Agencies get more help distributing COVID-19 relief in $2.3T catch-all

The latest COVID-19 relief package drew on some of the lessons agencies and lawmakers learned in implementing the first round of loans, payments and direct aid...

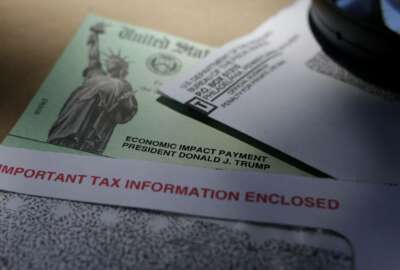

Congress has again called on several federal agencies to help disburse loans, economic stimulus payments and other direct aid to Americans during the ongoing COVID-19 crisis.

The $2.3 trillion omnibus spending and COVID-19 relief package, which Congress passed late Monday night, is packed with provisions designed to help agencies get the job done quickly — and address pandemic-induced funding shortfalls at other federal organizations.

It also drew on some of the lessons agencies and lawmakers learned in implementing the first major COVID-19 relief package earlier this year.

The IRS received a modest budget boost for the rest of 2021, but Congress also included a few new provisions that might make it easier for the agency to disburse a second round of stimulus checks in the coming weeks.

Americans earning less than $75,000 will receive a “recovery rebate” worth $600, according to the legislation. Married couples with a joint income of $150,000 or less will receive a stimulus payment worth $1,200, and families with children will receive $600 per child.

IRS, for example, gained full access to SSA’s Death Master File, which the agency didn’t have when it sent out the first round of stimulus payments this spring. The Government Accountability Office recommended Congress give Treasury full access to the Death Master File after the IRS sent nearly 1 million stimulus payments to the dead earlier this year.

Allowing Treasury full access should help the IRS better identify Social Security beneficiaries who aren’t eligible to receive a stimulus check during this second round, Congress said in the summary detailing the COVID-19 relief provisions.

Considering the IRS already issued more than160 million stimulus checks earlier this year, the agency may be able to provide this second round more quickly, said Chad Hooper, president of the Professional Managers Association.

“IRS employees are prepared to work diligently through the upcoming holidays to ensure stimulus payments are delivered as expeditiously and effectively as possible,” he said Tuesday in a statement.

Still, Hooper said the agency is hindered by aging IT systems and limited interagency collaboration.

The COVID-relief package does allow Treasury to work with the Department of Veterans Affairs, Social Security Administration and Railroad Retirement Board to issue direct stimulus payments to beneficiaries who didn’t file a tax return in 2019.

Small bit of financial relief for the Postal Service

The new bill allows the U.S. Postal Service to tap into the $10 billion loan it received through the Coronavirus Aid, Relief and Economic Security (CARES) Act, which Congress passed back in March.

The CARES Act, which Congress passed back in March, issued the loan to USPS based on specific conditions set by the agency and the Treasury Department.

This new provision is a far cry from the $25 billion House Democrats proposed this spring in their own COVID-19 relief bill. But allowing USPS to keep the $10 billion loan it received earlier this year should help partially alleviate the agency’s financial hardships.

USPS ended fiscal 2020 with a $9.2 billion net loss despite handling a historic volume of election mail.

Extra funding to bridge pandemic revenue losses for CBP

Customs and Border Protection ports of entry received an additional $840 million for 2021, which will help offset revenue losses associated with the pandemic.

CBP’s Office of Field Operations relies on customs and immigration user fees to fund 40% of its budget. But trade and travel volume fell during the pandemic, creating a funding gap for a portion of the agency.

The National Treasury Employees Union helped flag the CBP funding shortfall earlier this year, pushing Congress to authorize additional funds to avoid the possibility of employee furloughs later on.

“While this emergency funding is key to maintaining staffing levels at the 328 ports of entry, we will continue to fight for additional funding to hire more CBP officers because the agency remains short of the staffing target identified in its own workload staffing model,” Tony Reardon, NTEU’s national president, said Tuesday in a statement.

COVID relief extension for contractors

Federal contractors scored yet another temporary extension of Section 3610, the CARES Act provision that allowed agencies to keep their contractors in pay status if they’re unable to telework or enter government facilities during the ongoing pandemic.

The original CARES Act provision granted these protections to federal contractors through the end of fiscal 2020. The September continuing resolution extended the deadline through Dec. 11.

Now thanks to the latest omnibus and COVID relief package, federal contractors can take advantage of these protections through March 31.

The Professional Services Council applauded the extension Tuesday. PSC, along with the Intelligence and National Security Alliance, National Defense Industrial Association and other organizations had asked Congress back in November to extend pay status protections for federal contractors. An extension was especially important given the rising number of COVID-19 cases across the country, they said.

More money for pandemic oversight

GAO will receive an additional $10 million to continue oversight of agencies’ COVID-19 response efforts and spending during the pandemic.

The agency has published four comprehensive reports on agency implementation of the CARES Act and opened more than 100 audits on the federal pandemic response since mid-March, according to Senate Homeland Security and Governmental Affairs Committee Ranking Member Gary Peters (D-Mich.).

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED