DoD, IRS, HHS target of federal audit on inefficient and wasteful agencies

The Government Accountability Office's sixth annual report on "fragmentation, overlap and duplication," put the spotlight once again on the DoD, Treasury Department...

The Defense Department can’t keep track of its property, the Internal Revenue Service is struggling to keep up with identity frauds, and there aren’t enough employees to meet the mission of the Centers for Medicare and Medicaid Services.

The Government Accountability Office’s sixth annual report on “fragmentation, overlap and duplication,” put the spotlight once again on the DoD, Treasury Department and the Department of Health and Human Services for the “significant opportunities for cost savings and revenue enhancement [that] exist in these three areas.”

“In this report, we present 92 new actions that Congress or executive branch agencies could take to improve the government’s efficiency and effectiveness or achieve financial benefits across 37 areas that span a broad range of government missions and functions,” the GAO stated in its report. “Of these, we suggest 33 actions to address 12 areas in which we found evidence of fragmentation, overlap, or duplication in government missions such as defense, economic development, health, homeland security and information technology.”

Officials from those three agencies appeared April 13 before the House Committee on Oversight and Government Reform, where they were questioned on everything from acquisition to “zero” improper payments.

The hearing “sets a benchmark every year for us to look at whether it’s a high watermark or a low watermark,” said Rep. Mark Meadows (R-N.C.). “We’ll leave that up for debate for another day, but in doing that, we need to set that standard for each one of you. I would hope that next year that it’s not the same three agencies that are here.”

Department of Defense

The Defense Department comprised nearly one half of the government’s $1.2 trillion discretionary spending in fiscal 2015, according to GAO.

Since the 2011 annual report, the department has racked up 152 actions, 95 of which — or 63 percent — remain partially addressed or not addressed.

“Many of the actions fall within a few key areas, including acquisitions and contract management, support infrastructure and headquarters management,” the report stated.

Among the most recent actions the GAO directed DoD to do:

- Distribute excess ammunition to federal, state and local government agencies

- Better manage its underutilized military installation spaces

- Review eligibility requirements for living quarters allowance

Rep. John Mica (R-Fla.) said he was concerned about DoD’s inability to keep track of what it owns.

“They don’t have a good inventory, even of their properties and their assets, and this report highlights it again, and that’s a concern,” Mica said. “We have billions of dollars’ worth of assets, both domestic and international, and we can’t even account for it. I think this is troubling.”

Rep. John Duncan (R-Tenn.) asked about DoD’s acquisition program, which staff reports showed amounted to a total $1.3 trillion, with annual spending over $100 billion, he said.

Paul Francis, managing director of acquisition and sourcing management at DoD, testified that the department right now has a process that optimizes individual weapons systems, and that “we need to look more across the board.”

“One of the things that we’ve talked about is portfolio management, which is basically an approach for the department to look at its weapons system portfolio as a whole,” Francis said. “One of the looming problems for Defense is when you get beyond the next five-year plan, there’s much more demand for money for weapons systems than there’s money available. So the department has to take a more holistic look across weapons systems to see what the best mix of investments are for them.”

Treasury Department

GAO has given Treasury a total of 112 actions, but 63 percent of them remain open.

Among this year’s actions recommended by auditors:

- Improving the Internal Revenue Service’s efforts to stop identity fraud

- Better management of the IRS’ public referral programs

GAO said the IRS could collect billions of dollars in tax underpayments with better management of the whistleblower program.

John Dalrymple, deputy commissioner for services and enforcement at the IRS, said the agency is putting together a report that looks at the referral program.

“Our intentions are to limit the number of organizations that have referrals,” he said. “In other words, we intend to bring the referral process down to one centralized activity, and our intention is to at some point in time in the very near future, have an online opportunity for taxpayers to make referrals. So we’re looking at all of the recommendations that have been made, both by the GAO and the Treasury Inspector General for Tax Administration and I believe we’re going to be quite responsive to the issues that have been raised.”

The IRS collects more than $3 trillion in gross taxes, which in turn funds about 93 percent of government payments. In fiscal 2015, the IRS reported a tax gap of $385 billion.

“We do everything in a 10-year window,” said Rep. Gary Palmer (R-Ala.), who also sits on a budget committee. “If it’s $380 billion a year, that’s $3.8 trillion in our 10-year window,” he said. “I just want to see if the IRS can be more diligent in making sure that we collect the revenue that’s owed us.”

Rep. Gerry Connolly (D-Va.) pointed out that identity fraud was “virtually a cost-free crime.”

“The chances of us identifying you for illegally diverting somebody’s refund and prosecuting you and convicting you and even punishing you are pretty nil are they not,” Connolly said. “I think Congress has to provide resources to beef up that effort and help restore American confidence.”

Department of Health and Human Services

The Department of Health and Human Services has 82 total actions, about 67 percent of which are only partially addressed or not addressed.

They include:

- Improving the accuracy of federal Medicaid eligibility to reduce improper payments

- Equalize Medicare health care service rates, rather than basing them on where a service is performed

- Reducing duplicative federal spending on a person who moves between Medicaid and exchange coverage

Costs for Medicare, Medicaid and other major health care programs total $1 trillion in 2015, GAO reported. The Congressional Budget Office estimates that spending will continue to grow, with that amount doubling by 2026, the report stated.

Rep. Robin Kelly (D-Ill.) asked what was being done to address duplicative coverage between Medicaid and federal subsidies.

Dr. Patrick Conway, acting principal deputy administrator for the Centers for Medicare and Medicaid Services, said his agency was reviewing account transfers on a weekly basis and performing data matches

Conway also said when it came to verifying eligibility of Medicare providers and suppliers, his agency was making software updates for address verification and increasing site visit frequency.

But asked by Kelly whether there were enough people for this, Conway said based on employee feedback in the Federal Employee Viewpoint Survey, while it’s clear the roughly 6,000 employees are mission driven, “the other thing that comes across is the feeling they don’t always have the resources and the training and the ability to improve the system as much as they would want.”

Among other benefits

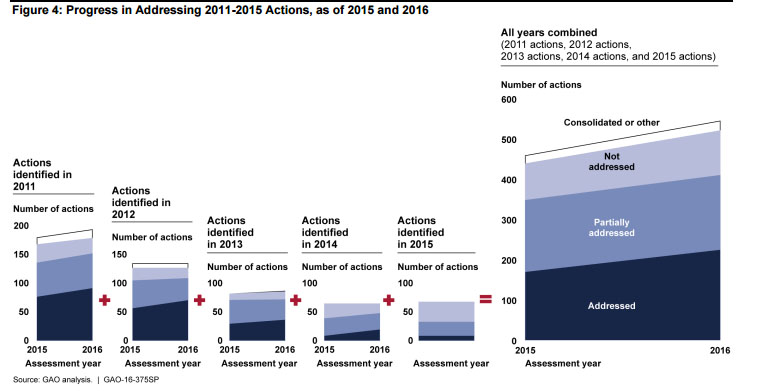

Between 2011 and 2015, GAO found more than 200 areas and recommended 544 congressional actions to reduce waste and inefficiencies.

According to the report, Congress and the federal agencies have addressed 224 of these total actions — or 41 percent — which have resulted in a financial benefit of roughly $56 billion between fiscal 2010 and 2015. An additional $69 billion is expected to be saved or recovered by 2025.

About 35 percent of those total actions have been partially addressed, while 20 percent have not been addressed.

“While not all actions taken by Congress and executive agencies result in financial benefits to taxpayers, all of our suggested actions, when implemented, can result in gains in government efficiencies or the elimination, reduction, or improved management of fragmented, overlapping or duplicative programs, among other benefits,” the report stated.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.