Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

Making smart investments to prepare for your retirement can be a challenge, especially when fraudsters promoting misleading opportunities want to take advantage of your hard-earned savings.

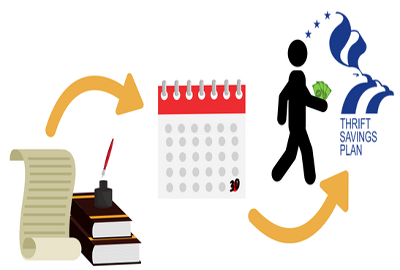

It’s why the Federal Retirement Thrift Investment Board (FRTIB), the agency that administers the Thrift Savings Plan, is partnering with the Securities and Exchange Commission to hold a training seminar for federal employees next week.

The session is geared toward federal employees who are considering retirement or may leave federal service in the near future, said Kim Weaver, FRTIB’s director of external affairs.

A trainer with the TSP will review upcoming changes to plan’s withdrawal rules, which have prompted many questions from participants in recent months after Congress passed legislation authorizing more flexibilities.

TSP’s session will also address questions on preparing for retirement and making smart investment decisions.

The TSP training seminar is part of the SEC’s World Investor Week campaign, which runs from Oct. 1-7 and is designed to educate members of the public about how they can be smarter and more informed investors, said Owen Donley, chief counsel for the SEC’s Office of Investor Education and Advocacy.

Specifically, SEC will share advice with with members of the public on how avoid investment fraud, how to vet an investment or financial professional and other common questions potential investors should consider.

“One of the first things that we at the SEC tell investors to consider is who they’re working with,” Donley said. “The vast majority of fraud, or a ton of fraud that we see in the retail space, is committed by people who are not properly licensed or registered to sell securities.”

Affinity fraud, or investment schemes that target a specific group of people, is common, Donley said. Federal employees and veterans are no exception.

“We do see scams that involve federal employees and that do mention TSP,” he said. “The best way to make sure that you’re dealing with an authorized federal government program is to go to the website. One of the things that we tell investors is that anytime you receive an unsolicited offer, that is, an offer that they haven’t gone up to try to find, they should be careful.”

Weaver said the TSP often receives calls from its participants who want to verify the legitimacy of an investment option, and the FRTIB encourages them to be inquisitive.

“We want to be very vigilant about their TSP account and questioning if they want to make sure that something is legitimate,” she said.

The webinar, “Your TSP Account, What to Think about When Nearing Government or Considering Leaving the Government,” will take place at SEC headquarters on Tuesday, Oct. 2, from 2-4 p.m. Participants can also attend via live webcast.

Find out more about World Investor Week at Investor.gov.

Copyright

© 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.