Millionaires club takes stock — no pun intended

With the stock market reeling from the impact of the coronavirus who do you feel sorriest for, the 22,432 TSP millionaires or the 5 million-plus smaller investors?

With the stock market reeling — temporarily, we hope — from the impact of the coronavirus on the world economy who do you feel sorriest for: The 22,432 active and retired feds whose Thrift Savings Plan accounts shrunk, taking them out of the Millionaires Club, or the 5 million-plus investors with smaller retirement nest eggs whose accounts shrunk less or in some cases actually increased a tad?

Or the poor soul whose TSP balance dropped from $7.4 million as of Dec. 31, 2019, to a mere $6.37 million as of March 31, 2020?

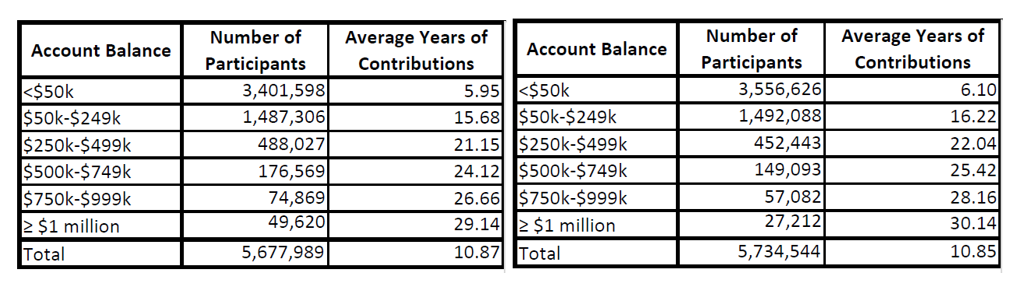

Here’s the tale of the tape according to the Federal Retirement Thrift Investment Board. The chart on the left shows account balances at the end of 2019. The one on the right shows where they stood as of March 31.

People who can crunch numbers — a club to which I do not belong — say that by and large people with million dollar-plus accounts took bigger percentage losses than those with more modest retirement nest eggs. Walter D., from Arlington, Virginia, said:

“It appears from your TSP balance table that a higher percentage of TSP millionaires have lost money than non-millionaires. You may want to ask your experts if this balance drop is directly related to millionaire accounts holding a higher percentage of stocks (and possibly bonds) than non-millionaire accounts. TSP historical data seems to say that the percent of stocks held per account decreases with age but this picture does not account for size of the TSP balance.”

Another TSP millionaire whose account balanced dropped but didn’t move him out of the club, believes those with bigger accounts tend to be people who commit to long term investments in the stock market (C, S and I funds). He said:

“Unfortunately, the Thrift Savings Board does not provide the data analytics for this analysis. Out of 4-5 million federal employees there is not that many millionaires because of each individual’s risk aversion. I know many employees who never moved their money out of the G fund during their career and their retirement. It was their safety. They are more likely to invest in mutual funds with their IRAs but these investors are few and far due to they are not investing beyond their TSP and their residence. Instead of IRAs, I see more feds with second homes or investment properties. The TSP millionaires are those who are confidant in the C and S funds and will always continue to invest some percentage during their careers and in retirement.”

Nearly Useless Factoid

By Amelia Brust

Pluto the dwarf planet, not Mickey Mouse’s dog, got its name in 1930 from 11-year-old Venetia Burney of Oxford, England. She suggested to her grandfather, a retired librarian of Oxford University’s Bodlein Library, that the recently discovered planet should be named for the Roman god of the underworld. He in turn passed the idea to astronomer and professor Herbert Hall Turner, who suggested it to the Lowell Observatory in Arizona, where Percival Lowell had first discovered Pluto. It probably helped that Lowell’s initials were P.L.

Source: NASA

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED