The Coalition for Government Procurement and the Naval Postgraduate School found agencies were getting better deals through GSA Advantage than through pilots using...

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

Congress needs to rethink its requirement for the General Services Administration to pilot and eventually set-up a new e-commerce platform.

Lawmakers should tell GSA to pause its efforts before any more money is spent by the government or by industry.

If the goal of the e-commerce marketplace is to give agencies easier access to commercial products, to obtain better data on what products agencies are buying and to save money, the smarter, more economical and more pragmatic approach would be to fix GSA Advantage and not develop something new.

The fact is GSA Advantage already accomplishes two of the three goals of the e-commerce marketplace, and addressing the data issue isn’t that much of a stretch.

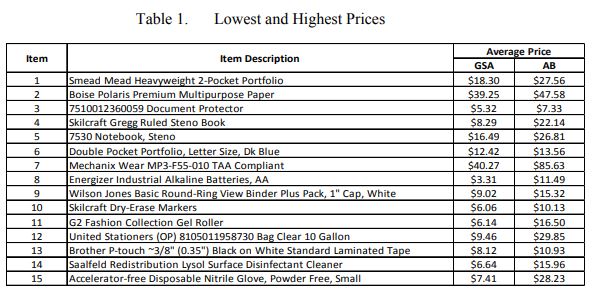

The latest example comes from the Coalition for Government Procurement, which analyzed 744 AbilityOne products on GSA Advantage and on a platform run by Amazon under a pilot program.

CGP found 741 out of 744 items on GSA Advantage had better prices as compared to the AbilityOne and Amazon site. Even when CGP accounted for minimum order quantities required under the government’s buying platform, GSA Advantage still provides agencies with a better deal 72 percent of the time and prices were lower 56 percent lower on Advantage as compared to the Amazon pilot.

Roger Waldron, the president of CGP, said his association’s analysis as well as one from the Naval Postgraduate school debunks the urban myth that GSA schedules aren’t competitive.

“For years, there’s been this complaint about GSA and its pricing and I think this study and the Naval Postgraduate school study shows this is a competitive marketplace,” said Waldron, who also hosts Off the Shelf on Federal News Network. “The thing about the schedules marketplace is there are additional layers of competition that can be had when you leverage requirements and get quotes that further lends itself to providing value to the government. So rather than doing micro purchase after micro purchase, you can leverage those buys through the schedules program.”

The December 2017 study by Air Force Capts. Holland Canter and Tabitha Gomez at the Naval Postgraduate School provided similar findings as the CGP report.

Canter and Gomez looked at an Air Force pilot with Amazon and GSA Advantage for credit card purchases.

Canter and Gomez found “of 300 vendors that offered the 60 compared items, GSA Advantage offered the lowest price 80 percent of the time (241 times out of 300). Although GSA Advantage offered the lowest price more frequently, every item had a minimum order requirement. Amazon Business did not have any stated minimum order requirements for any items that we examined.”

Both studies found some definite benefits with Amazon’s portal.

Waldron said the CGP study found that the Amazon portal with AbilityOne was more user friendly and easier to find products thanks to a landing page and search logic.

“There are some pop-ups that come up when you are looking and searching on the commercial tool that AbilityOne would want to look at in regard to the ‘essentially the same’ concept to see how that could work in the future,” he said.

The study also states, “[Amazon-AbilityOne] usually has effective and consistent product names; technical information, such as the size and weight of a product; and accurate photos of the product.”

The Naval Postgraduate School study found, based on interviews with users, that GSA Advantage’s requirement of minimum order quantities was unpopular, and gave Amazon a boost because it doesn’t have the same requirement.

“From our results, we infer that users preferred Amazon’s platforms for several reasons. First, the platform is used widely in the commercial sector and many people use Amazon in their personal lives. The platform provides a vast selection of supplies, product ratings and vendor ratings while also offering two-day delivery for most items,” the authors wrote. “We also found that older respondents were less likely to prefer Amazon.com or Amazon Business, compared to younger respondents. This is likely because older than 65 respondents are more familiar with GSA Advantage. They have used the platform for many years.”

The authors also found purchase card users said that while GSA Advantage worked well for purchases above the micro-purchase threshold and strategic sourcing initiatives, they didn’t like the minimum purchase requirements, shipping policies, return policies or search engine results page.

Both GSA and Amazon offered little insights into their individual thoughts about the CGP analysis.

“The Federal Acquisition Service (FAS) is committed to providing best value offerings to our customers. Purchasing through our multiple award schedules and global supply programs promotes compliance in meeting the mandatory AbilityOne purchasing requirements,” said Alan Thomas, the commissioner of FAS, in a statement to Federal News Network. “Through our Federal Marketplace Strategy, GSA wants to make it easier for our customers to buy solutions and for industry partners to offer them, including AbilityOne items. GSA is continuously improving existing platforms and developing new ones as we enhance the buying and selling experience.”

And Anne Rung, the former administrator in the Office of Federal Procurement Policy and now the director of Amazon Business government sector, said in a statement to Federal News Network that “Amazon Business provides government customers with another option for their purchasing needs, offering a combination of selection, convenience and value with features and benefits tailored to the needs of public sector organizations. These features and benefits simplify the procurement process and increase efficiency for procurement officials, who can spend more of their time focusing on mission-critical projects.”

Amazon has been a big supporter of the e-marketplace concept because, as Rung said in June, it can give the government more transparency and more efficiencies.

OFPP said in December it wanted to limit purchases during the e-commerce pilot to $10,000, below the micro purchase threshold. Many of these purchases now are done through government purchase cards. GSA announced earlier this month that agencies spent a record $30.6 billion in fiscal 2018, $2 billion more than the previous year, through the SmartPay program.

This leads back to both the CGP and Naval Post Graduate School studies. The researchers reviewed products that were under $100, meaning many of those items would normally be purchased with credit cards so creating a new e-marketplace to track this spending instead of just working with the credit card vendors is yet another reason for Congress to revisit this decision.

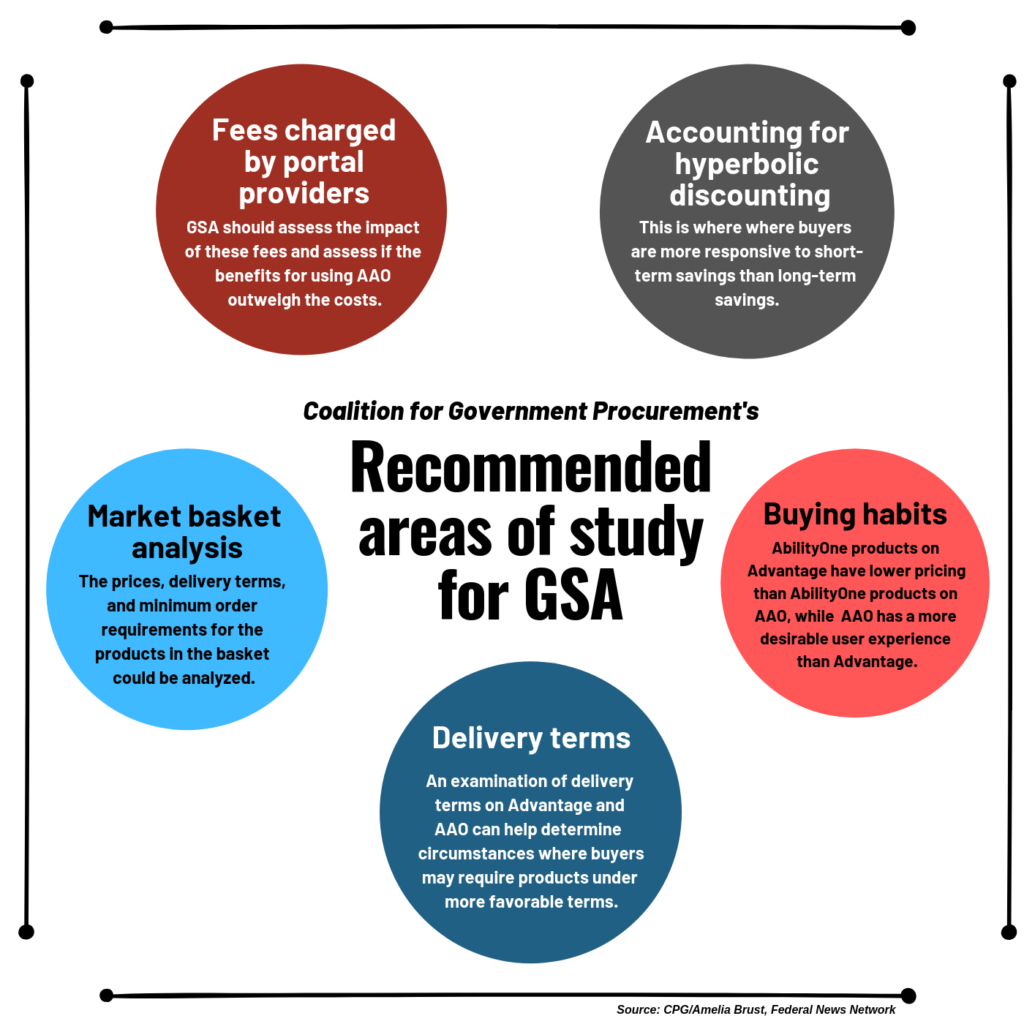

CGP included in its study some areas for GSA and OFPP to consider more closely as it conducts the e-marketplace pilot.

“We like to look at it from our members’ perspective to increase opportunities through e-commerce. So what does that mean? Making improvements to GSA Advantage by developing logical search capabilities that make it easier to use to take advantage of that competitive pricing that GSA has been able to establish,” Waldron said. “What role should e-commerce platforms play in the commercial market? Should they be part of the conversation and part of the solution? Absolutely, but what does that look like? We need to create opportunities for commercial firms across the board. It can’t be a zero sum game where you are taking one set of requirements and moving it to another place. I don’t think the government gets a better deal.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED