Are you on the government’s endangered species list?

If Uncle Sam kept a list of endangered workers, folks under the old Civil Service Retirement System would be at the top. Less than six of every 100 workers still on...

If anybody in your office has been with the government since the early 1980s take him or her to lunch. Your veteran office mate is golden and like many precious resources, their numbers are dwindling fast.

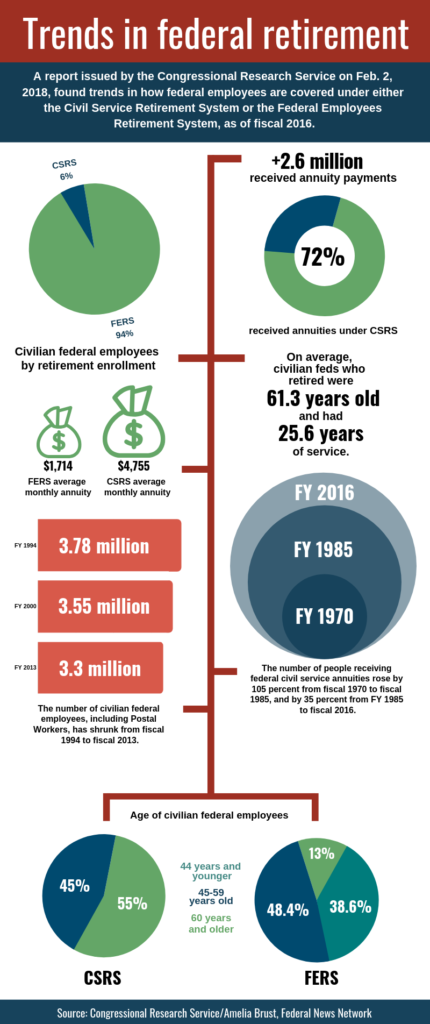

In fact, if Uncle Sam kept a list of endangered workers, folks under the old Civil Service Retirement System would be at the top. Less than six of every 100 workers still on the payroll are under the generous system that was phased out in the mid 1980s, in favor of a retirement package more like those in the private sector. It is the Federal Employees Retirement System, or FERS, and it covers those hired since 1984.

Although CSRS and FERS employees work alongside each other in many offices, their situations are very different.

CSRS provides a much more generous retirement annuity than FERS, while the latter group of employees are eligible for both Social Security and get a government match of up to 5 percent of their total pay to their Thrift Savings Plan accounts. The TSP is a good investment for CSRS workers and a must for FERS employees because of their smaller annuities.

CSRS provides a much more generous retirement annuity than FERS, while the latter group of employees are eligible for both Social Security and get a government match of up to 5 percent of their total pay to their Thrift Savings Plan accounts. The TSP is a good investment for CSRS workers and a must for FERS employees because of their smaller annuities.

In a Congressional Research Service study of the two retirement plans in fiscal year 2016, the average monthly federal benefit for retiring CSRS workers was $4,755 versus an average of $1,714 per month for those leaving under the FERS plan.

Because of the less generous civil service benefit and less inflation protection in retirement some people believe that those under FERS work longer than their CSRS counterparts.

For the past few years the Trump administration and GOP leaders in the House of Representatives have proposed a number of changes, including forcing feds to pay up to 6 percent more for their FERS benefits, eliminating gap payments for workers who retire before age 62 and basing future annuities on the employee’s highest 5-year average salary. That monthly annuity is now calculated on the employee’s highest 3-years service.

The administration has also proposed reducing future cost of living adjustments for people retired under the FERS program and eliminating them altogether for current and future FERS retirees. The budget President Donald Trump will send to Congress is expected to again propose such changes. But since Democrats have taken control of the House the drive to whittle down civil service benefits is likely to lose some steam.

In fact, Rep. Gerry Connolly (D-Va.) is picking up support for his bill to give current and future FERS retirees full cost of living adjustments each year. They are currently under a diet-COLA system which gives them smaller inflation catch-ups if the cost of living exceeds 2 percent in a year. This year, for example, CSRS retirees got a 2.8 percent COLA, but for FERS retirees it will be limited to 2 percent.

Connolly’s state, along with Maryland, California, Texas and Florida, was home to about one-third of all federal employee annuitants and survivor annuitants in fiscal 2016.

At the end of FY 2016, the balance of the CSRDF was $879.8 billion, more than 10 times the amount of outlays from the fund that year. The trust fund balance is expected to reach $909 billion by the end of FY 2018.

Nearly Useless Factoid

By Amelia Brust

The fastest marathon run by participants in a three-person costume was completed by Evan Williams, Ian Williams and Graham O’Loughlin on April 23, 2017, in London. They finished the Virgin Money London Marathon in 3 hours 13 minutes and 9 second wearing an inflatable raft-like costume and raising funds for the charity Heads Together.

Source: Guinness World Records

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED