Timing and your TSP investments

Financial planner Arthur Stein is today's Your Turn guest and will talk about investment time periods for Thrift Savings Plan participants.

When investing for retirement, knowing what an investment time period is and which one(s) to use can be very important. Financial planner Arthur Stein says the time period when you will need to tap into your Thrift Savings Plan account is important in determining the mix of stocks, bonds and treasury securities in your account.

People retiring under the Federal Employees Retirement System don’t get full cost of living adjustments during periods of high inflation, which, Stein says, is why they need enough stocks and bonds in their account to keep it from being eaten up by inflation. He’ll be my guest on today’s Your Turn, which airs at 10 a.m. EST on www.federalnewsnetwork.com and 1500 AM in the Washington, D.C. area. Stein will be talking about investment time periods which he explains like this:

“Remember the rock band Chicago and the song ‘Does Anybody Really Know What Time It Is?’ That might have been a good question in 1970 but we all know the time now. Even without a watch, we can look at our phone, smart speaker, oven or microwave — strange world.

“But do you know what time period it is, as in investment time period? What time period is appropriate when reviewing our investments? Are we living in a one month, one year or 10-year time period? Reviewing the wrong time period may lead to poor investment choices.

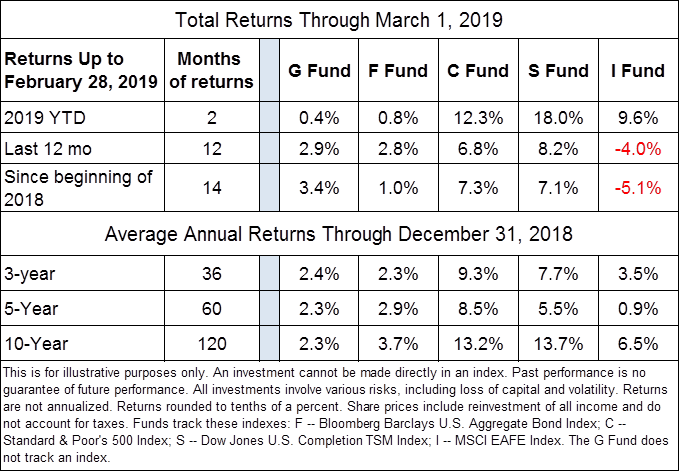

“The table below illustrates six different time periods for the traditional TSP Funds.

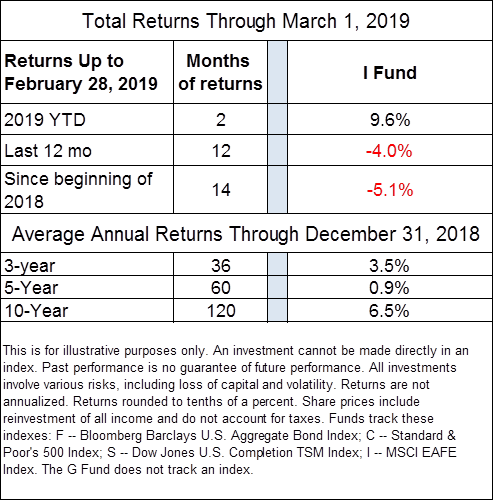

Time periods seem very important when reviewing the stock funds. As an example, let’s look at the I Fund, which had the most variation in returns.

“Avoiding technical terms, I Fund returns range from excellent — 9.6 percent over a two-month period — to bad — negative over last 12 and 14 months. Over longer time periods, returns ranged from OK to mediocre, and for 10 years not bad. The 6.5 percent, 10-year average means share prices increased 88 percent over that time period.

“Which of those many time periods is the most relevant? It depends upon when you expect to withdraw funds to spend.

- The stock funds should be considered for money needed 10 or more years in the future. Higher volatility and larger variations in returns are balanced out by returns that were, historically, significantly higher than the bond funds.

- For withdrawals in the next 1-5 years, F and G may be better choices. The F Fund offers much lower volatility and chance of loss than the stock funds, and outperformed G over most historical periods. G offers zero volatility and a government guarantee.

- The 5-10 year time period is more of a gray area. A combination of stock and bond funds might be a good combination.

“Please note that past performance is not indicative of future performance. There are no guarantees, except with the G Fund.

“‘Does Anybody Really Know What Time It Is?’ suggests the singer doesn’t know, doesn’t care and cannot imagine why others do. And that may be appropriate for Chicago or Jimmy Buffett lounging in Margaritaville. But for investors, not knowing the appropriate time period may be an expensive mistake.”

Nearly Useless Factoid

By Amelia Brust

Each day of the Tour de France, competitors, on average, ride 110 miles and burn 6,071 calories. That’s roughly the equivalent of 58 bananas or 3.6 Chipotle carnitas burritos.

Source: Business Insider

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED