56 federal financial systems nearing end of life puts Treasury on fast track to get shared services right

The Bureau of the Fiscal Service acting Commissioner Matt Miller said two requests for information and meetings with industry and agencies is leading up to the...

The Bureau of the Fiscal Service laid out its most complete vision to date of what the future of financial management shared services will mean to agencies and vendors alike.

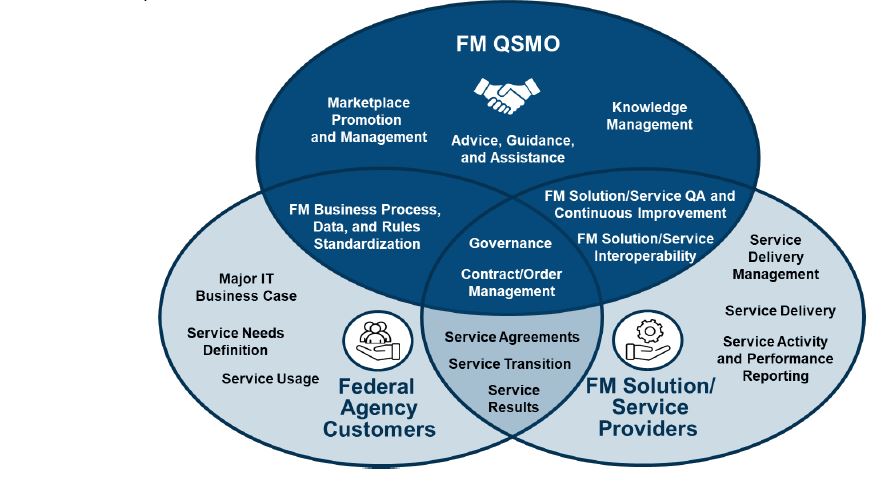

The second request for information released in June outlined the role of the Quality Service Management Office (QSMO) and how they intend to reach the right level of standardization vs. flexibility.

Matt Miller, the acting commissioner for the Bureau of the Fiscal Service in the U.S. Department of the Treasury, said there is more “meat on the bone” around the core financial system baseline capabilities as well as potentially other types of offerings from the QSMO marketplace.

“We’re looking for the commercial providers to bring those modern, configurable service-oriented software solutions that will hopefully help the government and agencies reduce some duplicative technology footprint as well as maybe reduce some of the burden for agency CFOs and their folks to not have as much to do when it comes to maintaining software and technology,” Miller said in an interview with Federal News Network. “The underlying premise is standardization and reuse. Where can you leverage things that are common, rather than creating and building customer unique services? I think that one of the key areas of distinction in this approach moving forward, that we think will really be beneficial, is much more of a focus on the customer and the customer experience. That’s one of our guiding principles.”

It’s a guiding principle learned after more than 15 years of fits and starts to get agencies to move to financial management services.

Started during the administration of President George W. Bush, financial management shared services has been a goal now of three Office of Management and Budgets. There has been a few successes such as the Department of Housing and Urban Development moving to Treasury’s ARC. There have been plenty of failures too like the Veterans Affairs Department’s unsuccessful move to the Agriculture Department’s National Finance Center or the Labor Department’s disastrous attempt with a private sector provider.

Initial launch coming late 2022

Ann Ebberts, the CEO of the Association of Government Accountants (AGA), said these latest efforts by Treasury are steps in the right direction.

“Looking across the government over the years, there has been a number of initial tries at implementing new financial management systems. We’ve heard the stories that the efforts were taking too long or the product didn’t work like the way agencies wanted it to,” Ebberts said. “Treasury is identifying the capabilities needed and I think taking a more straight forward approach should go a long way to identify standard processes and data. Treasury is trying to get the customer involved and getting agreement on how the system or processes should work and what processes should be provided or supported. They are not creating this from whole cloth. Sometimes it’s just a matter of putting the right people together to describe the pros and cons.”

Miller said the two RFIs and the dozens of meetings with industry and agencies has been about getting the right people together, and influencing the QSMO’s planning to launch its initial marketplace offerings in late fiscal 2022. To be clear, the QSMO will be a broker or organizer of services. It will not provide any services.

“One of the key distinctions that we’ll see in this marketplace, as opposed to the most recent marketplace under the most recent initiative that spawned from OMB memo 13-08 a few years ago, is the result of OMB memo 13-08 created a federal only and a provider-centric marketplace. There were the four designated federal providers, and they all brought to market or brought to bear a standard solution. They were solid solutions, but there wasn’t as much flexibility and there wasn’t as much of an ability for the commercial providers to interact directly in the marketplace as well,” he said. “Now what we’re looking at is a marketplace that will allow interaction with both commercial and federal, but still trying to allow that flexibility and choice, but incorporating the standards into the solution.”

Miller said the previous shared services approaches were less customer-centric and more system centric.

“With this marketplace, we will have a combination of commercial and federal providers and much more of a customer-centric marketplace. We’re taking the good from the past in initiatives and shared services, and then building on it with some of the lessons learned,” he said.

The need to modernize agency financial systems isn’t new, but it took on a bigger imperative when the QSMO surveyed agencies last year to create a baseline understanding of the market.

Miller said the QSMO asked about the current system provider, whether the applications are hosted in the cloud or in data centers and other details that will help them shape the marketplace offerings.

“Even excluding the Defense Department, what we found out is that today, there are in place 56 separate installations of core financial systems, and half of those are going to be in need of either a major upgrade or some sort of acquisition or action to extend their life beyond 2025. So just four years away, half of the agencies are going to be facing some sort of modernization need. Also 60% of those systems are hosted on-premise today,” he said. “The results of that data call did a couple things. Number one, it helps us understand which agencies might have the more time sensitive needs and where we need to focus our partnership with agencies on to try to prioritize adoption in the marketplace. But also, it definitely underscored the importance of and the need and the value of this marketplace, well in advance of 2025. It really helped validate, and confirm the criticality of the need of establishing this marketplace as quickly as possible.”

The move to shared services is never fast, nor easy. That’s clear from what agencies have been through over the last 15-plus years.

Acquisition strategy in the works

But it’s also why Treasury isn’t going at this alone. Miller said they are partnering with the General Services Administration to create an acquisition strategy that will lead to the initial offerings next year.

“This is going to be a complex acquisition approach that we need to figure out. We need to be creative and innovative. In trying to work out what that acquisition approach is, we’ve got some end goals in mind. From an agency standpoint, we want this marketplace to be easy to access, easy to navigate and easy to consume the services that are needed from that marketplace. We need to think about that in the acquisition approach,” Miller said. “From an industry standpoint, we want to make sure that whatever approach we use to build this marketplace allows for competition, that it allows for innovation and that it allows for on-ramps and off-ramps over time for different providers. There’s a lot of careful thought and consideration into trying to nail down what’s the right acquisition approach, then executing that acquisition approach is going to take certainly many months to do so.”

Miller said the QSMO and GSA should have a better idea later this summer of the acquisition strategy and release it to the public.

AGA’s Ebberts said the other challenge the QSMO must face is with the workforce and the need for financial managers and others to understand how to manage shared services and work with the data that comes from these systems.

She said AGA’s Certified Government Financial Management program is addressing the need to upskill and reskill the workforce as the QSMO finalizes its approach.

Like many initiatives, the financial management QSMO is going to evolve.

Miller said the QSMO will continue to talk and listen to industry and agency customers as it develops its current strategy and future ones.

“We envision the marketplace will have both federal and commercial service providers. We envision that the marketplace will provide agencies with flexibility and choice, but the flexibility and choice will be of standards-based solutions. And the kind of the marquee aspect, or the centerpiece of this, is we envision the marketplace will be modern cloud based, service based core financial management software solutions,” he said.

And of course, he hopes if the QSMO builds it, the agency customers will come and forget about the past struggles.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED