1.3 percent next year. It’s the lowest overall rate increase since 1996 and the lowest premium hike for enrollees since 1995, according to OPM.

The government will contribute 1.2 percent more toward participants’ health care premiums in 2019.

A formula set under law determines the share that the government and the enrollee pays toward FEHBP premiums each year. Government pays about 75 percent of a participant’s premium up to a certain cap. The cap equals 72 percent of the weighted average of the previous year’s premiums.

FEHBP participants have certainly seen higher rate increases in recent years. In 2018, enrollees paid, on average, 6.1 percent more toward their premiums. Participants paid 6.2 percent more in 2017 and and 6.4 percent more in 2016.

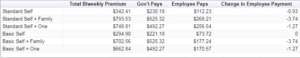

(Source: Office of Personnel Management)

But next year, enrollees in the popular, nationwide Blue Cross Blue Shield Service plans may actually see a decrease in their premiums.

Still, OPM once again is encouraging federal employees to review their options. Open season is the only time during the year that FEHBP participants have to make changes to their health care plans.

“Low increases are good news, but OPM continues to encourage enrollees to shop for coverage and evaluate alternatives, because even if your plan had a modest increase or decrease, you might still find a better value by evaluating your needs and choices that are available throughout the program,” Alan Spielman, OPM’s director of healthcare and insurance, told reporters Wednesday.

Lower premium increases this year are a result of a variety of factors, OPM said. First, the agency said it’s made a concerted effort to renegotiate provider agreements and has actively told FEHBP providers to find new ways to keep costs down.

“Several of our larger plans have better-than-expected experience,” Spielman said. “That’s been a factor. For 2019, there’s a statutory moratorium on the Affordable Care Act’s health insurance provider fee, and that’s a factor here as well.”

This past year, federal employees paid as much as $5.37, $12.55 and $12.17 per pay period, on average, for self, self-plus-one and self-plus-family coverage, respectively.

In 2019, non-postal FEHBP enrollees, on average, will pay:

- Self-only coverage: $1.53 more per biweekly pay period;

- Self-plus-one coverage: $3.06 more per biweekly pay period; or

- Self and family coverage: $2.55 per biweekly pay period.

Like last year, self-plus-one enrollees may, depending on their plan, end up paying more toward their premiums than participants in self-plus-family. FEHBP participants have complained that OPM’s still relatively new self-plus-one offerings weren’t as inexpensive as they originally expected.

But OPM said it still sees an opportunity for more people who are currently enrolled in self-plus-family to switch to self-plus-one, and it’s encouraging that population to consider the move.

In 2018, 710,000 people were enrolled in a self-plus-one plan, up from 643,000 in 2017 and 542,000 during in 2016, according to OPM.

Even though FEHB premium increases are smaller this year, the news still irritated at least one federal employee union.

“FEHBP enrollees can only absorb so much particularly given limited pay increases over the past few years and the administration’s call for a pay freeze in 2019,” National Treasury Employees Union President Tony Reardon said in a statement.

The National Active and Retired Employees (NARFE) Association praised OPM’s health care unit for its work in keeping premiums down this year.

“The very modest increase in premiums for 2019 shows the model is working to keep costs down as well,” NARFE President Richard Thissen said in a statement. “While in a perfect world, we would love to see premiums go down, the reality is a 1.3 average increase in premiums — the lowest since the 1996 plan year — is welcome news for federal employees and retirees.”

Changes to dental and vision

The Federal Employees Dental and Vision Insurance Program (FEDVIP) will also see more modest rate increases. The average dental premium rate will go up 1.2 percent. Vision insurance premiums will decrease by an average of 2.8 percent.

For the first time in 2019, FEDVIP will be open to uniformed service retirees and their families.

A provision in 2017 National Defense Authorization Act (NDAA) authorized certain TRICARE-eligible individuals to enroll in FEDVIP for the first time, and to comply, OPM added a TRICARE-retiree dental program for 2019.

DoD’s current dental plan for TRICARE-retirees will end on Dec. 31, 2018, so eligible retirees who haven’t enrolled yet should opt into to OPM’s new dental plan if they want to keep their dental coverage, Spielman said.

OPM has been working with DoD to get the word out but stresses that eligible military retirees must enroll during open season to continue their dental coverage.

FEHBP will offer a total of 265 plan choices in 2019, more than the 262 options OPM offered last year. Of course, not all FEHBP participants will have access to all 265 options, as some vary based on geographic location. The FEHBP will offer 16 national plans this year.

FEHBP participants can visit OPM’s health care site to review their current health care plans and compare other options. Spielman said OPM made a few improvements to its plan comparison tool this year.

For one thing, participants should have an easier time physically printing out the online comparison tool, which Spielman said was a common complaint from some FEHBP enrollees.

“There are also a number of technical things that we’ve done,” he said. “For example before, if you were enrolled in a self and family category, you could only look at the rates for self and family. But now you’ll be able to toggle and see also your self-plus-one versus self and family.”

More information about available FEDVIP plans for 2019 will be available Oct. 1 on Benefeds.com.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED