Your TSP in the tank: Now what?

The one sure thing about stock market predictions, whether and when it will boom or bust, is that eventually you will be right.

The one sure thing about stock market predictions, whether and when it will boom or bust, is that eventually you will be right. It will boom and it will bust.

Guaranteed — take it to the bank! Turns out that is the easy part.

A bit trickier, in fact a lot more complicated, is predicting when the market will peak, when it will tank and when both those events will happen. Most pros say it can’t be done.

For the past 11 years experts, real and self-anointed, have been predicting that the booming stock market couldn’t last. They warned, correctly, that the stock market regularly goes through a major correction, a drop of 20% or more drop, which it does normally. But the most recent one, from March 2009 to March 2020, surprised just about everyone. And the way this one was triggered, by a virus out of China, wasn’t on anybody’s guess list.

The question, as always, is what next? Is this a buying opportunity, as some claim? Are stocks on sale? Is this like the Great Recession, when stocks tanked then rebounded at a record pace for more than a decade? Or is this one different?

Most current and retired federal and postal workers have a 401k plan via the federal Thrift Savings Plan. For those under the Civil Service Retirement System, with its more generous indexed-to-inflation annuity for life, the TSP is a very nice thing to have. But in most cases, not a must. For those who are or will retire under the Federal Employees Retirement System program the TSP is a must. It is at least going to be one-third of their retirement income along with Social Security and their FERS annuity, which is not fully indexed to inflation. Over time that so-called diet cost of living adjustment formula means that normal inflation or anything over 2% will eat into their FERS annuity.

A number of long-time TSP investors, though not as many as before, have account balances worth $1 million or more. Many were in the $500,000 to $750,000 category, before the “correction.” During the Great Recession thousands moved money from the stock indexed C, S and I funds into the safety of the treasury securities G fund. That money was “safe” but its growth rate compared to the rebounding stock funds, was minimal. Those who stuck with the stock funds and continued to buy — at what turned out to be bargain basement sale prices — saw their accounts prosper. Things like risk-tolerance, age and how soon after retirement you will need to tap your TSP are key factors in deciding what to do or what not to do.

So, when in doubt, ask Arthur Stein. He’s a well-known financial planner with a lot of federal clients in the Washington, D.C., area. He’ll be my guest today on our Your Turn radio show at 10 a.m. EDT. Listen at www.federalnewsnetwork.com or at 1500 AM in the D.C. region. If you have questions shoot them to me before showtime at mcausey@federalnewsnetwork.com

Now, here’s Arthur’s take, written March 15:

The TSP versus the coronavirus

If you have looked at your TSP account recently, you have seen big changes. The longest ever U.S. bull market celebrated its 11th anniversary on March 8; the bear market began 12 days later. A bear market is a 20% or greater decline in stock prices from a previous peak.

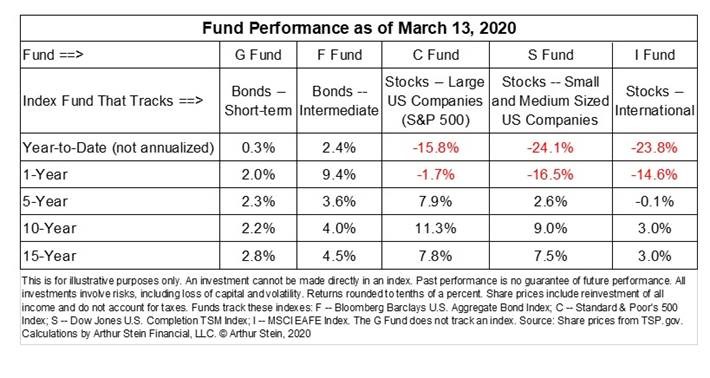

The TSP stock funds (C, S and I) peaked in February and then began declining. While it is often difficult to determine the cause of stock market declines, the coronavirus is clearly the culprit this time.

Bond prices continued to increase this year, a common occurrence when nervous investors sell stocks. That caused F fund share prices to increase in value. Here is a hypothetical example of the year-to-date values of $100,000 investments into G, F and C funds.

Here is a hypothetical example of the year-to-date values of $100,000 investments into G, F and C funds.

Stock market volatility has increased. For instance, stocks were up 9% last Friday but declined 10% for the week, including Friday. A Wall Street Journal article stated that “the S&P 500 Index moved up or down by at least 4% for five consecutive sessions, the longest such streak since 1929 …”

According to Market Watch, the average bear market decline for the S&P 500 Index (the Index used for the C Fund) is 35% and lasts an average of 146 trading days (days when the stock markets are open), or about seven months.

Nearly Useless Factoid

By Amelia Brust

Thirty years ago today thieves disguised as police made off with 13 paintings, valued at a combined $200 million to $600 million, from the Isabella Stewart Gardner Museum in Boston. It was the largest art robbery in history and to this day, a $10 million reward is offered for information leading to the recovery of all the works in good condition. There is also a separate $100,000 reward for the recovery of the Napoleonic finial.

Source: Isabella Steward Gardner Museum

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED