Fiscal 2015 a record-setting year for IRS online apps

Fiscal 2015 was a record-breaking year for the Internal Revenue Service, according to the tax agency’s Data Book. But it was also a year that marked a continued...

One agency accounted for more than $3.3 trillion in collected taxes; 119 million refunds given; 80,000 full-time-equivalent positions and 985 identity theft cases closed.

Fiscal 2015 was a record-breaking year for the Internal Revenue Service, according to the tax agency’s Data Book released this week. The IRS’ online refund tracer Where’s My Refund received 234 million inquiries last fiscal year, a 24 percent increase over fiscal 2014.

But fiscal 2015 was also a year that marked a continued decline in funding for the agency, leading to shrinking workforce numbers and a lower number of enforcement-related actions.

IRS Commissioner John Koskinen in his letter included in the Data Book said the IRS processed more than 243 million tax returns and other forms, and issued more than $403 billion in refunds.

“[Fiscal] 2015 also marked the fifth consecutive year of reductions to the IRS budget,” Koskinen said. “With more than a 15 percent reduction in full-time-equivalent staffing compared to five years ago, operations across a number of areas were downsized, including the total number of individual tax return examinations, which decreased by 22 percent over the last five years. Other challenges like identity theft refund fraud continued to evolve as we intensified efforts to root out fraudulent tax returns and pursue criminal investigations.”

National Treasury Employees Union National President Tony Reardon said the Data Book highlights the losses that not only put the agency at risk, but taxpayers as well.

“Our country depends on an efficient and effective tax collection system to fund our national defense, education and all of the other services our citizens expect from their government,” Reardon said. “That cannot be accomplished with far fewer employees than there were 20 years ago.”

Here’s a look at four important takeaways from the fiscal 2015 Data Book.

Shrinking funds, growing responsibility

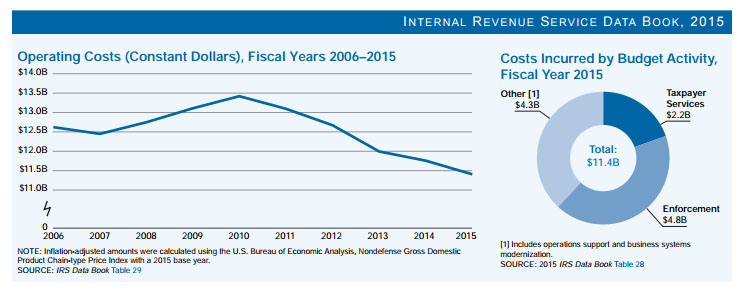

For fiscal 2015, the IRS received $11.4 billion from Congress, down from $11.6 billion in fiscal 2014.

That amount breaks down to:

- $4.8 billion for enforcement

- $2.2 billion in taxpayer services

- $4.3 billion in other costs including staffing, equipment, operations support and updating information systems

The roughly $240 million left over in expenditures, the Data Book said, was spent on information technology.

Workforce

Last fiscal year, the IRS employed about 80,000 full-time-equivalent positions, which is a drop of about 15.6 percent over the past five years.

About half of the positions “were dedicated to enforcement, followed by taxpayer services which represented 34.6 percent,” the Data Book said.

About two-thirds of the IRS workforce is female, and veterans make up about 10 percent of the total workforce.

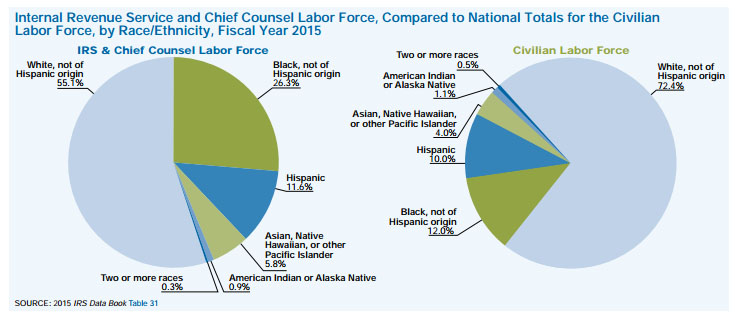

“Ethnic minority employees made up almost 44.9 percent of the IRS and Chief Counsel workforce, as compared to a 27.6 percent share of the overall civilian labor force,” the Data Book said.

Of the ethnic labor force at the IRS, about one-quarter of employees are black, while Hispanic employees make up the next largest percentage at 11.6 percent.

Taxpayer assistance

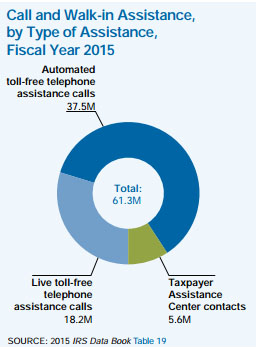

The IRS helped hundreds of millions of taxpayers through its online, phone and walk-in assistance.

While call and walk-in help has declined since 2012, “electronic transactions continued to grow, totaling over 307.9 million,” the Data Book said.

The IRS offered preparation assistance on about 3.8 million tax returns and helped close about 118,000 appeals cases.

Enforcement, audits

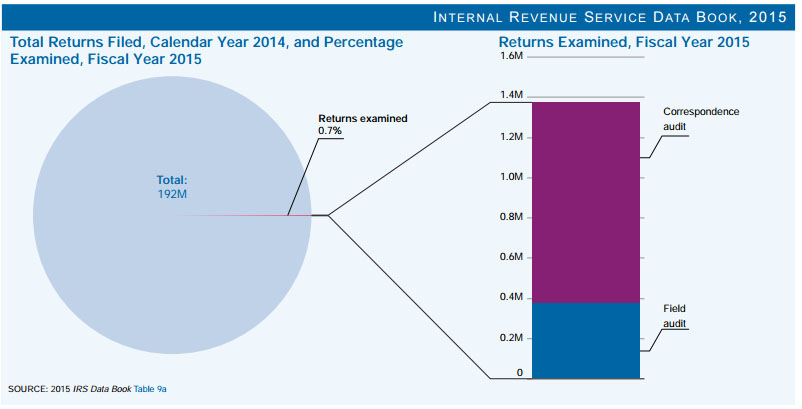

According to the fiscal 2015 Data Book, 192 million tax returns were filed; however, only 0.7 percent of all returns were examined. The number of audited returns has been decreasing since 2010.

“In FY2015, examinations protected a total of almost $2.1 billion in refund payments, of which almost $2 billion came from field examinations and $122.3 million from correspondence examinations,” the Data Book said.

For tax year 2014 — calendar year 2015 — the IRS sent out roughly 1.7 million notices to taxpayers about more than 2 million math errors found on their returns.

In fiscal 2015, IRS investigators started more than 3,800 cases and closed nearly 4,500.

Of those cases, about 22 percent involved identity theft.

For more serious offenses, “the IRS initiated 3,853 criminal investigations in these three areas — legal source tax crimes, illegal source tax crimes and narcotics related financial crimes.”

For more serious offenses, “the IRS initiated 3,853 criminal investigations in these three areas — legal source tax crimes, illegal source tax crimes and narcotics related financial crimes.”

As for late filing fees, the IRS collected about $2.3 billion in delinquent returns.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Related Stories