IRS looks to shrink $688B ‘tax gap’ through increased enforcement hiring

The IRS is seeing a growing disparity between the taxes it's supposed to receive each year, and the amount it actually collects — but expects increased hiring...

The IRS is seeing a growing disparity between the taxes it’s supposed to receive each year, and the amount it actually collects — but expects increased hiring will reverse that trend in the coming years.

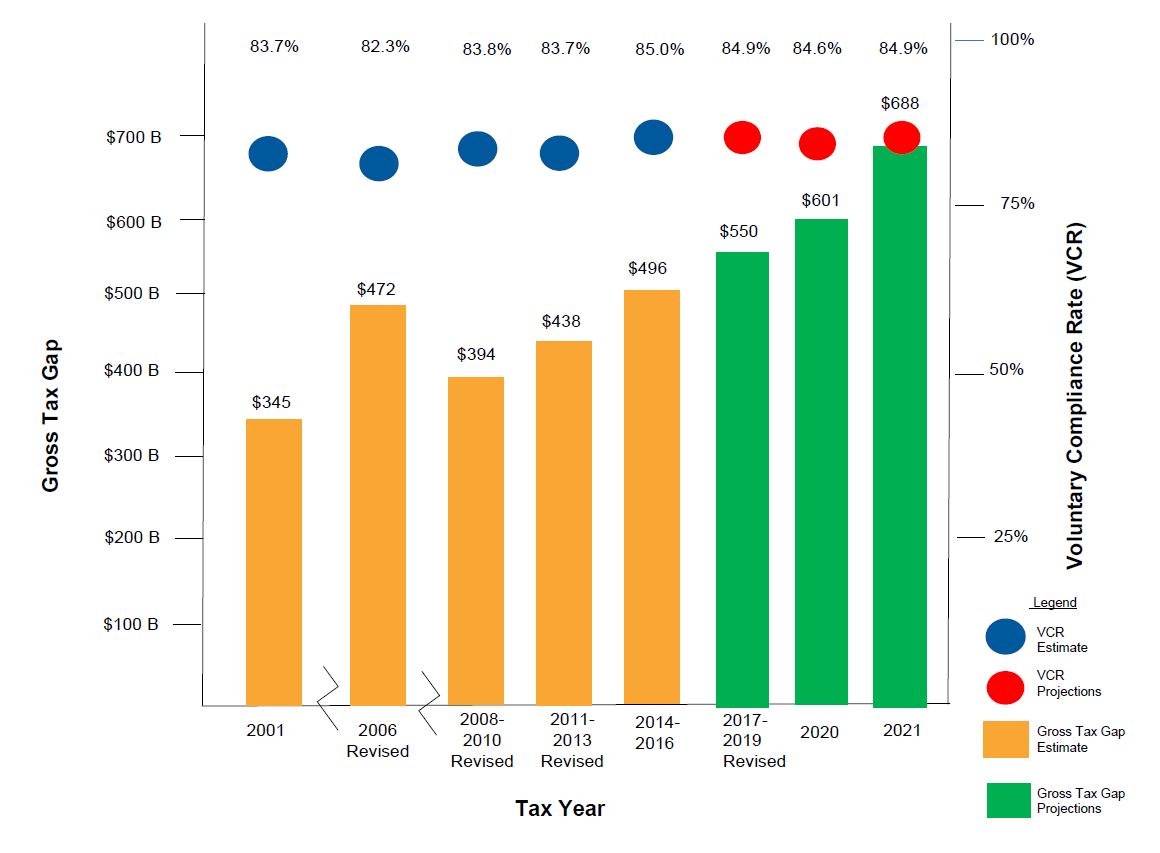

The IRS announced Thursday that the “tax gap” between what taxpayers owe, and what they voluntarily pay the federal government is now approximately $688 billion a year, according to its most recent estimates.

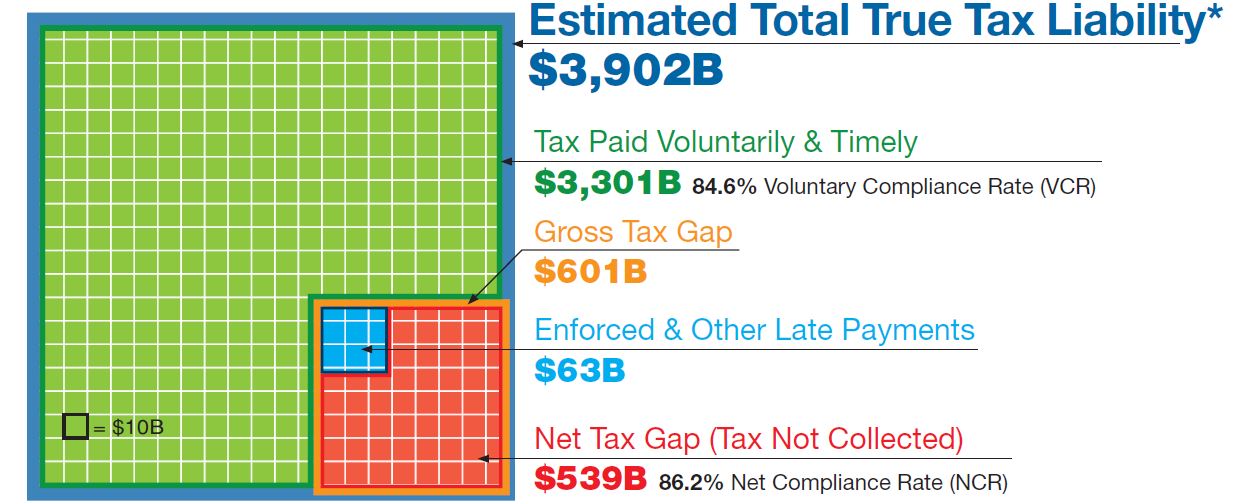

The IRS estimates taxpayers and businesses in tax year 2021 owed about $4.5 trillion in taxes, and that taxpayers paid $3.9 trillion of those taxes voluntarily and on time. The IRS said about 85% of taxpayers pay their taxes voluntarily.

The IRS, in a press release, called the updated tax gap project a “significant jump from previous estimates.”

IRS Commissioner Danny Werfel said in a statement that the increasing tax gap “underscores the importance” of the agency rebuilding its workforce through $60 billion over the next decade through the Inflation Reduction Act.

“With the help of Inflation Reduction Act funding, we are adding focus and resources to areas of compliance concern, including high-income and high-wealth individuals, partnerships and corporations,” Werfel said. “These steps are urgent in many ways, including adding more fairness to the tax system, protecting those who pay their taxes and working to combat the tax gap.”

The latest estimate is $138 billion higher than IRS tax gap estimates for tax years 2017-2019, and $192 billion higher than estimates for tax years 2014-2016.

But the actual amount of taxes that go uncollected each year is likely higher than the IRS’ latest tax gap estimate.

IRS Chief Data Officer and Analytics Officer Melanie Krause told reporters that the updated tax gap estimate is “based on what we’re able to measure now,” based on compliance data from tax years 2014-2016.

The latest tax projections don’t include tax avoidance through offshore finances, issues stemming from digital assets and cryptocurrencies, as well as corporate income taxes.

Krause added that the IRS, in its latest tax gap report, provides a “pretty fulsome discussion of the areas where we do not currently have data that we can use, or much data we can use to expand our estimate.”

“We’re working actively on updating our methods to be able to detect some of these issues more quickly,” she said.

Former IRS Commissioner Chuck Rettig told Congress in April 2021 that “it would not be outlandish to believe” that the actual tax could approach — or even exceed — $1 trillion per year.

Rettig also told Congress that the IRS was too “outgunned” to go after tax cheats and shrink the tax gap.

“The former commissioner was drawing attention to that delta between what we have had the resources to measure, and what the impact of that noncompliance would be,” Krause said.

IRS Deputy Chief Data and Analytics Officer Barry Johnson told reporters that the voluntary compliance rate is “virtually unchanged” from previous year estimates.

“We don’t have any change in the compliant behavior — we’re not projecting any change that way at this point,” Johnson said Thursday.

The IRS states the tax gap is growing, despite voluntary tax compliance staying roughly the same, because the economy is growing — and so is the total amount of taxes owed.

“It’s just a matter of a larger base of tax, based on economic growth, growth in income from various sources, recovery from the economic conditions of the earlier period,” Johnson said.

The IRS estimates that the country’s total tax liability grew by about 38% between tax years 2014-2016 and 2021.

The agency estimates it would bring in about $46 billion in additional revenue, if another 1% of taxpayers voluntarily paid what they owe.

In 2022, the IRS collected more than $4.9 trillion in taxes, penalties, interest and user fees.

The IRS’ $688 billion gross year tax gap estimate doesn’t include the $63 billion the agency collected through tax enforcement operations and late tax payments in tax year 2021.

Factoring in IRS enforcement and late payments, the agency estimates the net tax gap is about $625 billion.

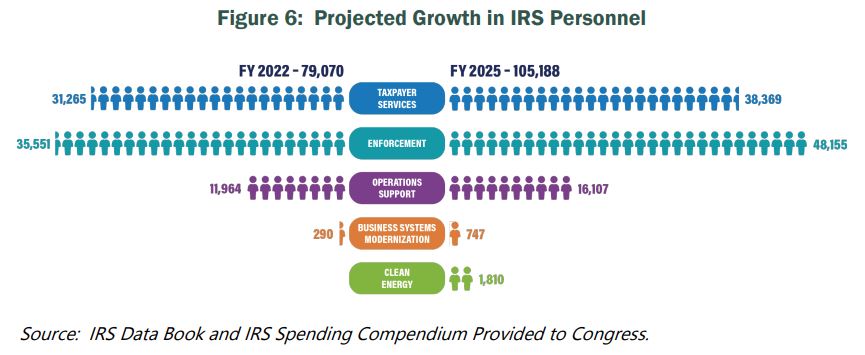

Krause said the agency expects to shrink the tax gap in coming years, once it hires more enforcement personnel.

“The additional staff and hiring at more senior levels is really a critical aspect of being able to expand our coverage in some of these areas,” Krause said.

The IRS expected to hire 10,000 new employees in fiscal 2023, and make about 10,000 hires this fiscal year. The agency is focused on staffing up its enforcement ranks, after it focused hiring last year on improved customer service.

The Treasury Inspector General for Tax Administration, in a report released Thursday, said the IRS is looking to increase its total workforce to more than 105,000 employees by fiscal 2025 — about a 33% increase from the more than 79,000 employees it had in FY 2022.

TIGTA, however, said the IRS faces “considerable challenges” in reaching its hiring goals. The watchdog said about 26,000 employees will retire or leave the agency between FY 2023 and 2025.

IRS is also investing in technology and data science to ensure the agency is more precise in auditing taxpayers who are actually behind on their tax obligations.

“They really are sort of intertwined, both additional staff, and then helping our staff to be as effective in their roles as possible,” Krause said.

Krause said the IRS, in the meantime, is looking to “rebalance” its compliance portfolio, based on the amount of staff it already has on board.

“[We’re] looking at ways that we can redeploy some of our staff to focus on some of these areas of strategic importance,” she said.

The IRS releases official tax gap estimates about every three years. The agency released its tax gap estimates for tax years 2014-2016 in October 2022.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED