COMET recompete, Polaris protests keep acquisition exciting in early fiscal 2024

The General Services Administration is facing two new protests of its small business IT services contract known as Polaris, while VA’s awards under T4NG2 remain...

Just over a month into fiscal 2024 and there is no shortage of excitement and intrigue across the federal acquisition community.

The General Services Administration’s Federal Acquisition Service, which reported a record 2023 with over $100 billion in sales, is once again, at the center of a lot of the activity.

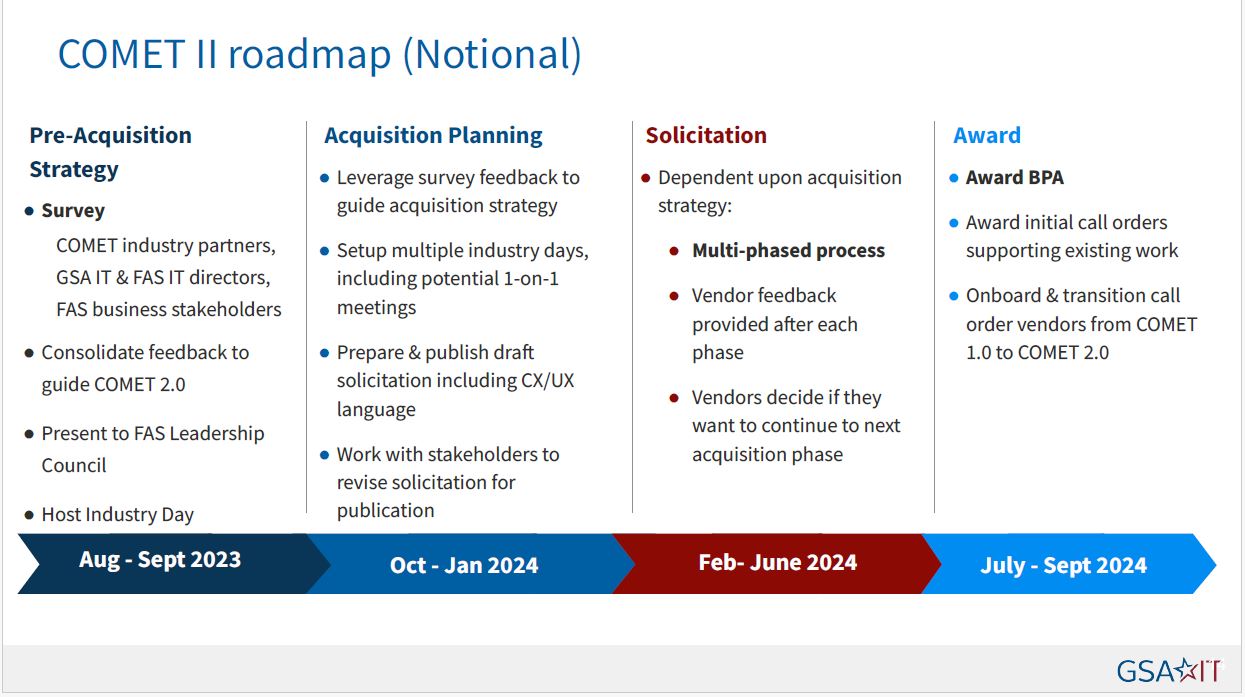

Planning for version 2 of its COMET vehicle kicked off with an industry day in September, attracting 400 companies and more than 750 registrants. GSA already is expecting COMET to play a much larger role in providing the outlet to continue to modernize their systems with a ceiling over more than $1 billion.

A current COMET contractor, who requested anonymity to talk about an active procurement, said the move toward a product mindset is a good change to the vehicle.

“With the current modernization efforts, there are some good successes because of product lines like the GSA fleet contract. For fleet, as an example, GSA asked vendors to show how you would’ve developed the product and then center the presentation around that with a big emphasis on how your team works,” the industry executive said. “GSA gave you a problem set and said ‘go work it for week and present to us how you would do this. User experience plays very much into the product line effort and that is a key feature of COMET 2.”

Dave Shive, the GSA chief information officer, said at the industry day that the scope of the follow-on contract will be larger and will build on the lessons learned over the past few years.

“Please take a look at our requirements that we express out to you very carefully. You’ll see some themes in there that are very important to the government. An example of that is GSA is pretty far along with our zero trust implementation across the four main pillars. For users and devices, we’re 100% implemented here at GSA. Across data and applications, we have considerable maturity in those spaces. We’re looking for partners who understand the basic principles of zero trust, especially at the application layer, where a lot of this work in the next generation of COMET is going to be prevalent,” Shive said. “We’re looking for partners who are going to be able to understand the application level security. Zero trust principles injected at the application level are critically important. Same thing at the data layer, knowing that the applications we build are going to have to know everything and anything about data and who’s using it so that we can apply our zero trust principles to that is going to be critically important. Same thing for customer experience.”

GSA’s COMET almost $1 billion in awards

The current COMET has been a success, according to GSA and vendors involved. So far, the agency has awarded 21 task orders worth more than $950 million to 11 different companies. The largest task order went to Booz Allen Hamilton for $247 million to create the cloud infrastructure that a lot of applications now reside on. GSA awarded COMET in 2019 to 12 companies.

“We’ve been really thankful to work with many of you in the past to develop some skill in that space so that we’re not learning how to move things to the cloud, we’re not learning how to do DevSecOps and we’re not learning how to do agile. We’re actually practicing and refining that process. We learned how to do that very well under COMET, and then the next iteration, you’ll see some reflection in our requirements about that maturity, which I think is going to be great to continue that public, private partnership,” Shive said. “One of the primary goals of COMET was to focus on modernizing, using our cloud smart strategy. We moved things to the cloud as a matter of course, it’s become our de facto norm. But we also listened to our industry partners, when we co-developed solutions to say, ‘what is the right place to host something?’ Usually, the answer is the cloud, but not completely. We’ll be smart about how we move to the cloud. Do we consider a managed service, which is another offering thing we consider? We’re looking for partners who have that broad mindset, that cloud smart mindset, with helping us do our work.”

The current COMET contractor said one big question they will be paying attention to as the acquisition continues to develop is how GSA will evaluate small businesses. The executive said under the current COMET vehicle two of the four small business winners did so well they were sized out of the contract quickly.

At the same time, industry continues to closely watch GSA’s Polaris small business contract, the OASIS+ recompete and what will happen with the ASCEND cloud blanket purchase agreement, which has been in the discussion phase for more than 18 months.

Sonny Hashmi, the FAS commissioner, said in a September interview that ASCEND continues to evolve.

“There’s a lot more to be done that front and more to come on us. I know I’ve said this before about ASCEND, I will say one blanket statement, we want to do the right thing. Rather than the expedient thing on ASCEND. There is a business case to be made for us, and we want to do it in a way that actually adds value to agencies and for the industry, so that requires some thinking,” he said. “More to come on that. This will require more engagement with industry. We’re going to be coming out with more engagement opportunities for industry partners to tell us how we structure it so that it actually adds value.”

Polaris bogged down

So while industry waits for GSA to finalize its ASCEND acquisition strategy, its other big governmentwide acquisition contract, Polaris, is facing another protest.

At issue this time is GSA’s handling of mentor-protégé and joint ventures. Akima Data Management filed a complaint with the Government Accountability Office on Oct. 31.

Akima is challenging the latest amendment, the ninth, around letting mentor-protégé joint ventures submit revised experience examples as part of their self-scoring proposal. Akima claims that change is unfair and improper. GAO has until Feb, 8 to decide the protest.

Absolute Strategic Technologies filed a second protest around Polaris on Nov. 7. This one also is focused on amendment nine, but is around changes GSA made to the proposal for cost and price, changes to the evaluation methodology and the experience of the vendors.

Absolute’s protest alleges GSA unreasonably limited the scope of what offerors may revise in their proposals and that the agency will not allow companies to update their offers beyond what they submitted on Oct. 7 with current past performance and experience information. Finally, Absolute says amendment nine unreasonably limits revisions to specific parts of proposals ignoring other parts of offerors’ proposals they should be allowed to modify.

GAO has until Feb. 15 to decide the case.

This is the second around of protests against Polaris. The small business contract received a pre-award complaint in March, and GSA took corrective action around the mentor-protégé and joint venture requirements.

Veterans Affairs $60B contract awarded

While GSA tends to receive a lot of attention around acquisition — and rightfully so — two recent awards from the Department of Veterans Affairs also deserve some notice.

The first from VA made 30 awards under the much-anticipated Transformation Twenty-One Total Technology Next Generation 2 (T4NG2) IT services contract vehicle.

And as of Nov. 13, GAO hasn’t received any bid protests over the award — which is good news so far, but that doesn’t mean VA is out of the woods yet.

Under T4NG2, which is a 10-year contract with a $61 billion ceiling, the mix of small and large contractors will provide a range of IT services including technical support, program management, strategy planning, systems/software engineering, enterprise network engineering, cybersecurity, operations and maintenance, and other services.

The current T4NG contract has been a popular vehicle across the agency. GAO reported last December that from 2017 to 2021, VA spent about $6.4 billion.

In addition to T4NG2, VA also made an interesting award to TransUnion to help fight fraudster targeting veterans and their families.

TransUnion and Four Points Technology will provide technology to improve VA’s ability to brand and verify its calls to veterans and their families from both landline and mobile phones.

Jeffrey Huth, senior vice president of TransUnion’s public sector business, said in an email to Federal News Network, said the contract addresses the VA’s Veterans Experience goals.

“The VA currently has a challenge with reaching out to veterans and their caregivers because of incorrect or missing caller ID across the enterprise. This challenge affects all facilities and contact centers who perform outbound calling on a consistent basis to engage veterans for the purpose of informing them of relevant information and available benefits,” VA stated in its solicitation. “Outbound calling could be more successful if veterans or their caregivers knew that the number calling was a trusted VA employee.”

VA says its annual outbound call volume is about 100 million a year, and wants the services to be able to handle as much as 310 million outbound calls a year.

Fraud against veterans growing

Huth said it’s difficult to know exactly how big a problem scams are for veterans, data collected fraud in the name of other agencies demonstrates the challenge VA and every agency faces.

He said a Government Accountability Office report in 2019 found the IRS reported that from October 2013 through March 2019, the agency was contacted more than 2.4 million times by taxpayers who reported calls from fraudsters posing as the IRS, and more than 15,453 taxpayers reported losing about $75.1 million in such scams.

Combating fraud continues to be a focus areas for the agencies. Just Saturday, the White House launched the Veteran Scam and Fraud Evasion (VSAFE) campaign and task force with the Federal Trade Commission (FTC) serving as a central hub for reports of scams targeting veterans and service members.

Huth said TransUnion and Four Points Technology piloted this technology for 10 weeks in the fall of 2022 with Veterans Affairs Solid Start Program and applied the technology to more than 82,000 calls.

“The VA experienced a 20% increase in weekly successful contacts. Average call attempts for a successful contact decreased from about 2.5 to 1.9,” Huth said about the pilot. “The VA is rolling the service out across the country over the next several months and to additional programs.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED