Fiscal 2016 a ‘turnaround’ year for IRS

Last year the Internal Revenue Service showed improved telephone customer service, and close to 300 million visits to the Where's My Refund? site. Agency leadership...

One agency, 122 million refunds, 209,000 new taxpayer advocate cases, 77,000 full-time employees.

Fiscal 2016 was a “turnaround” year for the Internal Revenue Service, according to the agency’s latest data book, notably in its improved telephone customer service, and close to 300 million visits to the Where’s My Refund website.

In a letter included in the data book, IRS Commissioner John Koskinen pointed out that “[a]t the same time IRS resources have shrunk, demand for help from the IRS has surged in key areas.”

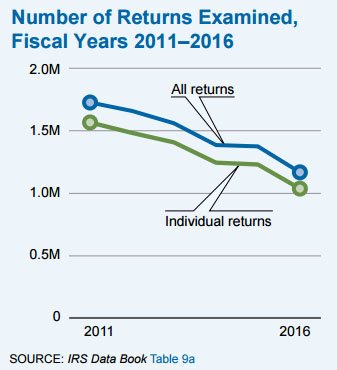

“The data book and its consistency year-to-year help illustrate trends over time, ranging from the increasing size of the taxpayer population to the decreasing size of the IRS workforce,” Koskinen said. “For example, in the last five years as the agency’s budget has been reduced, the IRS has lost almost 15 percent of its workers. Key measures of enforcement activity, including audit rates, have also declined in several categories.”

The report comes before Koskinen is set to speak April 5 at the National Press in Washington on budget cuts and tax reform, and he is also scheduled to testify April 6 before the Senate Committee on Finance. According to the President Donald Trump’s fiscal 2018 budget proposal, the Treasury Department would be cut by about $500 million. About $239 million would come from cuts to IRS.

“Critics may think that budget cuts at the IRS save money, but the opposite is true,” said National Treasury Employees Union National President Tony Reardon in a statement. “The IRS is responsible for collecting 93 percent of our nation’s revenue and when there aren’t enough people to help individuals and small business owners through the process, the entire system of voluntary tax compliance falters.”

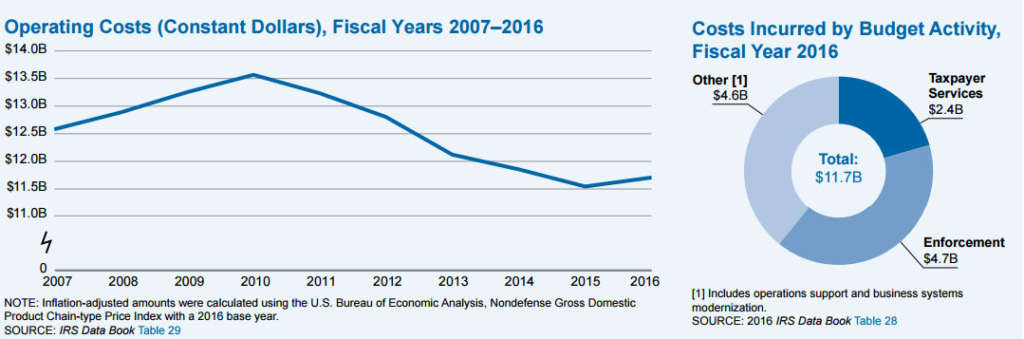

The IRS’ budget for 2016 was $11.7 billion. About $4.7 billion was spent on enforcement efforts, $2.4 billion was spent on taxpayer services, while the remaining $4.6 billion was spent on operations, like “staffing, equipment, and related costs used to manage, maintain, and operate critical information systems supporting tax administration.”

“The balance of IRS’ expenditures, more than $384.5 million, was spent on capital asset acquisition of information technology systems,” the data book said.

IT is a priority for IRS leadership, along with its advocates on Capitol Hill.

Nearly 50 lawmakers at the end of March sent a letter to the leadership of the House Financial Services General Government Appropriations subcommittees, asking that they reverse the President’s proposed budget cuts.

“The decline in taxpayer service and enforcement and the instability of underlying IT systems that

support them threaten to undercut the basic voluntary compliance fabric of our tax system,” the letter stated. “A 1 percent drop in the compliance rate translates into a revenue loss of approximately $30 billion per year, or $300 billion over the 10-year budget window.”

Taxpayer service

According to the data book, in 2016, the IRS had 77,924 full-time equivalent positions, which is a 17.7 percent drop from 2011. Of those roughly 78,000 FTE positions, about half worked in enforcement roles, while about 37 percent filled taxpayer service roles.

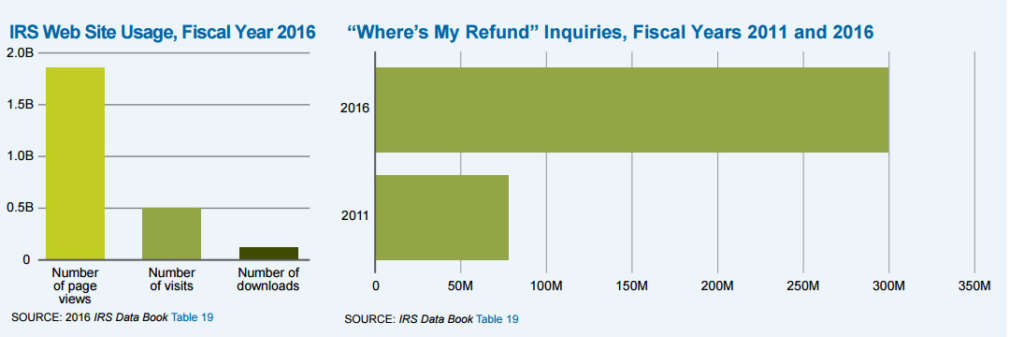

The IRS’ online refund tracer Where’s My Refund received 234 million inquiries in fiscal 2015, a 24 percent increase over fiscal 2014. But in 2016 that number hit nearly 300 million inquiries. The agency’s website itself was visited more than half a billion times.

Enforcement and examinations

Of the 193 million returns filed in calendar year 2015, the IRS audited 1.2 million of them — less than 1 percent.

“In FY 2016, examinations protected a total of almost $4.2 billion in refund payments, of which $4.1 billion came from field examinations and $89.4 million from correspondence examinations,” the data book showed.

Last year, IRS investigators opened 3,395 cases and completed 3,721. That’s compared to opening 3,800 cases and closing nearly 4,500 in fiscal 2015.

Of those case totals, IRS started 573 cases and completed 743 cases related to identity theft.

The IRS in 2016 also collected about $38,000 more in delinquent returns than it did in the prior year, for a total of $2.3 billion.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Related Stories