4 agencies made a lot of mistakes processing retirement claims last month

The House Oversight and Government Reform Committee is concerned about four agencies that had particularly high retirement processing error rates in September. The...

A handful of agencies are making more mistakes than others as they prepare their employees’ retirement applications and send them to the Office of Personnel Management for processing, and that’s raising a few questions from the House Oversight and Government Reform Committee.

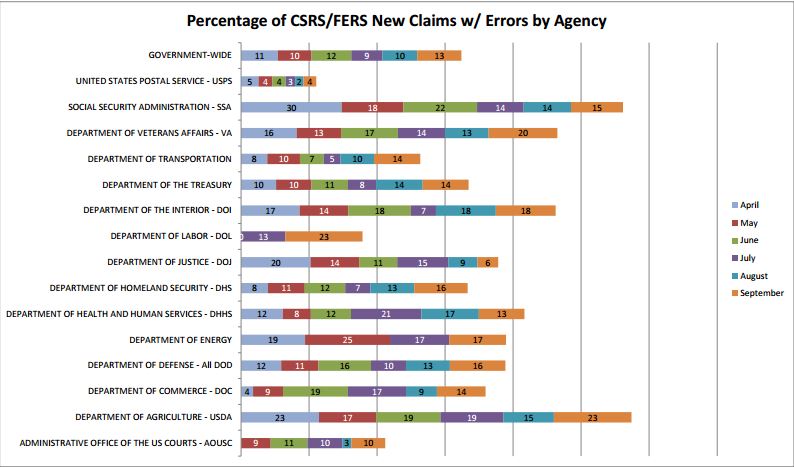

Four agencies in particular have error rates that stood well above the overall, governmentwide rate of 13 percent in September.

About 15 percent of the Social Security Administration’s cases had at least one error, or about 18 of 124 cases, last month. But SSA had higher error rates over the last six months, when 30 percent of its 27 cases in April had some sort of mistake.

Roughly 20 percent of 357 cases at the Veterans Affairs Department, or about 71 applications, had errors in September.

Mistakes delayed 18 percent of the Interior Department’s 51 cases, while the error rate reached 23 percent for the Agriculture Department on 92 cases in September.

The committee recently wrote to the Government Accountability Office, asking that GAO review the process that agencies and OPM undertake to prepare and process an employee’s retirement claim.

“While OPM continues to study how best to modernize retirement processing, it is critical that OPM ensure the current paper processing system is efficiently meeting the needs of retiring federal workers,” the committee wrote in an Oct. 19 letter to Comptroller General Gene Dodaro. “OPM must also work with its partner agencies to ensure accurate and efficient processing.”

Specifically, the committee wants GAO to review OPM’s guidance on how agencies should save an employee’s information so that it can be processed quickly and accurately during the retirement claims process.

Lawmakers also questioned whether agencies are properly following OPM’s guidance when they prepare retirement applications for processing, as well as the root causes for some agencies’ high error rates.

OPM Spokesman Sam Schumach said the agency appreciated the committee’s interest in the topic and would work with GAO to find new ways to improve.

There are several areas where something could go wrong as an agency prepares retirement information for an employee and sends it to OPM, said Jeff Neal, senior vice president of ICF International and a former chief human capital officer for the Homeland Security Department.

Agencies can stumble over the annuity calculations for employees who worked for a variety of departments or who spent a period of time working as a part time, temporary or seasonal worker, Neal said.

Switching status from a career employee to a political appointee can be confusing, and military service can also complicate an agency’s retirement computation, he added.

Applications that lack a signature or another element also lead to processing errors and longer wait times.

Neal said some mistakes chalk up to human error or carelessness, and some agencies may have better trained staff than other departments to handle retirement claims.

Though it’s rather unclear why some agencies have higher error rates than others, Neal speculated that agencies like the departments of Agriculture, Interior and the Social Security Administration typically have higher numbers of temporary and seasonal employees.

“It could be that there are some employment characteristics in their workforce[s] that causes them to have more errors,” he said.

Complications calculating benefits for employees with veterans preference could be the culprit behind VA’s high error rate, which typically employs a large number of veterans, Neal said. But many veterans also work for the Defense Department, where only 16 percent of its 929 cases in September had mistakes.

And it doesn’t help that agencies don’t have a single human resources system that stores information for all federal employees, Neal said. Instead, agencies must pull information from a variety of disparate systems when putting together an employee’s retirement application.

“It’s easy for people to poke at OPM when OPM isn’t the entire problem,” Neal said. “OPM is a part of the problem. But agencies are also part of the problem.”

OPM has largely shouldered the blame for many of the complaints about the lengthy retirement backlog in recent years. The agency’s system for processing claims is mostly done with paper, though OPM has made several attempts in recent years to modernize its retirement system.

Employees and annuitants don’t often know where their claims stand and assume the problem exists somewhere within OPM, said John Hatton, deputy legislative director for the National Active and Retired Federal Employees Association.

“I don’t think our members are necessarily always aware of why there’s a delay processing their claim, or that the problem may be with the employing agency rather than OPM,” he said. “Rather, they’re just aware there’s a significant delay, and often don’t understand why.”

OPM has said it’s goal is to process 90 percent of retirement claims within 60 days or less. So far in 2016 the agency has come closer to meeting that goal than in the past; it processed 80 percent or more of retirement applications within that time frame for four months this year. That rate has dipped slightly in recent months. As of September 2016, the agency processed roughly 77 percent of claims within 60 days or less.

The average processing time was 100 days for applications that took longer than the 60-day benchmark.

Though NARFE has seen OPM’s processing improve in recent years, there’s no doubt that delays still exist, Hatton said.

“In fiscal 2016, OPM’s Retirement Services met and exceeded its goal of processing 90 percent of cases in 60 days or less by completing 100 percent of cases in an average of 54 days,” Schumach said. “There are periods every year—usually in January and July—that can lead to peaks in volume. During these peaks, and when funding is available, OPM provides overtime to [Retirement Services] employees in order to more quickly reduce the increase in caseload.”

The 54 day average in 2016 refers to the average time it took OPM to close all cases it processed that year, Schumach said. The retirement reports OPM releases each month are a “snapshot” of the progress it’s made to date.

The backlog typically fluctuates quite a bit through the year, as OPM consistently receives more claims in January than any other month out of the year. The backlog stood at 15,146 claims in September — about 2,000 more than OPM’s self-proclaimed “steady state” of 13,000 applications.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED