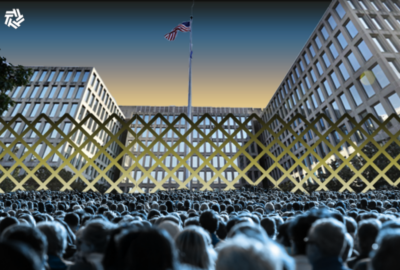

Government shutdown averted, but federal employees still wary as Congress shifts deadline to holiday season

Federal employees see the extended shutdown deadline as a chance to set aside emergency funds, in case lawmakers can't reach another 11th-hour deal just before...

Federal employees prepared for a government shutdown that was all but certain — until it wasn’t.

Congress averted a government shutdown on Saturday evening by passing a continuing resolution. The stopgap funding bill gives lawmakers until Nov. 17 to reach a bipartisan spending deal for the rest of fiscal 2024.

Several federal employees told Federal News Network on Saturday morning — before the House put the 45-day continuing resolution to a vote – that they tightened their household spending as much as possible, not knowing whether they’d receive their next paycheck on time.

Federal employees see the extended shutdown deadline as a chance to set aside more emergency funds, in case lawmakers can’t reach another 11th-hour deal just before Thanksgiving and the start of the holiday season.

LaRhonda Gamble, president of the American Federation of Government Employees (AFGE) Local 12 and an employee at the Labor Department’s Employment & Training Administration, said bargaining unit members have been saving up in preparation for a government shutdown.

“A lot of our members are actually living paycheck-to-paycheck. Some people automatically think if you’re a government employee, you make this big, astronomical amount of money – when, in fact, we are being paid less than what some people are being paid on the outside,” Gamble said Saturday at a union-sponsored member appreciation barbecue in Fort Washington, Maryland.

Tyra McClelland, an employee with the Court Services & Offender Supervision Agency (CSOSA) and AFGE District 14’s National Women’s Advisory Coordinator, said the Oct. 1 shutdown deadline came at a particularly challenging time.

Federal student loan borrowers started making payments on Saturday, after a three-year pause. Federal employees also had to make rent or mortgage payments at the start of a new month.

“You have to do what I call furlough math,” McClelland said. “Furlough math is you normally let your daughter take a shower, and you don’t care how long she’s in there. Now, with furlough math, you care. With furlough math, you have to figure out, would I have a large load of laundry? Well, [now] we’re going to have a super-large load of laundry. It’s just the little things, and I don’t think that people understand that you have to do mathematical equations on absolutely every aspect of your life.”

The shutdown deadline, she added, put an added toll on federal employees, who have just figured out their “new normal” since the start of the COVID-19 pandemic.

“It’s disappointing to hear people saying, ‘Oh, they’ve been through this before. They should already know how to do this.’ It’s different each time,” McClelland said.

Many federal employees will receive their next paycheck on Oct. 14. Those employees would have seen a partial paycheck, if a shutdown occurred and lasted for two weeks or longer.

“[It’s] the anxiety level, and it’s an unnecessary emotion that our government leaders put us in,” McClelland said about the uncertainty of the situation.

Patrick Holmes, an employee at Court Services & Offender Supervision Agency and chief shop steward for AFGE Local 727, said he’s been saving as much as he can, but said, “it’s not fair that every year we face the uncertainties of a shutdown, not knowing when our next paycheck might come.”

“Not knowing when you will get the next paycheck, it’s stressful. Working in law enforcement, it can already be stressful, and then adding more stress on top of it – not knowing when you’re going to get paid – it’s just going to be a stressful situation,” Holmes said.

Holmes said a shutdown can have a ripple effect on federal employees in law enforcement and national security jobs. Excessive debts can prevent some candidates from obtaining a security clearance or passing a federal background check.

“You can’t have certain debt working with the federal government. So Congress should understand that when we become behind [on bills], our jobs are potentially at risk, because we are delinquent on our bills, and you can’t do that. You can’t be delinquent on your bills being a federal employee,” he said.

Agencies also scrambled late last week to determine what funds, if any, were available to keep employees paid for at least the first week of a possible shutdown.

The Department of Housing and Urban Development (HUD) told employees in an email last Thursday that the agency would stay open through Oct. 7 — if Congress triggered a government shutdown.

HUD told employees, in an email obtained by Federal News Network, that its workforce would “work as normal —with pay and scheduled travel and leave” this week, even if Congress triggered a government shutdown.

“Whether the potential shutdown would be your first or not, the idea can cause a lot of stress and worry,” Felica Gaither, the deputy assistant secretary for field operations at HUD’s Office of Public and Indian Housing, told employees in a follow-up email. “I hope hearing you will receive full pay in the upcoming weeks will ease uncertainty.”

Salvatore Viola, president of AFGE Council 222, which represents 5,000 HUD employees, said HUD’s plan to stay open ran counter to its usual contingency plans.

“I think the employees are very confused,” Viola said in an interview Friday. “This is the first time that HUD is actually having a different shutdown [plan] than the rest of the government,” Viola said. “They’re confused. First, they’re being told a shutdown is inevitable. Then they’re told it doesn’t matter if there’s a shutdown, you’re going to work anyway – and don’t worry, we’ll pay you for the week.”

While HUD’s carryover funds during a shutdown would have softened the financial impact for employees, Viola said he was surprised to hear HUD had leftover funding.

“There’s more retirements now than ever. Employees cannot just keep up,” Viola said. “They’ve had all this money to keep the agency open for a week. Why aren’t you using that same salary-and-expense money and backfilling positions, especially in those programs areas within HUD that employees are seriously overworked?” Viola said.

The agency, he added, hasn’t been hiring to keep up with its rate of attrition over the past two years.

But other agencies would have furloughed a majority of their workforce in the event of a shutdown.

“It will be a very skeletal crew,” Gamble said. “It will be individuals that have to go in, to do the basics, to make sure the government can still function somewhat with the activities that will still be going on.”

The annual uncertainty of a government shutdown, Gamble said, makes an otherwise “good government job” challenging.

CSOSA received the worst grade among midsize agencies in the latest Best Places to Work in the Federal Government ranking from the Partnership for Public Service.

Holmes said the routine threat of a government shutdown makes it hard for the federal government to recruit the next generation of employees to join the agency.

“It’s going to be hard to recruit that age group of 40 and under, because they’re going to be like, ‘Why should I waste my time and career working for a government that doesn’t appreciate me, and not knowing when my next check is going to come?’” he said.

The House and Senate are no closer to a spending deal.

The Senate has a full slate of spending bills ready for a full vote. They keep most nondefense discretionary spending frozen at current levels. But the House is still working on its own version of those bills that push for spending cuts

The House is scheduled to vote soon on three FY 2024 spending bills.

“They should not have to wait 45 days. There’s no excuse for another crisis here,” White House Press Secretary Karine Jean-Pierre told reporters Monday.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED