Like Texas, don’t mess with the G fund

During the Great Recession in 2008, thousands of TSP investors pulled money out of the stock market C, S and I funds and put it in the G fund.

For many investors in the federal Thrift Savings Plan, the best place to be is the G fund made up of special U.S. Treasury securities. Because it is guaranteed by Uncle Sam, the G fund has a reputation as the never-has-a-bad day haven. The place to be for those who fear that the record-long bull market is the place to be when the stock market goes south.

During the Great Recession in 2008 when the market lost 40 percent, hundreds of thousands of TSP investors, active and retired, pulled money out of the stock market C, S and I funds and put it in the G fund. Many also stopped investing in the U.S. and international stock funds even though they were on sale while the markets were roaring back to their current record-high levels.

Some investment professionals advise their federal clients not to have too much money in the supposedly super-safe G fund. They argue that while it is “safe” because it doesn’t react to the market having too much of their retirement nest egg in it is actually risky because over time inflation will erode their accounts. They say that investors, particularly those who are or will retire under the FERS program, need some money in stocks to keep their accounts growing. They point out that over time most of the funds, including the F fund (bonds) consistently outperform the G fund — usually by a lot.

Whether you consider the G fund super-safe or risky, many investors worry that something or someone is tampering with it, or that Congress will devalue the G fund in future.

Typical is this email from a reader who asks:

“Question: Has the government changed the rate on the G fund in the TSP? My principal value keeps going up, but the interest I receive on that value keeps dropping over the past three weeks. I know there has been a proposal to eliminate the G fund. But is the government trying to eliminate it by making it worthless?”

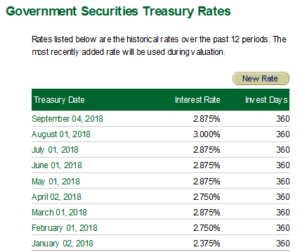

A spokeswoman for the TSP responded that “Absolutely nothing about the calculation of the G fund rate has changed.” At the right is a snapshot of the monthly rates on an annual basis used for the first nine months of this year. September showed a slight decline because August rates moved lower.

Nearly Useless Factoid

By Amelia Brust

Heinz requires that its Ketchup flows at 0.028 mph, or half an inch per second. Any faster and it’s too runny.

Source: Houstonia Magazine

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED