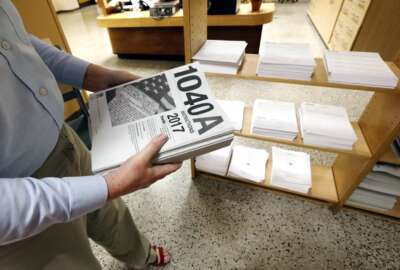

Tax act having unintended consequences for feds who relocate for work

Federal employee groups are encouraging fast action from the General Services Administration to quickly update tax regulations and write new guidance on tax...

A series of complex changes embedded in the new tax act are having unintended consequences for federal employees who move for the job.

The Treasury Department and General Services Administration are updating a large variety of regulations and current policies to comply with the provisional changes in the Tax Cuts and Jobs Act, which Congress passed last year and became effective Jan. 1.

But without more specific guidance from GSA and immediate changes to the previous provisions regulating taxes on travel, transportation and relocation reimbursement, agencies are forced to have their employees foot the bill.

Impacted employees are facing financial hardship, and some are declining reassignments or choosing to leave federal service, several organizations in the Federal Postal Coalition said in a letter to GSA Administrator Emily Murphy.

As many of 25,000 federal employees a year relocate for their jobs, the coalition said, which includes the Senior Executives Association, Federal Managers Association, Federal Law Enforcement Officers Association and FAA Managers Association, among others.

Previously, employees who relocated for the job could deduct certain moving and travel expenses from their taxes. Those previously deductible expenses were not included in the Withholding Tax Allowance and Relocation Income Tax Allowance computations.

“Clearly, this unintended policy outcome of tax reform holds the potential to be personally ruinous to affected federal employees,” the organizations said. “Moreover, this policy is specifically impacting those federal employees who already faced the daunting prospect of uprooting and relocating their lives in the name of public service.”

In particular, these changes are impacting employees at the Agriculture, Defense, Homeland Security and Justice Departments, as well as the Federal Aviation Administration, the letter said.

Without clear guidance from GSA, agencies are withholding moving and travel expenses directly from impacted employees’ paychecks.

Some federal employees have gotten bills for $3,500 and $6,000, the Senior Executives Association said.

“We ask that you move quickly to take the steps necessary — including consultation with Treasury Secretary Steve Mnuchin — to resolve this matter,” the federal employee groups said.

While the Senior Executives Association believes agencies are simply charging their employees who relocate for the job absent of a clear guidance, the organization said GSA needs to work with the Treasury Department to update language in the U.S. Code.

However, It is less clear how employees who have already relocated and paid moving charges could be made whole.

The recent tax code changes are also impacting new hires, employees returning home from a stint overseas or senior executives eligible for “last move home,” an obscure benefit for career SES who move upon retirement from federal service. A fix for employees in these situations, SEA said, would require a statutory change.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED