Hubbard Radio Washington DC, LLC. All rights reserved. This website is not intended for users located within the European Economic Area.

On Air: Federal News Network

Trending:

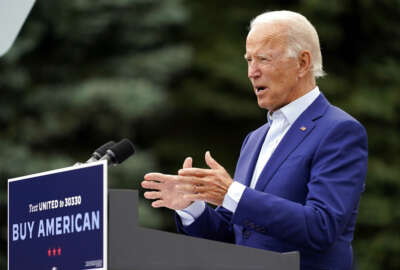

What’s different — if anything — about Biden’s ‘Buy American’ agenda from past directives?

Procurement law and regulation have required buying American for decades. Is there anything left to do?

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

Among the blizzard of executive orders coming from the Biden White House was a June missive telling agencies to buy American. But procurement law and regulation have required buy American for decades. Is there anything left to do? For one interpretation, Federal Drive with Tom Temin turned to Venable attorney Dismas Locaria.

Interview transcript:

Tom Temin: Mr. Locaria. Good to have you on.

Dismas Locaria: Great. Thanks for having me, Tom. Appreciate it.

Tom Temin: And having looked at this executive order, I’m trying to find out what is new here because agencies have to buy American except when there is nothing American made that they need. So what do you see going on here?

Dismas Locaria: This has been a constant kind of political ping pong ball from the Trump administration, to the Biden administration, even going back, as you mentioned, decades, but there are some nibbling around the edges that can be done. The executive order itself doesn’t really do much. It just talks about an effort to do something. And we’ll expect regulations out in the coming months on that, but there was some more recent development on that executive order as it related to exceptions. One thing the executive order talked about was creating a centralized body that would determine exceptions and publicize those exceptions. And that’s starting to take shape within OMB. I think that’s pretty significant, because that’s long been one of the kind of loopholes is that agency-by-agency, contracting officer-by-contracting officer, you could get exceptions, and contracting officers and program officials would prioritize the procurements over buy America goals. But now that it’s centralized, with OMB removed from that interest of getting the program accomplished, I think you’re going to see a lot more difficult time for contractors to get those exceptions.

Tom Temin: These are what they call waivers, in other words, and the order seem to establish kind of a database publicly of waivers and why they were issued agency-by-agency.

Dismas Locaria: Yeah, that’s exactly right.

Tom Temin: Well, I guess the question becomes, why are they getting waivers under buy America as it stands now? Because there are certain commodities that are simply not made the United States, I mean, laptop PC’s, for example. There’s a few in the ruggedised area, but for the most part, they’re assembled all over, from parts all over, copiers, all of those things, the nuts and bolts that make any organization operate nowadays. Do they have something else in mind? Could they be aimed at software?

Dismas Locaria: Well, I think, and candidly, I think the COVID-19 pandemic brought some of this home, which is we have a dearth of manufacturing capability in the United States, and I think the administration wants to try to improve upon that in any way it can. You’re right, things like laptops and other high tech IT equipment, it’s unlikely that that’s going to turn into manufacturing jobs overnight. But, I do think that there’s a lot of new technology coming online, that the Biden administration wants to make sure that companies and organizations are planning to do some manufacturing in the United States. That way, as new products are coming online, this is taken into account.

Tom Temin: And the order also calls for a senior accountable official in each agency. Is it your understanding this would be the procurement chief of a department, for example, or who might that be?

Dismas Locaria: I think that’s probably right. But the order is not explicit on that point. And the regulations will spell that out more, but it’s typically the head procurement officer for each agency. So I would anticipate that to be the case.

Tom Temin: And in your experience dealing with companies, what is their perception of what the government looks like when it’s trying to buy American?

Dismas Locaria: It’s a challenge, because companies want to take advantage of that government marketplace. But, if they’re commercial companies, they’re unlikely to change their manufacturing process solely to capture that government market unless it proves extremely lucrative. Now, if it does prove lucrative, and those procurements are in the hundreds of thousands of dollars, it avails themselves to what’s called the Trade Agreements Act. And the Trade Agreements Act will allow organizations companies to manufacture in countries that where we have treaties, Mexico, Japan, lots of other places, not China, not Malaysia, but a number of countries, Taiwan, where commercial organizations have manufacturing facilities set up. So the buy America generally applies to the smaller dollar procurements, whereas the trade agreements kicks in for those larger procurements.

Tom Temin: We’re speaking with Dismas Locaria, he’s an attorney with Venable law firm. Yes, I was thinking of the federal vehicle fleet, which is mostly purchased, not completely, but mostly purchased by the GSA. And so many of the, let’s say plain Jane, four door sedans that they buy are made in Mexico, even under U.S. name plates. So that’s the kind of thing you’re talking about.

Dismas Locaria: Exactly. Now, one big exception that I think is going to become pretty important here and we’re going to be dealing with a pretty quickly here is Department of Transportation has their own domestic preference regime, and that applies to steel. And so when we talk about infrastructure and the new infrastructure bill, and that is a much less forgiving domestic preference scheme than the commercial commodities that we’ve been talking about. So that’s another area to keep in mind is that when we look at DOT money, particularly through this infrastructure plan, steel, and other raw materials, as well as rolling stocks, so, trains, cars, things like that, those could all be impacted by that DOT statute that is much less forgiving as I mentioned.

Tom Temin: I guess in the case of rail cars, and transit types of cars, like Metro, often the foreign manufacturers it’s worth their while to put a factory, I think there’s a factory in upstate New York to assemble rail cars from Bombardier, if I have the company right, in the United States, because of the high dollar volume of a single item there might be a couple of million dollars.

Dismas Locaria: Right. And so for those organizations and companies that routinely sell to Department of Transportation, they well understand these domestic requirements. But it’s noteworthy and newsworthy, that this multi-trillion dollar plan is coming down the pike. And so, what we see is lots of companies coming out of the woodwork saying, oh, I want to capture this, I want to capture this, this infrastructure, there’s gonna be a lot of money flowing through this infrastructure bill, I want to capture that. But they don’t realize that there are significant hurdles attached to that money. And the longtime players understand that. But the new companies, the new companies to the marketplace don’t typically understand that. And they may already have operations set up elsewhere.

Tom Temin: And you mentioned steel. And I think even at this point to history, not only raw steel, but engineered steel parts are still more economical to source in other countries and ship here, often than having beams and pre cut engineered parts made here. So that’s an issue. But what about like, I don’t know, pre stressed concrete components, where they’re lifted in place, and you’ve got a bridge or the bottom of building or something. Anything regarding that, that you’ve seen?

Dismas Locaria: I think it will be an issue because it’s about the manufacturing process. So you’re taking prefab concrete and building a highway, I don’t think the DOT will consider the highway the end product, I think they’re looking at the raw materials that are being brought in. And I think that would be an issue. So, the idea of prefab kind of concrete components, I don’t think would pass muster, necessarily.

Tom Temin: Yeah. And if new buildings get built, which let’s face it, this infrastructure will cover anything anyone wants to call infrastructure. I mean, in the reality, when the rubber meets the engineered road, buildings could be part of this. So then you’ve really got all of the issues coming to bear, even the HVAC systems and components, the wiring, and so forth, it’s all subject to the fact that there’s less expensive commodities coming in from overseas.

Dismas Locaria: Absolutely. And you have to consider I mean, bridges, roads, everything is smart technology now, right? Smart roads, smart bridges, where they’re going to have information technology components built in. So you’re looking at all sorts of not just your typical steel girders and concrete trusses, but rather you’re looking at it equipment as well.

Tom Temin: Reminds me of when Eisenhower said a B-29 bomber cost more than a brick schoolhouse. That was a long time ago. And what do you expect from this Made in America office to be established at OFPP [Office of Federal Procurement Policy]? Because there’s not even an OFPP director in place yet.

Dismas Locaria: Well, I think it’s going to be difficult to surmise that at this stage, but I do expect President Biden has a long track record of kind of domestic sourcing and blue collar kind of background. So I would anticipate this is more than just a flash in the pan for him, and this is something that they’re going to carry through with. You mentioned, what else could be done? On the buy America, there’s a U.S. component requirement set at 55% of the end product. I think it’s very likely that that gets bumped up more than just a few points. And that will had a significant impact on organizations that look carefully at that component percentage when determining where and how to manufacturer. So it’s hard to say exactly how this is going to take shape. But in the coming months, I think this fall we’ll have a much better sense, and like I said, I think it’ll be more than just a flash in the pan for this administration.

Tom Temin: Dismas Locaria is an attorney at the Venable law firm. Thanks so much for joining me.

Dismas Locaria: My pleasure, Tom. Appreciate it.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Tom Temin

Tom Temin is host of the Federal Drive and has been providing insight on federal technology and management issues for more than 30 years.

Follow @tteminWFED