Is it time to time your TSP moves?

Almost everybody knows the buy-low-sell-high "rule" of investing. But many people don’t follow it.

Almost everybody knows the buy-low-sell-high “rule” of investing. But many people don’t follow it, primarily because it’s hard to know at the time when the market has peaked and when it has bottomed out, like during the Great Recession of 2008-09.

And lots of people are increasingly nervous today because its been a decade since there has been a major correction of 20% or more in the stock market. May has been a roller coaster with the stock market down “on paper” $200 billion one day and up $250 billion few days later.

Arthur Stein is a Washington, D.C.-area financial planner with a lot of active and retired federal clients. Several of them are self-made millionaires thanks entirely to their Thrift Savings Plan contributions. He and I will be talking today at 10 a.m. EDT for Your Turn on www.federalnewsnetwork.com and 1500 AM in the D.C. area. We’ll discuss what people should not be doing with their TSP accounts. To set the stage he wrote this column-within-a-column:

TSP returns – What time periods matter?

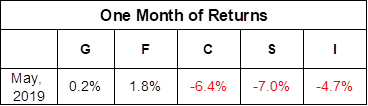

TSP participants who read articles by Mike Causey, Amelia Brust and Nicole Ogrysko at www.federalnewsnetwork.com should be well informed about May’s dismal returns for the stock funds. Here are the returns for the five traditional funds:

So May returns were bad. Should participants care?

Well, it depends upon personal circumstances but I can’t think of many situations where one-month returns would be meaningful. No one should have invested on May 1 for funds needed on May 30.

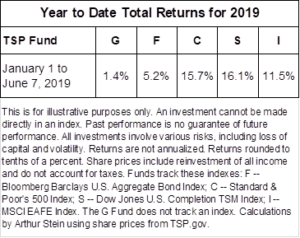

Actually, monthly returns may hide what is happening in the stock and bond markets. For instance, let’s compare the monthly returns above to the year to date returns below:

That should take TSP participants from sad to happy. The stock C, S and I funds have increased significantly this year, even after taking into account the May declines. Isn’t that more important?

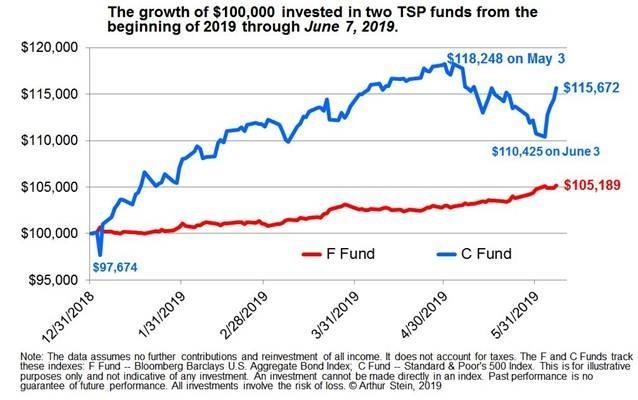

On the other hand — I used to be an economist, so I say this phrase a lot — the year-to-date returns in the table at the right also hide something: The volatility of the stock funds — volatility as in the C fund. Note:

- Decreasing 2.3% during the first three trading days of the year,

- Increasing 21% from that low by May 3,

- Decreasing 6.6% from the May 3 high by June 3,

- Increasing 4.8% over the next four trading days.

Nearly Useless Factoid

by Amelia Brust

Badminton is the world’s second most popular sport, based on participation and viewership, and the fastest racket sport. The fastest shuttlecock “birdie” on record was 306.336 mph by Malaysia’s Tan Boon Hoeng in 2013, and the fastest hit in competition was 259.112 mph by Malaysia’s Lee Chong Wei in 2017. By comparison, the fastest tennis serve was 163.4 mph by Samuel Groth of Australia in 2012.

Sources: ESPN, Pledge Sports, Guinness World Records

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED