The TSP millionaires club just lost nearly half its members

The Thrift Savings Plan millionaires club was going strong before the coronavirus pandemic. Now, it's lost 45% of its members.

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

There’s just no escaping the economic downfall created by the coronavirus pandemic.

All the signs are there. Every single Thrift Savings Plan fund took a much-anticipated nosedive last month.

More TSP participants are withdrawing from their accounts. Inter-fund transfers — albeit from a relatively small group of participants — are up too.

Even the number of the TSP millionaires is down — by 45% at the end of March.

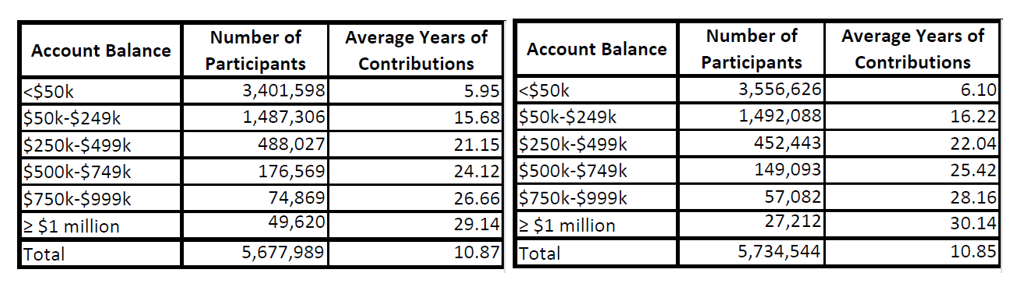

According to the Federal Retirement Thrift Investment Board, the agency that oversees the TSP, just 27,212 participants were part of the famed “millionaires club” at the end of the last month.

That group includes federal employees of all stripes who have, on average, been investing in the TSP for 29-plus years. Those participants have primarily stuck with the C, S and I funds, through the good times and the bad.

Now is certainly one of those “bad times.”

Compare the March total with the 49,620 TSP millionaires at the end of 2019, before the average person on the street even knew what the coronavirus was or where it came from.

At the end of 2019, the highest TSP account balance stood at nearly $7.4 million. Now, the highest account balance is $6.37 million.

A closer look at the data reinforces what most of us already know: retirement accounts have taken some serious hits this past month, and it’s all due to wild swings of the stock market.

Many feds are delaying their retirements now because of it all, at least until the market bounces back a little bit, said Greg Klingler, director of wealth management for the Government Employee Benefits Association (GEBA).

“The markets as they are today have never seen anything like this before, a pandemic with this level of contagious nature and this level of potential mortality,” he said in an interview. “The markets have not seen this, so the markets are latching on to bits and pieces of information and trying to make decisions accordingly.”

Klingler described recent stock market volatility as a kind of “saw tooth” — low lows one day, followed by high highs the next.

So when will the market hit rock bottom? And what should you do in the meantime?

Klingler warned against anyone offering a confident prediction; they’re probably using very limited data and information to hedge their best guesses.

“We’re closer to the bottom than we are to the top,” he said. “Typically when you’re sitting in that place you do not want to sell, because the last thing you want to do is buy high and sell low. Selling now would effectively cause that.”

So what would the TSP millionaire, or the former one, do?

This is one of those times where financial planning is everything.

Remember, corrections in the market happen; situations like this are why you planned in the first place. Federal employees with properly diversified portfolios should stay the course, Klingler said.

“You lean on your fixed investments and you start spending that money for the time being until your equity has increased,” he said. “You shouldn’t be worried if you’re in a properly diversified portfolio. This is what it’s planned for; this is why we diversify.”

And for those who haven’t planned or diversified?

“It may be time to just reevaluate where you are,” Klinger said. “If you can take on more risk or if you have more money sitting on the sidelines, as we get closer to the bottom, it’s not a bad time to have more money enter the market, whether that be through rebalancing or actually adding money to the market.”

“We have nothing to attach this to, and the average investor is reaching and grasping on every piece of information that they see, trying to make a strong decision,” he said. “What we’re telling our members is that unfortunately we don’t have a crystal ball. I can tell people that I think we are closer to the bottom of the market than the top.

Planning for those market corrections and then reassuring yourself when the moment comes is difficult, though.

There’s little to compare this moment to, Klingler said. Maybe the 1918-1919 Spanish flu, but the stock market didn’t exist then.

“Make decisions accordingly,” he said. “Now more than ever before is it important to make sure that you’re diversified properly, to make sure your portfolio represents your risk tolerance and to move forward thinking mathematically, and not getting caught up in emotion.”

Nearly Useless Factoid

Mount Everest is still growing, at a rate of about one-quarter inch per year.

Source: National Geographic

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED

Related Stories