How long can the TSP’s bull market last?

Many experts say that the current bull market began in March 2009 and if it lasts through this month it will be the longest in history. Others say it didn’t...

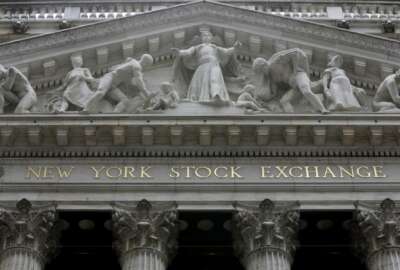

Merriam-Webster defines a bull market as “a market in which securities or commodities are persistently rising in value.” A lot of people agree on that description of market good times, like right now.

But the start and end dates of bull, and by comparison bear markets, are in dispute. Each group accuses the other of believing that the Earth is flat like a pancake instead of round like, say, a planet. The question, at least for them, is who is correct. And if you think about things like selling at the peak and buying when shares are low, it might matter to you too.

Many experts say that the current bull market began in March 2009 and if it lasts through this month it will be the longest in history. Others say it is nowhere near the longest because it didn’t start until much, much later, by their reckoning in February 2016.

But if you agree that things have been getting better, even with the usual ups and downs, since 2008 the good news is that we are on the cusp of a record — a really good thing. Of course the bad news is that all good things, including bull markets, come to an end sooner or later.

So what, if anything, should long-term Thrift Savings Plan investors be doing with their valuable, optional retirement nest eggs? Workers and retirees under the old Civil Service Retirement System are in the best position. They will get a more generous government annuity for life, with a survivor option and fully linked to inflation, starting for most at between 50 percent and 80 percent of their final salary. And that will go up each year to keep pace with inflation as measured by the Labor Department.

Workers and retirees under the FERS program, which replaced CSRS, get less generous annuities. But they too are for life and are partially indexed to inflation. To offset any differences, workers under the FERS program are eligible for a tax-deferred 5 percent match from their agency. An employer-match that high, or of anything at all, is extremely rare in the private sector.

Depending on when they retire and how long they draw their lifetime annuities, Washington area attorney Tom O’Rourke said they are the equivalent of having a $1 million to $2 million-plus certificate of deposit that will never run out.

Nearly Useless Factoid

By Amelia Brust

Abraham Lincoln had two pet goats during his presidency: Nanny and Nanko. The animals were known to chew flower bulbs and furniture, and Lincoln’s sons would use chairs as carts to be pulled by the goats through the White House.

Source: The Presidential Pet Museum

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED