According to a Federal News Network analysis of Office of Personnel Management data, 6,000 fewer employees retired in 2019 compared to the previous year. Federal...

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

It turns out it’s not easy to predict a federal “retirement tsunami,” the long-dreaded phenomena that human capital experts have been warning of since the mid-1990s.

Annual federal retirements have remained relatively consistent, peaking occasionally for a year or so before dropping again to a more predictable number.

That trend continued in 2019.

Roughly 6,000 fewer federal employees retired in 2019 compared to the previous year, according to a Federal News Network analysis of monthly data from the Office of Personnel Management.

OPM processed 101,580 federal retirements in 2019. The figure still outpaces federal retirement numbers from the later years of the Obama administration, when around 95,000 employees left government each year.

Governmentwide totals turned upward in 2018, when OPM processed 107,612 retirement applications in 2018, a five-year high.

Federal retirements hadn’t reached a peak that high since 2013, when 114,697 employees left their agencies. By all accounts, 2013 was certainly a tumultuous year for the federal workforce, which experienced a third consecutive year of frozen pay, administrative furloughs due to sequestration and a 16-day government shutdown.

Total federal retirements steadily dropped since 2013 and began to pick up slightly in 2017. Many had questioned whether the presidential transition or the first year of a new administration would finally prompt retirement-eligible federal employees to head for the door.

Retirements did pick up slightly in the first year of the Trump administration, but employees didn’t leave their agencies in droves, according to annual OPM data.

Federal retirements, however, did increase noticeably in 2018. Financial planners and human capital experts pondered whether 2019 would see a similar boom in federal retirements, with agency human resources offices scrambling to catch up after a 35-day government shutdown to process a backlog of mounting retirement applications in February.

Would 2018 signify the start of the long-dreaded retirement tsunami, or at the very least, a wave?

Not so, according to the 2019 data.

Perhaps, predicting federal retirement trends is more complicated.

Federal agencies themselves have expressed concern over the sheer number of retirement-eligible employees within their workforces. The Government Accountability Office in 2017 estimated 31.6% of the federal workforce would be eligible for retirement by 2022, though those numbers vary significantly depending on the agency.

But according to a Federal News Network survey of 1,565 respondents, reaching retirement age isn’t necessarily a bellwether for actually leaving federal service.

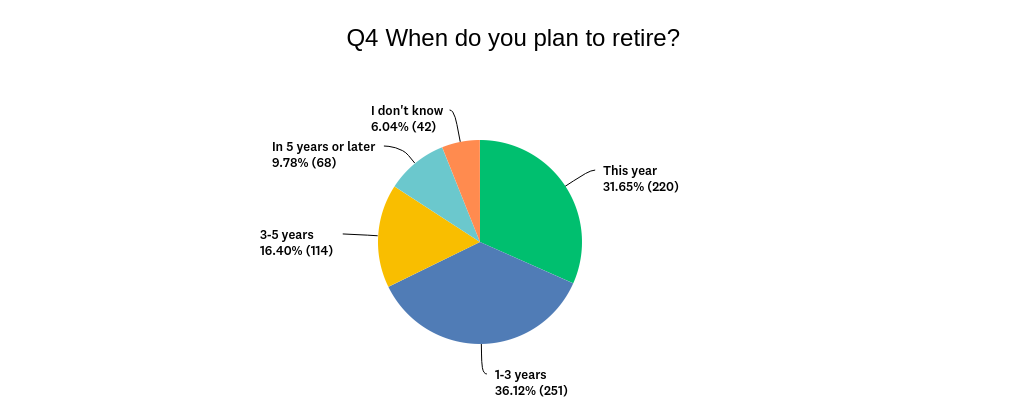

Of the nearly 700 survey respondents who indicated they were eligible to retire, nearly 32% said they planned to retire this year. Another 36% said they planned to retire in the next one-to-three years, while 16% planned to delay retirement for another three-to-five years.

And of the 565 respondents who aren’t currently eligible, 23% said they planned to retire within one-to-three years of eligibility, while another 28% said they planned to leave federal service after three years or more.

A majority of currently ineligible survey respondents, or 43.5%, said they would retire as soon as they’re eligible.

But survey respondents overwhelmingly cited a wide variety of financial, health, family and personal reasons as factors driving their decision to retirement. Job satisfaction, or dissatisfaction, also play a central role.

And because so many factors influence those decisions, the long-predicted “retirement tsunami” has been difficult to pin down, financial planners have said.

There is, however, one key milestone that is often a predictor and key influence for federal employees, said Greg Klingler, director of wealth and management for the Government Employees’ Benefits Association.

Many survey respondents said they planned to retire at age 62, because the Federal Employee Retirement System (FERS) incentivizes participants to keep working until that specific age.

Financial planners say this is a key target for many federal employees, especially for those who have been investing with the Thrift Savings Plan and have created specific retirement plans.

“I am retirement eligible with 34 years of service. I love my job, the mission of my agency and my colleagues,” one survey respondent said. “Age 62 is my retirement target, which is five years from now.”

For the purposes of calculating their annuities, 62-year-old employees with at least 20 years of service receive 1.1% of their average highest three years of salary for each year of service, instead of 1% for employees under age 62. Employees age 62 or older also receive annual cost-of-living adjustments; those under age 62 do not.

“I waited until I was old enough to receive the maximum benefit while still young enough to enjoy it,” one employee said. “I’ve been ‘ready’ for years, but doing so earlier would have involved a significant reduction in benefits.”

Another survey respondent said he’ll earn nearly $20,000 more per year in retirement if he leaves at age 62 compared to age 56.

In addition, some respondents said they planned to postpone retirement past eligibility and even beyond age 62 due to other financial commitments. Several respondents, for example, said they had children in college and wanted to delay retirement until they had graduated or helped pay down student loan bills.

Yet others said they feared the savings they had accumulated while working would be enough to sustain their current lifestyles in retirement.

“I would love to retire as soon as I’m eligible, but want to ensure there will be enough in TSP, Social Security, etc., to ensure a comfortable life,” one federal employee said. “Realistically I plan to retire within three-to-five years of eligibility.”

For Klingler, this is a common concern among his clients, especially among federal employees who he said are “dedicated savers.”

“For people who are indoctrinated into this saving mentality, it’s a hit in the gut when you tell them to let their [retirement] account[s] go down,” he said. “That can be pretty scary for people.”

Beyond financial, health and family factors, several survey respondents cited frustrations with their supervisors and the direction they believed their agency was headed.

Several survey respondents mentioned dwindling budgets and resources, as well as the stress that comes with doing more with less, as key motivations for their retirement.

“Up until the past couple of years, I really enjoyed my job,” one respondent said. “But the agency leadership has become more focused on ‘the process’ rather than the work. They have failed to provide the resources (i.e., employees) to get that work done, and the political environment frankly has become more toxic than usual.”

“Although I love working at NASA, 30 years of fighting declining budgets and strategic directions changing every four-to-eight years and I’ve had enough,” one employee said.

An upcoming agency relocation claimed at least one survey respondent who plans to leave federal service rather than move. The Bureau of Land Management announced plans last year to relocate its headquarters to Grand Junction, Colorado. Some positions were tapped for relocation to Colorado, while others are being moved to other western states.

“My position is moving to Denver, so I am retiring,” a BLM employee said. “I am 70 years old with more than 41 years of federal service. Our daughter, son-in-law and granddaughter live five minutes away.”

For others, the commute, hours and other stresses at the office are driving their decisions to retire.

“My spouse is ready for me to retire, and I am pretty tired of the commute and traffic,” another respondent said. “[I’m just waiting to get a bit more cushion financially. My job is still fairly interesting, but it’s getting close to the time for me to step aside and let someone else have a go at it.”

Others mentioned low morale.

“The salary is excellent, but chaos at work is making work life difficult,” one employee said. “My finances are in order, so I’ll go as soon as I have 20 years in.”

A handful of survey respondents said the political climate had been weighing on them; others cited the uncertainty with the upcoming presidential election or prospect of a future government shutdown as factors that may prompt them to retire.

“Federal workforce has become too politicized. The days of being objective in our work is gone,” one employee wrote. “You can’t talk about your political preferences without open hostility from others. Promotion plans favor younger but not necessarily better qualified workers. The appeal of working for the government is gone except for the fact that we have great benefits.”

To be clear, several survey respondents said their passion for their job and their agency was a motivating factor to delay their retirement and keep working well past their minimum retirement age.

“I’m just not ready yet,” one employee wrote. “I love my job.”

Klingler said this sentiment is especially noticeable among his clients in the defense and intelligence spaces.

“We do find that for a group of people, maybe about 25%, mission is very very important to them,” he said. “They’re not retiring until something that they wanted to accomplish in their career is finished. That does keep people working later.”

Retirement-eligible employees keep working, Klingler said, because they like their jobs. Their work drives their sense of value and self-esteem.

But those positive feelings aren’t universal, Klingler said, and they often depend on an employee’s agency and their organization’s political climate. He mentioned his clients at the EPA and State Department, who had no intentions of retiring three-to-five years ago.

Now they do, he said.

Reorganizations, relocations and changes to telework and other workplace policies have changed the culture at agencies such as the Agriculture and Interior Departments, among others.

Those changes have been difficult to ignore, federal employees said, but they work through the uncertainty until they’re financially and personally ready to retire.

“My husband is retired military, so we are just waiting until the end of 2022 when I become eligible to go. Then it’s time to travel and enjoy our time together,” one survey respondent said. “Truthfully I do not really enjoy my job; it’s a means to an end. [There’s] too much bureaucracy to wade through anymore. It used to be enjoyable and like working with your family. [Agriculture Secretary] Sonny Perdue has really changed the culture around here. “It’s not a place most of us want to be, but don’t really have a choice when we are this close to the end of our careers.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED