Hubbard Radio Washington DC, LLC. All rights reserved. This website is not intended for users located within the European Economic Area.

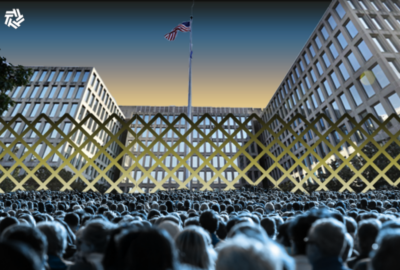

How will a government shutdown affect military families?

Military families are worried about how a government shutdown would affect them, including their paychecks, the impact it will have on food assistance programs ...

In November, the nation reflects upon the service and sacrifice of veterans and military families. A few days ago, we celebrated Veteran’s Day and think of the more than 18 million living veterans in the U.S. and those who served before them. November is also National Military Families Month; this can be a time to reflect on the sacrifices they and service members make. Today, there are more than two million service members and 2.6 million family members.

Sacrifice can come in many forms, and while military families sacrifice on a day-to-day, they can struggle more during a government shutdown. With a potential shutdown just days away if Congress does not pass funding by Nov. 17, military families could experience more financial strain and services they rely on could stop.

A September 2023 survey by Blue Star Families found that 84% of currently-serving respondents said they would be greatly or somewhat impacted by a government shutdown.

“Military families right now are struggling with food insecurity,” Jennifer Goodale, director of military spouse and survivor policy at the Military Officers Association of America, told Federal News Network. “They’re struggling to find affordable housing and childcare. And so, they already have a little bit of mistrust with their leadership. When the government shuts down, it further erodes the trust that military families have in the government to be able to take care of them.”

Tom Porter, vice president of government affairs for Blue Star Families, added that a shutdown creates chaos for family members.

“Military families, they’re doing what they do, supporting their military, supporting their country, out of patriotism. Patriotism doesn’t make you rich, so they’re not doing it for the money. But what they do need is they need our support, they need predictability, they need safety. They need less chaos in their world,” Porter said in an interview.

Money, money, money

A third of military families have less than $3,000 in savings. This is often not enough for the expenses of life: Rent, mortgages, bills, gas, groceries and childcare. Like anyone else, military families have bills they need to pay, but several studies have shown more than two-thirds of military families are living paycheck-to-paycheck. The looming government shutdown could further the financial strain on military families.

Adding to that burden, many military families solely rely on the service member’s income. While there is not concrete data on military spouse unemployment, estimates suggest that around one-third of military spouses are not employed, but want or need to be working. The estimated unemployment rate for military spouses in 2020 was drastically higher than for civilians, 20% and 3%, respectively.

If there is a shutdown, military members will get paid, but not until Congress approves funding. As a result, members could go without a paycheck for an unknown period of time. This can be challenging when already living paycheck-to-paycheck.

“They depend on being paid on time,” Porter said. “They don’t just have a few thousand dollars, usually, sitting in the bank for a rainy day.”

Porter said that as a result, military members will go to a payday loan shop to bridge the gap to their next paycheck.

“There are many payday loan shops that are more than happy to take service members goodwill and charge them 35% interest in order to lend them some money to get them across the aisle until [the] next payday,” Porter said. “They know they’re good for it, but they’re taking advantage of them. I think most Americans would rather not have our military families be at the mercy of payday loan companies because that’s where they’re going to end up because they’re going to need to put food on the table. They’re going to need to buy clothes for their kids. They’re going to need to pay the rent, the mortgage and the energy bill. When Congress doesn’t pay them on time, that forces them to find other ways to pay their bills.”

Moreover, there are approximately 16,000 military spouses that are employed by the federal government. So, a shutdown would greatly impact those families by not immediately having both incomes.

Services

There are non-defense services that military families rely on like Supplemental Nutrition Assistance Program (SNAP), the Special Supplemental Nutrition Program for Women, Infants and Children (WIC) and school funding program Impact Aid, but a shutdown could mean military families are unable to access these services. Services not covered under defense appropriations could be impacted even if DoD is funded because these services are provided by other agencies like the Department of Agriculture (USDA), which may not get full appropriations or get their budgets cut.

“We’re very pleased to know that the commissaries released a statement prior to the continuing resolution that they would stay open,” Goodale said. “Childcare facilities are typically run off of non-appropriated funds, meaning that [it’s] their clients or constituents who pay for those services. That’s where that money is coming from, so those wouldn’t shut down. We’re optimistic that the services, at least in the short term, would not be impacted for military families, but it will reduce the number of gate guards and just make little inconveniences throughout the day. It’ll impact whether or not they can get their health care if people are furloughed and appointments go away.”

Food assistance

Many military families need food assistance. A recent study found that more than 13% of military families relied on food banks or other food assistance in the past 12 months. A government shutdown could cause this number to increase as military families struggle to make ends meet and put food on the table.

Commissaries — or neighborhood grocery stores located on military installations — said they would be open before the continuing resolution in September passed; the same could apply this time around. While commissaries will be open, they will likely only be open for 60 days or until funding runs out.

Child care

A shutdown will also impact childcare. Some on-base childcare facilities might close, others might stay open until funding runs out.

“The services were very proactive before the continuing resolution notifying families of what things would and would not be available. And childcare is one of those things that until funding ran out, potentially, it would be around. So, it could be several months that they would be fine,” Goodale said.

Medical

If there’s a government shutdown, participants in TRICARE — DoD’s healthcare system — will be able to receive health services from a private sector provider under TRICARE. Additionally, inpatient care at DoD facilities and acute and emergency outpatient care at DoD medical and dental facilities will continue. Wounded warrior medical care would also not be impacted by a shutdown.

Current DoD guidance does not address routine appointments. However, if on-base healthcare workers are furloughed during the shutdown appointments will likely be canceled.

Legislation

Lawmakers have recently made a push to help military families with food, childcare and spousal employment, and DoD is also making strides to help military families in these areas.

“The now-routine failure to secure needed resources for Defense and for the whole government erodes military trust in civilian leaders,” Deputy Defense Secretary Kathleen Hicks said recently. “If you add up the months, DoD has been under a [continuing resolution] since 2011, it totals four years’ worth of delays, delayed new programming’s, delayed training and delayed permanent change of station moves. We cannot afford any further delays.”

While Congressional members have introduced bills to ensure services members get paid if there’s a shutdown, none have passed. If there’s no funding, 1.3 million service members would continue to serve without pay after Nov. 17, and hundreds of thousands of civilian DoD employees would be furloughed or have to work without pay.

“It’s the erosion of trust in leadership and that military members are expected to show up at work whenever they’re needed,” Goodale said. “So that could be anytime of the day, any time of the year. When Congress can’t continue to function the way that they’re supposed to and keep the government running and finalize the budget, it erodes that trust and confidence.”

Miscellaneous impacts

Morale

The uncertainty of a shutdown can impact morale, not only for military families but all impacted by it.

“If you have to take out a loan to make ends meet, that impacts morale,” Porter said. “If you can’t afford to go visit your family 1,000 miles away during the holidays because you don’t know when your next paycheck is going to come, that’s going to impact morale.”

Holidays

A shutdown could come right before Thanksgiving, a holiday that around 55 million Americans traveling to see family and friends to celebrate. However, the uncertainty of a shutdown and when the next paycheck is coming could impact travel plans for the holidays.

“Just like the rest of America, you spend a lot of extra money during the holidays,” Porter said. “You like to travel, you like to have family visit, or you’d like to go visit family, that all cost lots of money. If you don’t think you’re going to be paid on time, you’re probably less likely to have a pleasant holiday season.”

Previous shutdowns

The last government shutdown over the holidays in 2018 and into 2019 significantly impacted Coast Guard service members and their families. While DoD had funding, the Coast Guard, which is under the Department of Homeland Security, did not. This meant nearly 41,000 Coast Guard members went 35 days without pay, while still performing their jobs.

This go round, military organizations are advocating for them to be included in defense appropriations. Sen. Ted Cruz (R-Texas), introduced a bill in September to make sure the Coast Guard gets paid if there is a government shutdown, but it has not become law.

It is unclear how many military families will need to take out loans if there’s a shutdown, or took one during the last shutdown. However, during the 2018-2019 shutdown, Navy Federal Credit Union gave out loans to 20,000 members. This highlights the large impact a shutdown has on thousands of families.

Nearly Useless Factoid

The term military brat originated in 1921, and stood for “British Regiment Attached Travelers”

Source: Military.Com

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Kirsten Errick

Kirsten Errick covers the Defense Department for Federal News Network. She previously reported on federal technology for Nextgov on topics ranging from space to the federal tech workforce. She has a Master’s in Journalism from Georgetown University and a B.A. in Communication from Villanova University.

Follow @kerrickWFED

Related Stories

Related Stories

-

A government shutdown Q&A for federal employees Government Shutdown

-

What happens to furloughed employees during a government shutdown? Government Shutdown