IRS ends year with record-breaking reduction in tax return backlog, but challenges remain

The IRS will continue to deal with a pandemic-era backlog of unprocessed tax returns through next year’s filing season, and possibly through the summer.

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

The IRS will continue to deal with a pandemic-era backlog of unprocessed tax returns through next year’s filing season, and possibly through the summer, according to a recent watchdog report.

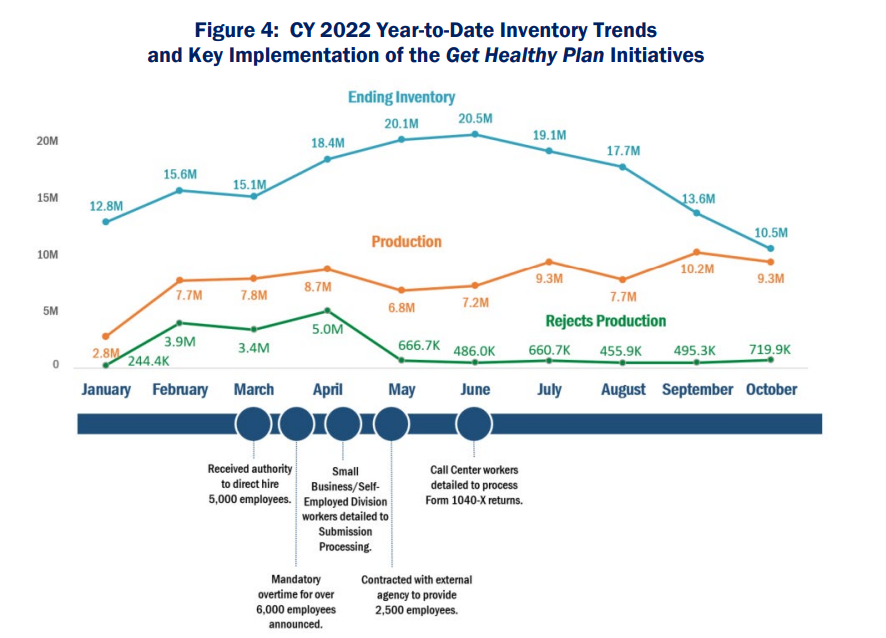

Extraordinary measures, such as temporarily reassigning IRS employees to “surge teams” and mandatory overtime, helped the agency chip away at a largely paper-based backlog of tax returns and taxpayer correspondence this year.

But the Treasury Inspector General for Tax Administration, in a report released Thursday, said the IRS fell short of its hiring goals, as of the end of September, and will likely miss its goal of getting its tax return backlog to a “healthy,” pre-pandemic state by the end of December, as agency leadership told lawmakers throughout this year.

An IRS spokesman said the data from TIGTA’s report, which was collected in October, “does not reflect our most recent progress,” and that the agency processed more of its tax return inventory in the last 12 months than at any 12-month period in its history.

“This unprecedented effort has been through an all-hands-on-deck approach, including reassigning more than 1,600 staff members to process paper (outside their normal roles) as well as hiring and onboarding 15,000 new staff in the fiscal year 2022 and so far in fiscal year 2023,” the IRS spokesman said.

The IRS, the spokesman added, is also scanning millions of paper tax returns to decrease the time employees spend manually processing them.

“Much work has been done in the last several weeks and will continue to be done in the weeks ahead to make progress to address the remaining inventory and to ensure that the agency does not face such challenges in the future,” the spokesman said.

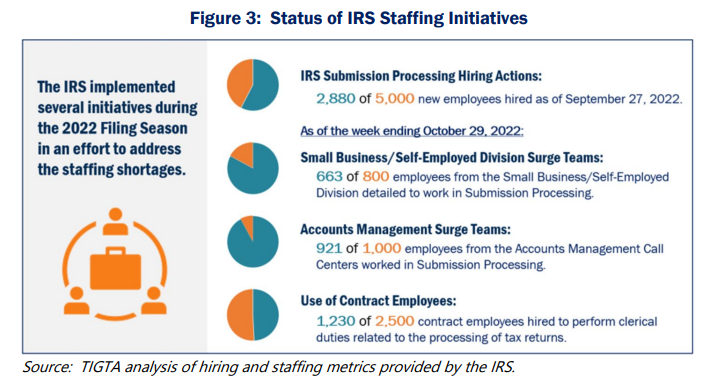

TIGTA said the IRS did not meet its hiring goals, including goals for hiring contract employees, because many of these workforce initiatives started late in the filing season, or because of the time it took to hire and train new and reassigned employees.

TIGTA said the IRS fell short of its goal to hire 5,000 employees to work at its three tax processing centers. The report found the IRS only hired 2,880 new employees under this authority, as of the end of September.

The IRS received direct hire authority in March, as part of the omnibus spending bill for fiscal 2022, to bring on 5,000 employees at its three tax processing centers. Those centers are located in Austin, Texas; Kansas City, Missouri and Ogden, Utah.

TIGTA also found the IRS hired more than 1,200 contract employees to help with clerical duties related to processing tax returns, but fell short of its goal of hiring 2,500 contract employees.

TIGTA said the IRS did not meet its hiring goals, including goals for hiring contract employees, because many of these workforce initiatives started late in the filing season, or because of the time it took to hire and train new and reassigned employees.

“These efforts have recently resulted in an increase in productivity levels,” TIGTA wrote, “however, our assessment of remaining inventory indicates that the IRS will not meet all its goals by the end of calendar year 2022.”

The tax return backlog peaked at 20.5 million individual and business tax returns in June, but fell to 10.5 million tax returns by the end of October.

TIGTA said the IRS is on-track to meet one of its backlog targets, but will once again operate through the upcoming filing season and accept new tax returns while processing its backlog of prior year returns.

The IRS is on-target to process its backlog of about 3 million individual paper tax returns by the end of December. But TIGTA expects it will take the agency until January 2023 to clear its backlog of business paper tax returns, and won’t clear its backlog of rejected returns, unpostable returns and amended returns until June 2023.

TIGTA also found the IRS won’t fully dig out from its backlog of taxpayer correspondence, complex amended returns and other casework until approximately April 2023.

In addition to its hiring goals, the IRS implemented mandatory overtime for 6,000 employees and voluntary overtime for 10,000 employees.

The IRS detailed about 1,500 employees from other agency functions with help with tax returns processing and a backlog of taxpayer correspondence.

The IRS put about 900 employees in accounts management remote offices to work on “surge teams” to handle a backlog of amended tax returns. The agency also sent more than 650 employees in its Small Business/Self-Employed Division to assist with the backlog at tax processing centers.

IRS management told TIGTA that surge team members will continue working on their returns through the end of the calendar year.

The agency also shifted 800 employees from other IRS functions to work in Accounts Management, the primary IRS division for customer contact. Employees in Accounts Management answer taxpayer phone calls, as well as handle correspondence and amended tax returns.

The IRS relied on some automation tools to help reduce the burden on its workforce. The agency automated the correction of some common tax return errors, but the tool was limited only to electronically filed tax returns, and its backlog is largely paper tax returns.

The agency also suspended dozens of notices “to reduce taxpayer burden and prevent inventory increases. It also implemented voice and chatbots to answer some taxpayer questions, or route them to the right department for help.

IRS management told TIGTA the agency will continue to use its direct hire authority, which Congress reauthorized in the fiscal 2023 omnibus, to continue to address its backlog. The agency will also continue to rely on contract employees to help with clerical backlog work through 2023.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED