OPM’s retirement processing finishes strong for 2023, but still ‘not where we need to be’

After chipping away more than a third of the federal retirement claims backlog, the Office of Personnel Management is now bracing for an upcoming surge in...

In the first few months of the new year, the Office of Personnel Management is bracing for a surge in federal retirement claims.

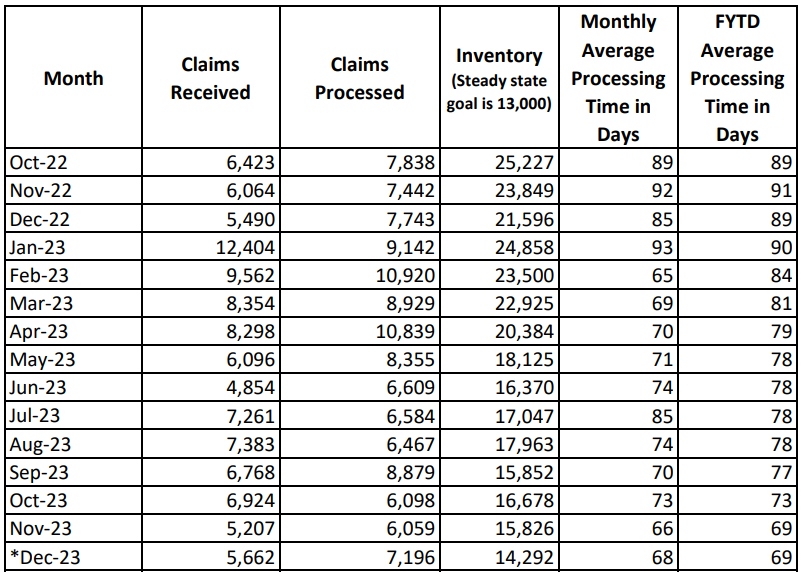

The annual uptick in claims is typical for OPM’s retirement services division. Throughout 2023, close to 89,000 federal employees filed for retirement. About 12,400 of those claims were processed in January alone, the month with by far the highest number of claims.

The approaching surge comes after OPM made significant strides in paring down its backlog of unprocessed retirement claims from federal employees in the back half of 2023.

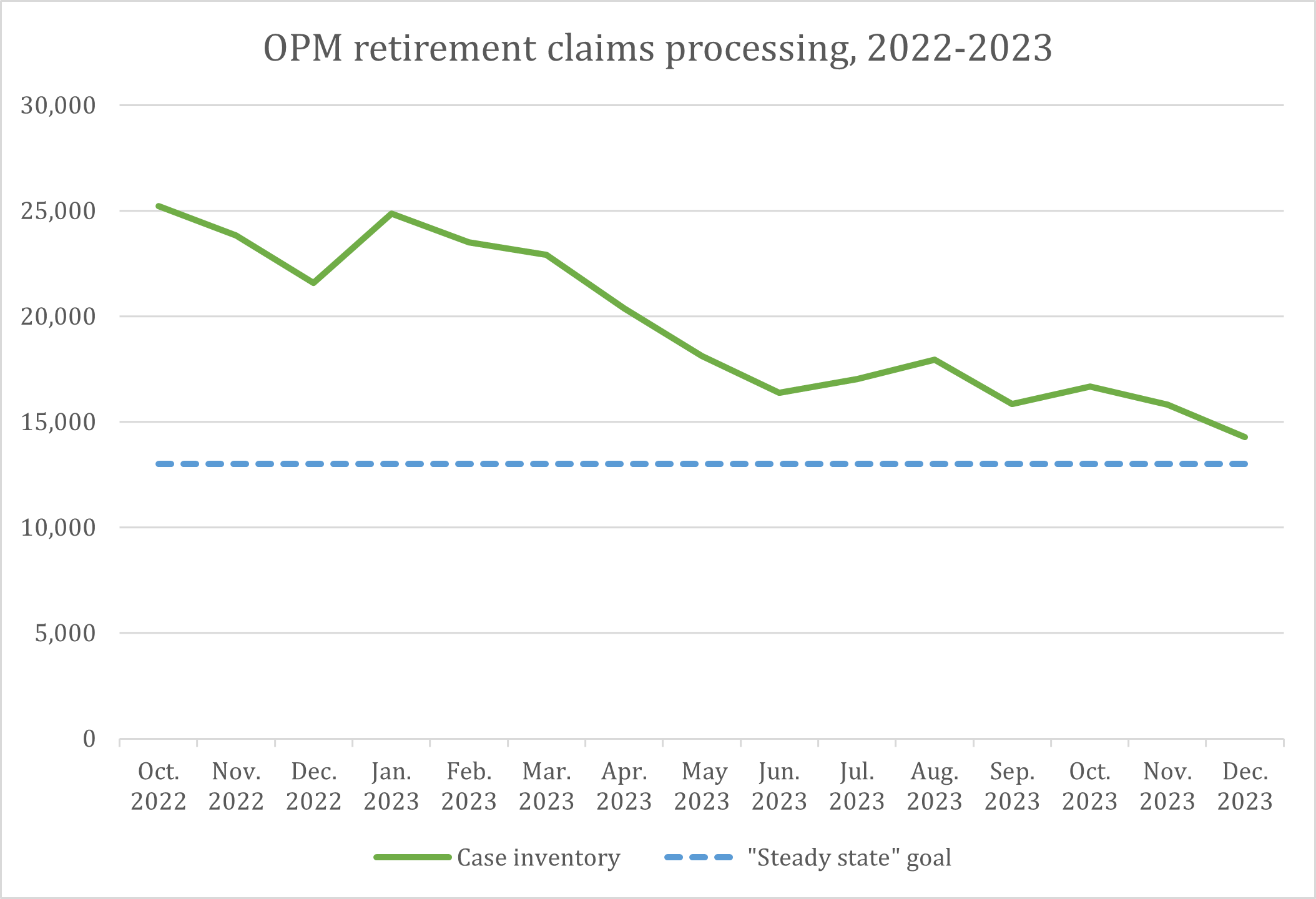

OPM’s latest retirement report showed that there are currently 14,292 cases sitting in the inventory. It’s the smallest retirement claims backlog since December 2017, when there was a 14,515-case inventory.

With a strong finish for the year, the agency reduced its case inventory overall by 34%, a significant decline since the approximately 36,000 pending claims that OPM had a couple of years ago.

The inventory, though, is still 1,292 cases above OPM’s “steady state” goal of 13,000, or the number of cases OPM aims to have in processing at any given time.

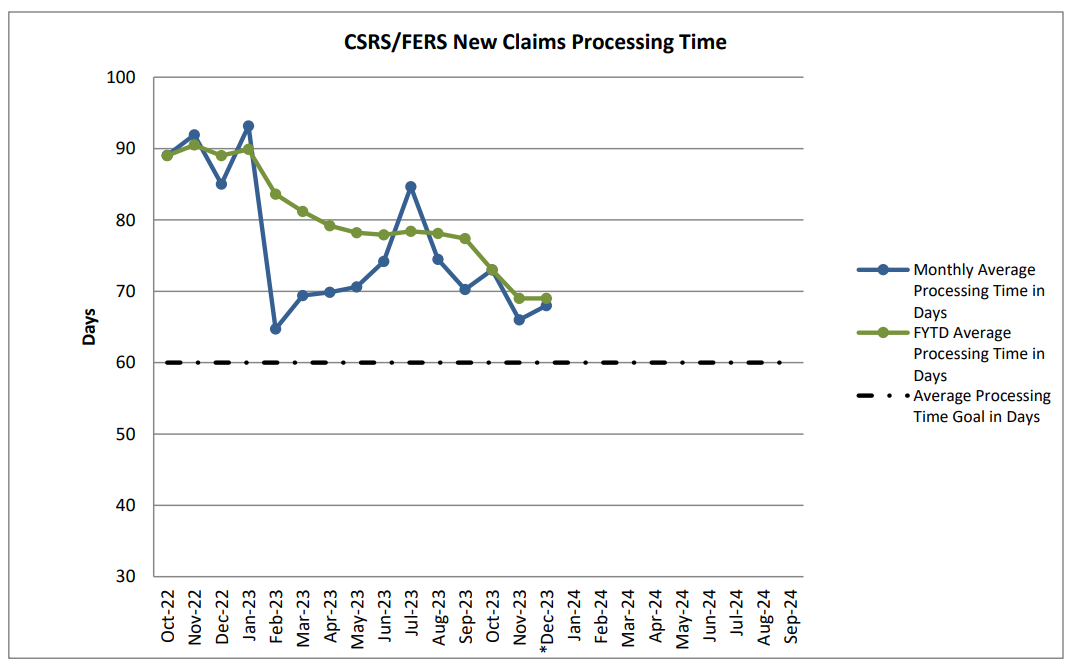

The time it takes OPM to process cases also climbed slightly higher in December, reaching 68 days, up two days on average since the 66-day processing time in November.

The fastest month for processing during 2023 was February, when OPM was finalizing retirement claims at an average of a 65-day pace.

But again, the processing time is still above OPM’s goal of a 60-day average.

The percentage of retirement claims that contained errors also trended downward by the end of 2023.

In December, 14% of retirement applications had errors, compared with 23% in July, according to data from OPM.

Part of the reason OPM may have been relatively successful in processing this year was due to the lower number of total feds who retired during 2023. The roughly 89,000 feds who retired over the last year were significantly fewer than the 103,000 or so who retired during 2022.

For the coming months, OPM Deputy Director Rob Shriver said the agency is already preparing for the annual period of time when retirement claims typically ramp up.

“We’ve made really good progress on retirement, but we’re not where we need to be,” Shriver said in an interview with Federal News Network. “And we’re about to step into our surge period for the year. We’ll have our work cut out for us.”

On top of the anticipated surge, ongoing appropriations debates and the possibility of a government shutdown also threaten the ability of retirement services to keep up the pace. OPM’s retirement services staff continue to work during a shutdown, but cannot process a retirement application without first receiving the completed application from a retiring employee’s agency. In the case of a shutdown, processing can be delayed when payroll employees at a feds’ employing agency are furloughed, OPM has said.

And despite recent improvements in the overall processing numbers, individual cases of major delays show the difficulties many federal retirees still face. On average, cases that took more than 60 days for OPM to complete had a processing time of 128 days.

But in some cases, the wait times can be much longer.

One federal retiree, in an email to Federal News Network, said he has still not received an annuity payment, more than two years after he first filed his retirement application with OPM.

In a long series of errors with his application, the retiree said he was first directed to submit his application to the wrong facility — and then given the wrong type of retirement form to submit to OPM. He said the lengthy and paper-based process as well as limited information on the status of his application have contributed to the ongoing issues.

“I am still waiting for my first annuity payment for over two years since my federal retirement date with no other substantial income,” the retiree, a former Department of Veterans Affairs employee, said in an email. “A simple measure, such as standardized labeling of the application’s status would allow these applications to be prioritized, processed quicker and separate from the bulk of new applications also being received.”

Modernization plans lie ahead

OPM has massive challenges ahead in retirement services, involving a balance of both managing the current system, while simultaneously planning out a years-long IT modernization project.

“That’s a big undertaking,” Shriver said. “I think there have been efforts in the past to do it as one big modernization — that hasn’t been as successful. So we’re just chipping away, taking a modular approach.”

So far, OPM has taken several steps toward modernizing the process, such as piloting an online retirement application with the goal of eventually stepping away from the currently paper-based system.

“We’re evaluating for possible continuation and expansion,” Shriver said.

Additionally, during 2023, OPM rolled out a chatbot pilot, beginning on a smaller scale with a relatively limited scope of questions the digital tool could answer from retiring feds.

“We have plans to increase the number of issues that people can get served on through the chatbot, so that they don’t have to call the call center as much,” Shriver said.

But at the same time that OPM is working on modernization, there are the more immediate needs of currently retiring feds.

“We have people that need to be served, and they need to be served quickly and effectively,” Shriver said.

To try to address some of the more common issues, OPM published a retirement quick guide during 2023, and created several video tutorials aiming to help feds better understand the steps of the process, and what typically causes delays.

The retirement quick guide aims to help feds get a clearer picture and timeline of the process to help ease their transition to retirement. OPM said it hopes to proactively answer some of the more common questions about federal retirement, most notably, “what is the status of my retirement application?”

The guide also aims to explain common errors in retirement applications to try to proactively catch issues before they cause delays. Some of the most common reasons for a delay are missing signatures or missing forms, especially if a retirement applicant worked at multiple different agencies during their career.

For the next few months, Shriver said OPM is bringing in staff from other agencies to assist during the surge period of retirement applications.

“We think it’s a great exchange to have people who are doing the work at the agency side, see the way that it happens at OPM, so they not only help us during the surge period, but then take that knowledge back to their agencies,” Shriver said. “We also learn from the agencies, when we’re working side by side with them, what their pain points are. We’ve continued to work with agencies on improving the accuracy of the applications that come to us, so that there aren’t as many bumps in the road with the processing.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED