Va. lawmakers remind OPM: We haven’t forgotten about rising long-term care premiums

Reps. Don Beyer and Gerry Connolly (D-Va.) haven't forgotten about rising premium rates to the Federal Long Term Care Program, and they certainly haven't forgotten...

Two Virginia Democrats are pushing the Office of Personnel Management to give them answers about its plans to deal with rising Federal Long-Term Care program premiums.

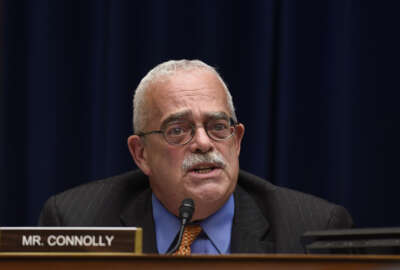

The letter from Reps. Don Beyer and Gerry Connolly (D-Va.) follows a November hearing, where lawmakers — often loudly — questioned OPM and FLTCP vendor John Hancock Life & Health Insurance Company why long-term care premiums rose by triple digits in some cases last year.

Lawmakers largely criticized OPM for the way it administered the FLTCP and announced the new premium rates, which caught many federal employees by surprise.

OPM announced in July 2016 that premiums could rise for policyholders by as much as 126 percent. The premium hikes were expected to affect 264,000 active and retired federal employees, who are expected to pay an average of $111 more per month for the same coverage they have now.

“Our constituents cannot afford to wait until the end of the current contract to learn how the program might be altered or that they might face enormous premium increases,” Beyer and Connolly wrote in a June 22 letter to OPM Director of Healthcare and Insurance Alan Spielman. “They must be able to plan and prepare.”

OPM at the time said it didn’t have a proposal to offer to the subcommittee yet, and it couldn’t offer a timeline for when it would present its ideas in the future.

“We do not have a position that I can offer in terms of recommendations to this committee as far as what we think we should do to move forward in terms of addressing the problems with long-term care insurance,” John O’Brien, then OPM healthcare and insurance director, said in November. “I have found this hearing very, very helpful. There are a number of ideas and proposals and ways to deal with the challenges of the program, and we are wide open to working with this committee and all of these individuals on how we can come up with solutions.”

Lawmakers, however, weren’t impressed with the agency’s responses.

“We made it clear that those answers were not sufficient and that the subcommittee would expect a timeline and solutions,” the congressmen wrote.

An OPM spokesperson said Friday that the agency had received the letter and is reviewing it.

The agency is required by law to issue a new contract for the long term care program every seven years. John Hancock was the only bidder in 2016. And OPM awarded the contract to the same company in 2009, when premiums rose on average by 17 percent and as much as 25 percent overall.

Both OPM and John Hancock attributed the rising premium rates to poor projections about the program’s costs and returns and an aging population that’s submitting longer claims more frequently.

Several lawmakers said they had a difficult time understanding why OPM chose not to raise premiums incrementally over a few years, or at the very least, why the agency did not better publicize its predictions about the future costs.

Connolly at the November hearing made his frustrations with OPM loud and clear.

“I’m going to use every influence I [have] to make sure you are summoned back to this subcommittee, and at that point, we will expect specific proposals,” he said. “You owe that to the federal employees and retirees who count on this product. You’re not a passive observer, just respond[ing] to the whims of the market with, ‘Oh my.’ You have an obligation to the people you serve. And you have an obligation to this Congress to come here with concrete ideas about how to ameliorate and resolve this issue, and we will expect that next time we see you, sir.”

Beyer isn’t a member of the House Oversight and Government Reform Committee but was invited to question the witnesses in November. He said his office’s phone was “ringing off the hook” with calls from federal employees in his district who worried they’d have to pay at least $100 more a month for the same long term care insurance.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED