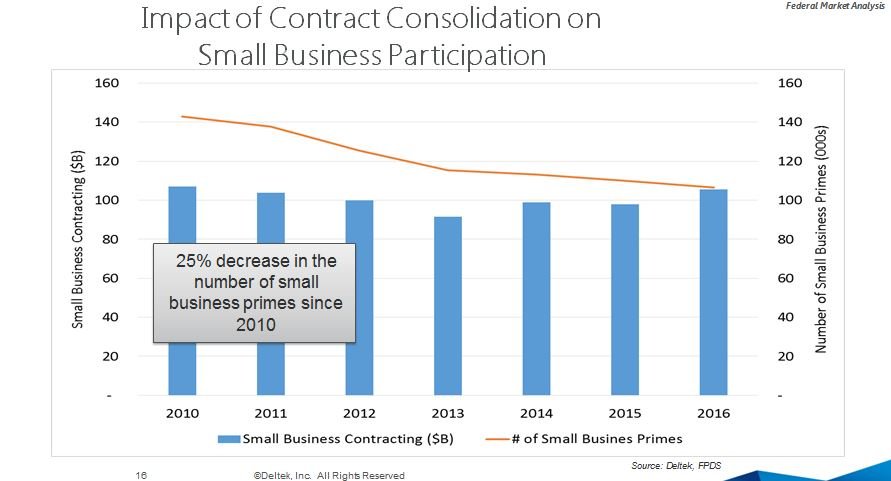

Number of small business prime contractors down by 25 percent since 2010

The market research firm Deltek found the small business sector has seen significant reductions over the last seven years.

Federal agencies met the governmentwide small business goal for the fourth straight year in fiscal 2016. Last year also saw a $9 billion increase in the total of prime contracts going to small firms.

What these numbers aren’t showing, and what should really worry the Small Business Administration and the broader contracting community, is the number of small businesses winning prime contracts is dramatically down.

Deltek, the market research firm, analyzed the data and found a 25 percent decrease in the number of small business prime contractors since 2010.

“There are fewer small businesses that are engaging as a prime and that is the same pattern across large businesses,” said Kevin Plexico, the vice president of information solutions at Deltek, during the FedFocus 2018 event in Vienna, Virginia on Oct. 10. “The dollars are holding steady but the number of prime participants is declining.”

The government’s focus on total dollars going to small businesses may be shortsighted. The number of businesses in the marketplace is just as important as the total amount of contracts small firms are winning.

“The Deltek data is interesting, but I’m not surprised to see the analysis. It certainly is a concern across the federal government with respect to what’s happening in the market space and the impact of consolidation, strategic sourcing and category management, and this is somewhat a result of that,” said John Shoraka, managing director of PilieroMazza Advisory Services, LLC, a consulting firm focused on small businesses, and a former associate administrator of Government Contracting and Business Development at SBA during the Obama administration. “There’s fewer requirements out there. There is a lot of consolidation of requirements because of strategic sourcing and the category management and the drive to efficiency.”

Shoraka added that the pressure on the agency contracting officials to use more governmentwide vehicles and multiple award contracts also limits the number of opportunities for small businesses.

Steve Koprince, a managing partner of Koprince Law, which represents small businesses, echoed Shoraka’s comments about not being surprised about the shrinking marketplace and the impact of strategic sourcing and category management.

Concerns about the impact of category management on small firms aren’t new, but the data seems to confirm many of those worries.

The General Services Administration is holding each of the managing partners for category management accountable for meeting small business goals.

But the goals are focused on total dollars, and not total dollars and participation.

That’s why Congress got involved in the 2016 Defense authorization bill, by requiring the SBA scorecard to measure the participation rate of small businesses in contracting.

Shoraka said this new requirement is a direct pushback against the consolidation happening across government and the fact that agencies still were their meeting goals.

At the same time, Koprince also said because of the upturn in the economy, those commercial firms who decided to try government contracting decided to self-select out because they didn’t need the public sector market any longer.

Other drivers, Koprince said, are the changes SBA made in 2015 around the mentor-protégé program and the rules governing joint ventures and teaming.

“SBA loosened up the requirements for joint ventures and prime-sub teaming, and the upshot of those changes are coming at the same time as you see these contract efficiencies,” he said. “SBA made it easier for small businesses to team together as well as making joint ventures easier for small businesses to team with large businesses through the mentor-protégé program. So now, no matter how large a mentor is, they can team with a small business and pursue a set-aside. There is both a greater interest by small businesses and there’s a realization that if my competitors are doing this, so should I.”

SBA’s change to the joint venture rules only requires both companies to be below the size standard threshold individually instead of adding both companies’ revenues together and then determining if the joint venture is below the threshold.

Koprince said he’s working on joint venture or teaming agreements almost every day.

Shoraka added the changes to the joint venture and teaming rules are another reaction to the strategic sourcing, category management and overall move to larger, more complex requirements across the government.

“For existing government contractors, the landscape is changing,” Shoraka said. “When they used to go after a set-aside contract, their competitors used to be other small businesses. But now with the joint ventures, the competition is tougher because of changes in rules.”

Shoraka and Koprince also pointed out that mergers and acquisitions reduced the number of small businesses eligible for prime contracts.

Latest Acquisition News

Further data from Deltek seems to support this as well.

Large and small contractors alike aren’t seeing the opportunity to grow by winning new work, so buying competitors or buying into a sector, such as defense, cyber or homeland security is the next best way increase revenue.

Deltek said contracting spending is estimated to be about $473 billion in 2017, down from $479 billion in 2016. But the company expects agencies to spend more in 2018, particularly the Defense Department.

Plexico said the data shows that 2018 will see the second highest value of potential opportunities in the last 13 years, with professional services accounting for about $150 billion, or half of all opportunities Deltek is tracking.

He said Defense opportunities represent 71 percent of the total contract value available, and across the government, 91 percent of all opportunities are considered follow-on contracts.

Shoraka said one way to stem the tide of small firms leaving the prime contracting arena is for large multiple award contracts to offer on-ramps and off-ramps more often. He said this way growing small firms don’t have to wait until there is a recompete on a contract like Alliant small business or OASIS small business to earn their hunting license.

Koprince said despite the 25 percent decrease of small business primes since 2010, there is plenty of competition in the market.

“In general, when I ask my clients, they say they may be seeing the same usual suspects, but that probably has always been the case in a specific niche,” he said. “There are plenty of acquisitions where there are 12 bids and tons of interest and it’s very competitive at a macro level.”

That’s good news for the government, but it’s something SBA and the Office of Federal Procurement Policy should pay closer attention to as the long tail of category management and strategic sourcing continues to grow.

Return to the Reporter’s Notebook

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED

Related Stories