TSP participation up while FRTIB on track to launch new digital tools

TSP participation rates for the Federal Employees Retirement System and active duty uniformed services were at all-time highs in January: 94.9% and 81.3%,...

New tools, fewer fund reviews and an evolving retirement landscape await the Federal Retirement Thrift Investment Board in 2022. The group, which oversees the Thrift Savings Plan, the federal employee 401(k), announced a series of changes at its latest meeting as well as forecasts for the continued pandemic economic recovery.

In its presentation to the board last week, State Street Global Advisors, one of the TSP’s fund managers, said the recovery will likely be less intense in 2022 than last year, but the spike inflation may be more persistent and less of a cyclical occurrence than previously thought. Lori Heinel, executive vice president and global chief investment officer, said pressure on the supply chain side, along with high capacity utilization and slowing delivery times, are worth watching.

As for potential impacts from the conflict in Ukraine, on State Street said on Monday that it did not expect major consequences for the TSP:

“Like others, we were hopeful of a diplomatic solution and remain hopeful this will happen very soon, but we were and remain prepared for any outcomes. In general, military conflicts have a relatively short term impact on markets, so we do not recommend overreacting to the geopolitical situation with regard to the plan. In fact, for other SSGA clients who are positioned to make tactical portfolio changes, we suggested adding a bit of equity exposure given more attractive valuations as the market has pulled back from recent highs. Importantly, we do think the conflict provides support for our view that the Fed will move in a more measured way – likely 25 bps in March vs. the 50 bps that some market participants are forecasting.”

TSP participation rates for the Federal Employees Retirement System — the system for feds who have joined government service since 1987 — and active duty uniformed services were at all-time highs in January: 94.9% and 81.3%, respectively. Tee Ramos, FRTIB director of participant services, said an additional 3,400 newly separated participants began receiving monthly payments last month, joining the 241,642 participants who were already receiving payments.

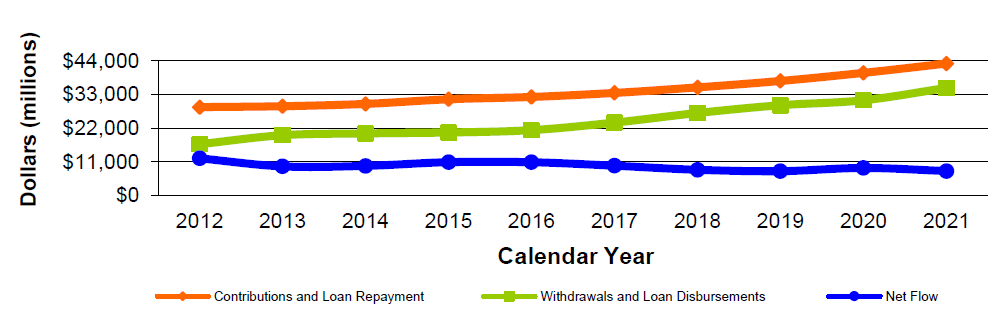

The amounts of contributions to and disbursements from the fund have increased year over year since 2012, but the net cash flow has slowly decreased in that time. The TSP’s balance dropped to $780.6 million in January from $811.7 million in December, and from $792.6 million in November, according to FRTIB’s January 2022 report.

However, from a personnel side, the pandemic and supply chain issues have affected Participant Services’ ability to maintain staffing at contact centers, while they hope to be back on track in March thanks to a hiring and training pipeline.

Ramos said the turnover rate is unusually high, above 90%, or more than double what it normally is. Vendors have launched campaigns to recruit previously terminated employees, raised pay during contract negotiations to be more competitive, and people hired in January or early February are winding down training and will be ready to “hit the phones in March.”

Fortunately for the TSP’s staff and participants, new digital tools through the ThriftLine Service Center are scheduled to launch midway through the year, as part of FRTIB’s multi-year modernization effort called Converge. These include a mobile app, virtual assistant, live-agent chat, electronic signature and electronic payment options, and a secure account inbox for statements and other transaction notices, according to a letter to TSP participants.

Program Manager Tanner Nohe said readiness testing will complete on time, and performance testing will start next month. Agencies that will use the new payroll portal will be credentialed and trained through mid-March, Nohe said.

Blended Retirement System activity slows as legacy auto-enroll ends

One new metric for fiscal year 2022 is the BRS full matching contribution rate, which measures the percentage of active duty Blended Retirement System (BRS) participants deferring 5% or greater. BRS was created by the 2016 National Defense Authorization Act, combining the uniformed services’ traditional legacy retirement pension, or “defined benefit,” with a defined contribution benefit into the TSP. The BRS began in January 2018, and while those under the legacy system were grandfathered in there was also an opt-in period that ended in 2019.

For the first quarter of 2022, participation in the BRS full matching contribution was at 69%, lower than the 80% target rate set by FRTIB. Dennis McNulty, the board’s Strategic Performance Branch chief, said this was driven mainly by auto enrollees who were enrolled prior to the increase of the default contribution rate.

“This is the first quarter that we’ve combined the deferral rates for both BRS auto enrollees as well as BRS opt-ins into a single metric. We had previously only included the BRS participants who had opted in,” he said. “Based on a review of historical data, the full matching rate for the combined BRS population has steadily increased over the past year, and we expect this metric to continue to increase going forward to the impact of the 5% deferral rate.”

Fewer fund reviews and faster target dates

FRTIB also voted Wednesday to begin reviewing investment policies on an annual basis going forward, rather than on the quarterly schedule it currently uses. Under the Federal Employees’ Retirement System Act of 1986, FRTIB has to review the polices but the law does not specify how frequently.

A study of regulatory and client guidance, industry surveys and the practices of large public defined-contribution plans turned up little in the way of clarity, except that annual reviews are more common than other large public investment fund clients. The board also considered that quarterly reviews could give the impression that recent investment performance or trends motivate board policy, while annual reviews are more in line with the long-term nature of the TSP’s investment policy.

“Put simply, TSP’s current circumstances are that the TSP offers a small number of passive index strategies, supporting four of the five funds that were created by statute. Changes in the type and number of funds is extremely rare, as are changes in the funds’ benchmarks,” said FRTIB Chief Investment Officer Sean McCaffrey. “Review of the funds in board meetings consists of monitoring of the success of the passive investment strategies. In other words, the funds are not actively managed, and deviations from benchmark resulting from investment management are expected to be small.”

Employers find it harder to plan for workers’ retirement

Now that FRTIB is using a two-manager structure for the TSP, State Street Global Advisors, which manages part of the C, F, I and S funds, gave board members some future outlooks for 2022 and beyond.

Brendan Curran, D.C. head of U.S. Investment strategy for State Street Global Advisors, said target date funds, like the TSP’s Lifecycle funds, are gaining popularity and have delivered higher median returns and lower volatility for participants, compared to portfolios that a participant self-constructed. Participants may not always construct allocations that are optimal and may not check their balance frequently because of their busy schedules or other priorities, Curran said.

Where State Street is focusing now, are the future compounding challenges of retirement planning: People living and working longer, and benefits structures getting more complicated. He said a recent convening of 13 plan sponsors revealed that employers need more tools to determine when their workers are likely to retire, and they are changing their philosophies around the retention of retiree assets to drive scale and keep costs low for all plan participants.

“Additionally, we see more and more plan sponsors revisiting the distribution options that are available in plan so that it’s not so black and white that participants have to keep all their savings in plan or take them all their assets out on one lump sum, instead looking at systematic and partial withdrawal technology,” Curran said, adding that one solution may be to pull target dates forward.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Amelia Brust is a digital editor at Federal News Network.

Follow @abrustWFED